How To Buy A SaaS Business Via The SBA - Part 1

We have a deal under LOI right now that we plan on financing via the SBA. I'd like to document that process step-by-step since as far as I can tell, most of the Twitter advice on this is being shilled by charlatans who don't know jack about the process.

This information is from a dozen or so calls with various people or SBA lenders. Always do your own research.

Brief History

The SBA (Small Business Administration) was created in the early 50's as an independent agency of the US government. Their mission is pretty clear:

The U.S. Small Business Administration (SBA) helps Americans start, build, and grow businesses.

The loans themselves are made through banks and other facilities who partner with the SBA (i.e. the banks make the loans but the SBA guarantees them). The doozie is they are personally guaranteed (sometimes seen as the acronym P.G.). If this sounds like a kind of corporate welfare, it is. The banks at no risk to them give you a loan backed by the government. The government backs the loan at no risk to the American taxpayer because of the PG. Ultimately, if you buy a business with an SBA loan and it goes belly up, it's your own shirt that will be lost. And no, you can't get rid of the PG obligation via bankruptcy.

Historically, entrepreneurs used SBA loans to buy laundromats, liquor stores and other physical businesses. We're going to talk about using them to buy a SaaS company.

The Opportunity

The amazing part about the SBA is that you can have one (or multiple in separate transactions) SBA loans totaling up to $5M. The other cool part is that over time, as you pay off the principle, you can get up to $5M at the time of the transaction meaning if you received $5M worth of loans but you've paid off half of the principle, you could still get another $2.5M in SBA loans. This is truly amazing. Think about buying a business or assembling a portfolio with only $500k down (total) that does roughly $1.5M a year. As you'll see below, you'd roughly be paying $1M back as loan payments and cashflow $500k annually. I'd say yes to that all day long.

SBA Lenders

There are two main types of SBA lenders: Cashflow lenders (we want this) and asset-based lending. SaaS companies typically don't have any hard assets so you'll need to find an SBA lender that specializes in cashflow lending.

Most of this info is from Live Oak. They're one of several SBA lenders and my only relationship with them is that we're using them as our lender while we go through this process ourselves. There are a few other top lenders that can do SaaS deals but Live Oak is a great place to start.

For a deeper dive, take a look at one of their webinars, or signup for one online

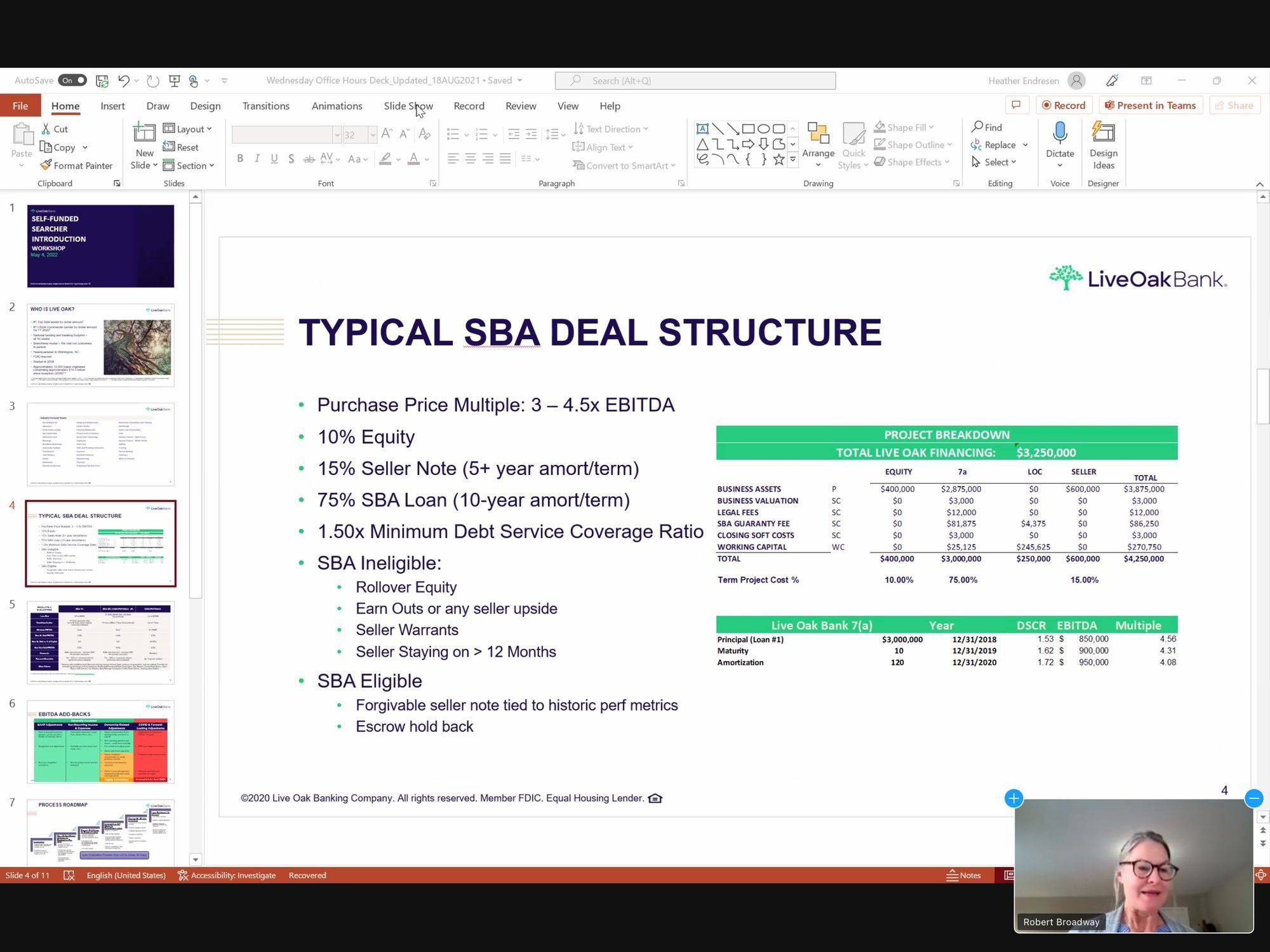

Typical SBA deal structure

Let's say you're going to buy a business for $1M purchase price. The business should have at least 3 years of tax returns. For smaller deals sub $1M, you can sometimes get away with only 2 years. For cashflow lenders, the last 12 months are significantly more important than the previous years.

In this scenario, you'd shell out $100k in cash. There would be $150k of seller financing with a 5 year term. This seller financing is typically 2nd in line behind the SBA loan and must be forgivable. The seller in this case would get $750k at closing plus a monthly payment for 5 years for the $150k seller note.

In order for this deal to qualify, you cannot have any rollover equity, earn outs, or even keep the founder on for longer than 12 months. Basically you have to buy the previous owner out 100% and there can't be any variable upside or downside for the seller. This limits the creativity of the deal structure but keeps it relatively simple.

In order for the bank to finance a deal like this, they want at least a 1.5x debt service coverage ratio (DSCR). Basically the business needs to be able to support paying back the loan, plus some cash left over to pay the other business expenses which, in our case, is typically servers and people.

DSCR = Annual Net Operating Income / Annual Debt Service

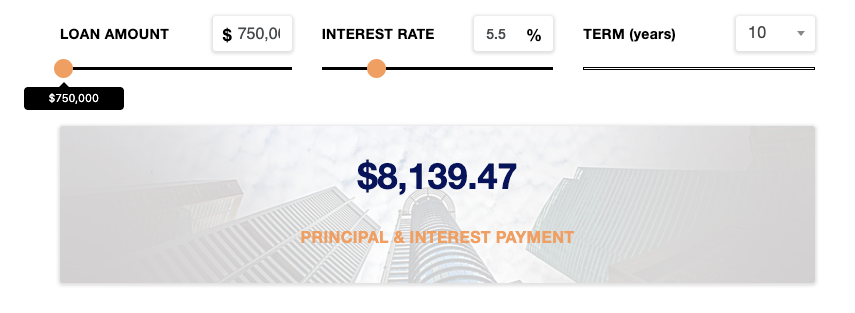

For our example, the annual deb service is about $100k.

Let's use round numbers for simplicity:

So in our theoretical example, our acquisition target's net operating income must be at least $150k. Practically speaking, this is a tough position to be in. Imagine you just bought a business for $1M. It will net you < $50k a year after expenses, and probably close to zero in the real world given unforeseen costs, growth (which is expensive), etc. If the business had less than $150k in net operating income, it is likely not a good match for an SBA loan unless you put more equity (cash) in than 10% such that the DSCR is 1.5 or greater.

The other implication of this deal structure is there is sort of a maximum multiple you can pay (holding the 10% down constant). That multiple is around 3-4.5x EBITDA. This also makes doing an SBA deal for SaaS tough depending on the market as many founders have (irrationally) in their head that their company is worth 10X ARR. This is not strictly false as valuations can hit this multiple or even higher for strategic acquirers. That's not us. We ain't paying no 10x, and neither will the SBA.

So you found a deal ...

Let's say you found a deal. Awesome!

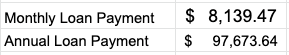

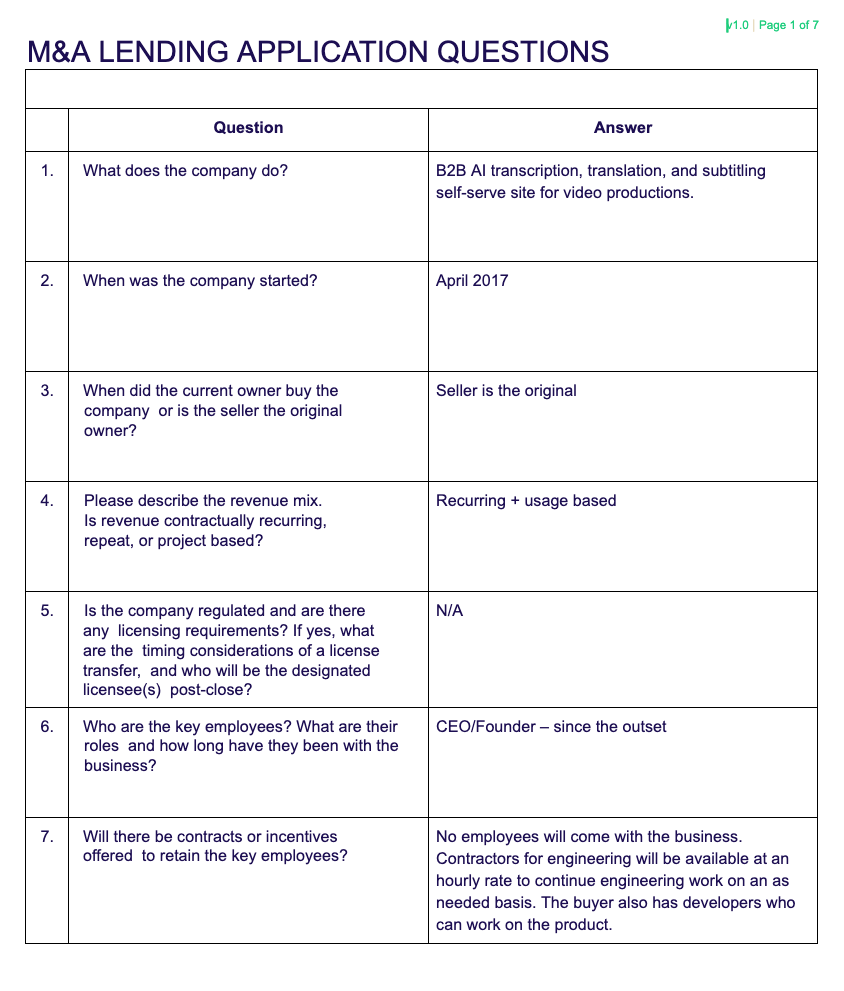

The next step in the process is to fill out a 9 page questionnaire with the seller. Below is page 1 of the questionnaire. Essentially the bank needs to see initially if they think this company is "worthy". The banks themselves must submit the business / terms to the SBA who must approve the deal before the bank can finance it.

In addition to the questionnaire, you need to put together a 1-page teaser based on a template as well as provide 3 years of tax returns + year to date interim financials. They also want you to plug in your financials to their cash flow model to make sure the debt coverage is solid. You're typically going to need an accountant to help with these spreadsheets, they're not simple if you don't know your way around a cash flow model. These are full financials, not a "high level P&L" either. A ton of time can be lost here if the seller does not have financials prepared.

Although the process can take 90 days. I suspect it will take longer. There will be whole days or even weeks where the seller is just working on pulling together documentation on the business. Then of course there are days spent waiting for the docs to be reviewed and I'm certain there will be times when something critical is missing, starting the process over again. I think if in theory the seller had 100% knowledge of every step and had all docs prepared the process could take as little as 30 days, but welcome to the real world.

This is as far as we've gotten so far. The next step if we pass the pre-LOI stage will be to sign an LOI (which needs specific items in it as determined by the pre-LOI stage), and of course, fill out more forms.

✌️ ,

Andrew