Consolidating Our Portfolio

We've decided to consolidate our portfolio into a smaller number of large bets. Part of the reason for consolidation is this new fund we're a part of that will allow us buy slightly larger businesses.

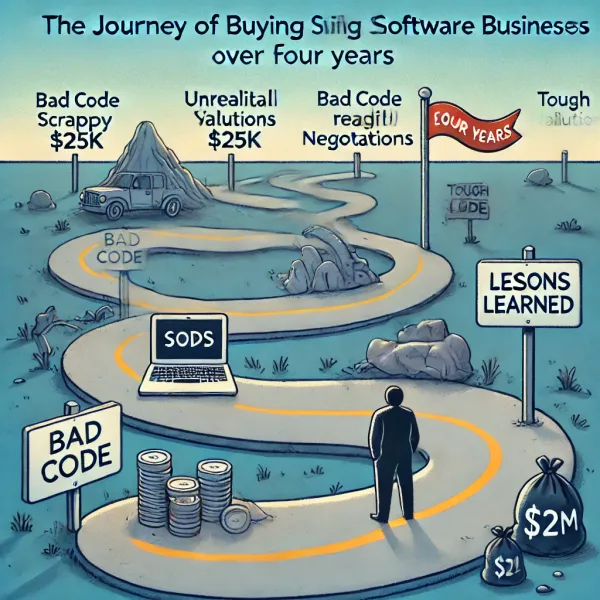

To get to this point in our history, I think we had to do these smaller deals. Back in 2020 we had no idea what XO would become or if this would even work as a business. I also didn't have the ability to go raise money into this model. I do now. I certainly don't regret our early buys. They've been fairly successful and taught us a metric ton about how to actually build a micro PE business. That being said, it has been an absolute grind.

Stacking multiple early stage products together is a difficult task operationally. There's almost always bugs you inherit, and there's typically 1-3 fires per week when you have 3/4 different products. Sometimes it's a third party api going down, sometimes its a bug, sometimes it's a feature we pushed but didn't thoroughly test. The only certainty is that it's always something.

Initially, we treated these smaller acquisitions as "jobs", because that's what they are. There's really not a lot of margin to work with and even when we started hiring a shared services team, there is still management overhead. We were also very fortunate to have sheet.best and screenshot api in our portfolio since both of these required (over time) very little engineering, and had very low support overhead. Despite these two gems, it was still operationally complicated to execute strategies across each company well. We were basically mediocre at operating each of them and probably got a bit lucky.

As we look to the future of XO (let's call it XO 2.0), we are aiming to become more of a holding company than an operating company.

For Flip Fund 1 and for our new fund we are absolutely the operators. No two ways about that, but we're actively looking around the corner to understand what we can do today to ensure we're moving in the direction of a holding company.

This is why we need to sell off our smaller assets. Cold dm, growth bar, super send, and cold email studio are all for sale at the moment. The timing isn't awesome. The market isn't great, and we may end up just holding them if we can't get reasonable prices for them, but the intent remains to become a holding company.

XO 2.0

This new operating model will change how we invest. I don't know how yet but it will (it must!). Some minimums we're considering:

- The business has to support 1 full time growth person (they also do support. Sometimes called a GM, or JR CEO or just head of growth)

- The business has to support 1 full time developer

Shared services is tough to execute on. We're trying to simplify operations and as such would do away with the shared services part. This new model demands the focus of dedicated staff.

If we're using our own cash again to experiment with this model, we will have the flexibility to try many things including:

- buying the business along side an operator (not us) that takes a salary, equity, and it's their FT job to be CEO of the company

- Buying the business, then hiring an operator

- Funding an operator (as a searcher)

- Possibly something closer to venture (maybe closer to Tiny Seed)

In a dream scenario, our community is where we find operators, and we supply the cash, help out of course wherever we can but operationally (day to day) we do not have responsibilities. This is a big shift to make. It's going to take probably 2 years, but we'd like that clock to start ticking now.

Onward and upward!

Andrew