Getting Smaller To Get Bigger

We're underway with xo 2.0. That means, fewer, larger* businesses.

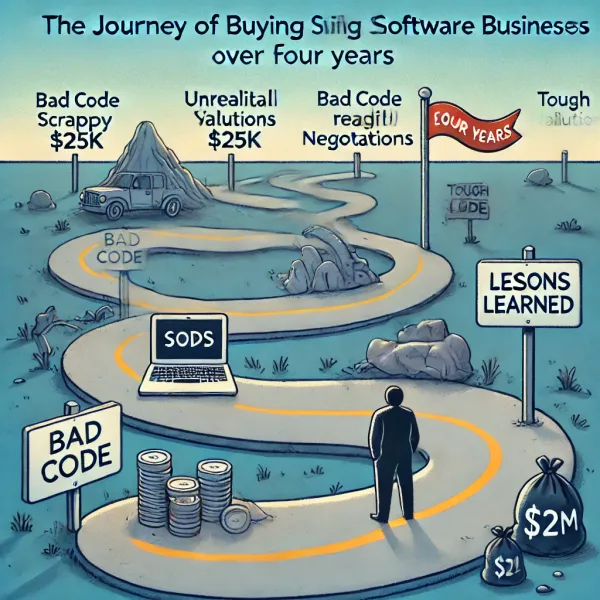

We started (very) small and quickly (after 3 years) realized that operating multiple tiny companies is death by a thousand cuts. So we've sold most of them off ( still have a few lingering things) but we mostly now just focus on 2:

- journey.io

- onsched.com

Our "MRR" is ~$65k.

Things are calmer.

We can afford (mostly) to hire the people we need. We don't have 10x the support tickets for 10x more customers. We don't have 10x more features we need to build to support 10x more customers. And we don't need 10x more channels to grow. We waited too long to buy bigger but better late than never.

Buying bigger* is a little different. There are employees. The stakes are higher. We're currently working on a v3 for OnSched's API because the code we have is just not going to get us to double the biz which I absolutely think is possible from here in our hold period (about 3 years). This is the first time going through a SOC2 process end to end as well. With B2B SaaS, it's almost a requirement now to have SOC2 and frankly the process is a bunch of BS. I'd say 20% of it is worthwhile, the other 80% is paying lip service to meaningful security.

The point being, we're buying businesses about 4-7x bigger than we were last year and the amount of work isn't 4-7x more. It feels right. Starting small felt right for us to just try this model out and see if we liked buying businesses. But now that we have a bit more experience, it's time to grow beyond micro saas.

*Big to us is 7 figures (purchase price). Maybe one day it will be 8, but for now we'll deploy $1M-$2M at a time into each acquisition and do 5-10 of those. From there, given our ability to raise more cash, we'll see what laddering up market looks like or if we've found our sweet spot right here.