2023 In Review

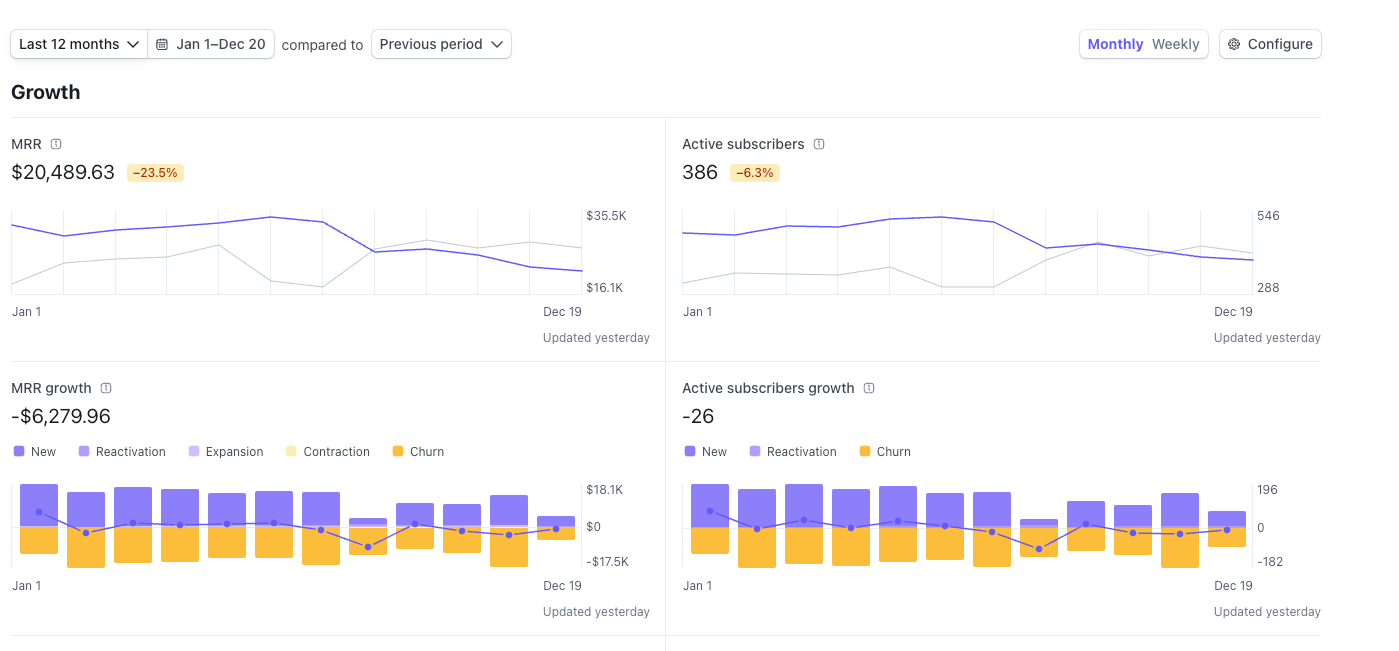

2023 was a tough year. It started out with a bang (high expectations, everything going right) and ended with a whimper for us. The zero interest rate environment really came down hard on a few products like Cold Email Studio and now that the AI craze is cooling off, we're seeing slowing growth in (ironically) growthbar. We had some tough team changes, and 2024 looks like it's shaping up to be a tough year as we more consciously move from an op co to a hold co while also continuing our commitments to Journey via Flip Fund 1. It's also possible we'll do Flip Fund 2, and hopefully raise a little more $ so we can hire great operating talent or at least a full time person as a GM.

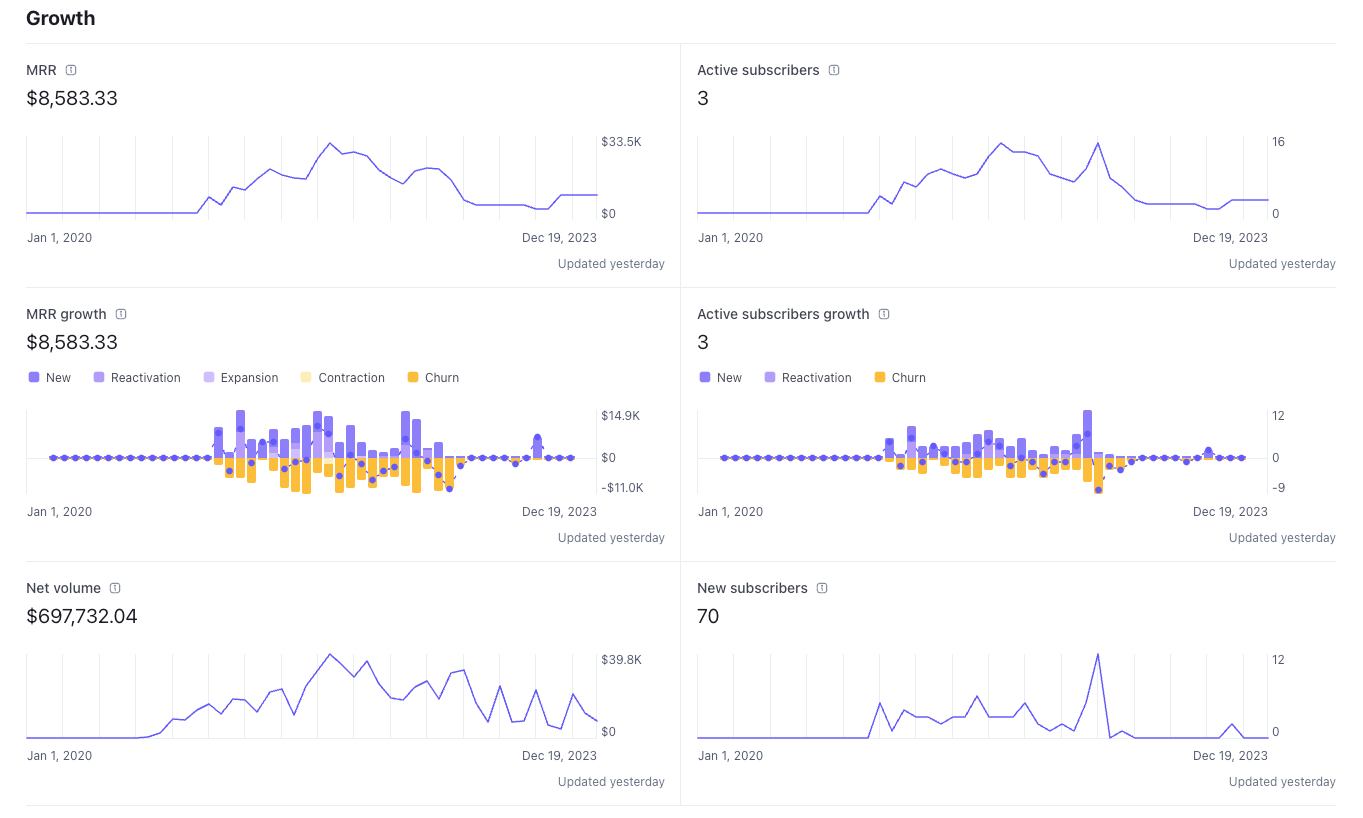

Looking back at our 2022 annual review, we missed our goal of hitting $1M ARR in 2023. We just didn't buy a big enough business early in the year. Now of course next year we may very well hit $1M ARR but it will be mostly with other people's money so our MRR number will read high, but our ownership will be lower. Not a bad tradeoff but MRR will likely become just a vanity metric for us instead of a more meaningful amount of MRR XO owns 100% of. Yes of course we'll own a smaller piece of a bigger pie but it will be less straightforward to communicate that in a single metric.

I can also tell from reading our 2022 annual review that we hadn't lost yet. We were and (mostly) are used to winning. I think that contributed to our mistake in buying Growthbar for too much $.

I saw this math in the post:

Portfolio valuation at 4x = $1.3M

That's probably wrong. It's more like 2x-3x so roughly $325k ARR * 2 (conservative) = $650k. Still cool, but certainly not as impressive. It's hard to get a 4x multiple on acquire. A lot of people don't even care about the revenue because it's so small relative to their existing business. I even had 1 yahoo try to tell me a company was worth peanuts because the EBITDA was low. Just very different conversations than we were having at even the beginning of the year.

We bought:

- growthbarseo.com

- journey.io

- support guy

- userping

We sold:

- workclout

- support guy

Where we won:

- work clout

- Raising Flip Fund 1

- Getting more google cloud credits

Where we lost:

- growthbar

Lessons learned:

- Do not pay full price for annual subscription customers / revenue with no history of renewal. Structure a deal where if they renew, then give the previous owners the revenue, but do not assign a multiple for it. If they renew, great, the previous owners benefit, if they don't you won't have paid for revenue + customers you never see. This only works for newer Saas that is mostly monthly subs.

- Don't buy into hype

- We've bought 2 businesses at their peak MRR. Not sure how to avoid this but it should be avoided!

Looking Forward

I think we'll be a bit more cautious in 2024. We'll be dealing more with investor money than our own cash. It's prudent to be a little more conservative. I'm glad we bought Growthbar with our own cash. If we had to do a bad deal, it's better we lose our own money than investor's money.

I'll personally be a little more humble in 2024. I thought we couldn't lose. Turns out we can and will lose and we have to stay vigilant. It's a tough lesson. The reality is we're going into year 4 of XOs existence and we're becoming better investors with every deal we do.

My hope is we can deploy $2M - $4M in 2024. I'll stick to that instead of an MRR goal since we'll likely own only a small percentage of these deals and will be making our money on carried interest. $2M is more than we've ever deployed in total so it's still an ambitious goal but we have a partner lined up for next year to help us get there. And then of course we still intend to do Flip Fund 2 after Journey.io gets on a good path.

All startups are tough, and it's a little strange to think of XO as a startup but it 100% is. In some ways it's easier (we get to start with a product we buy and some revenue) but in other ways it's much more complicated (shared services, multiple projects, etc).

Individual Performance:

Sheet Best

Cold DM

Inlytics

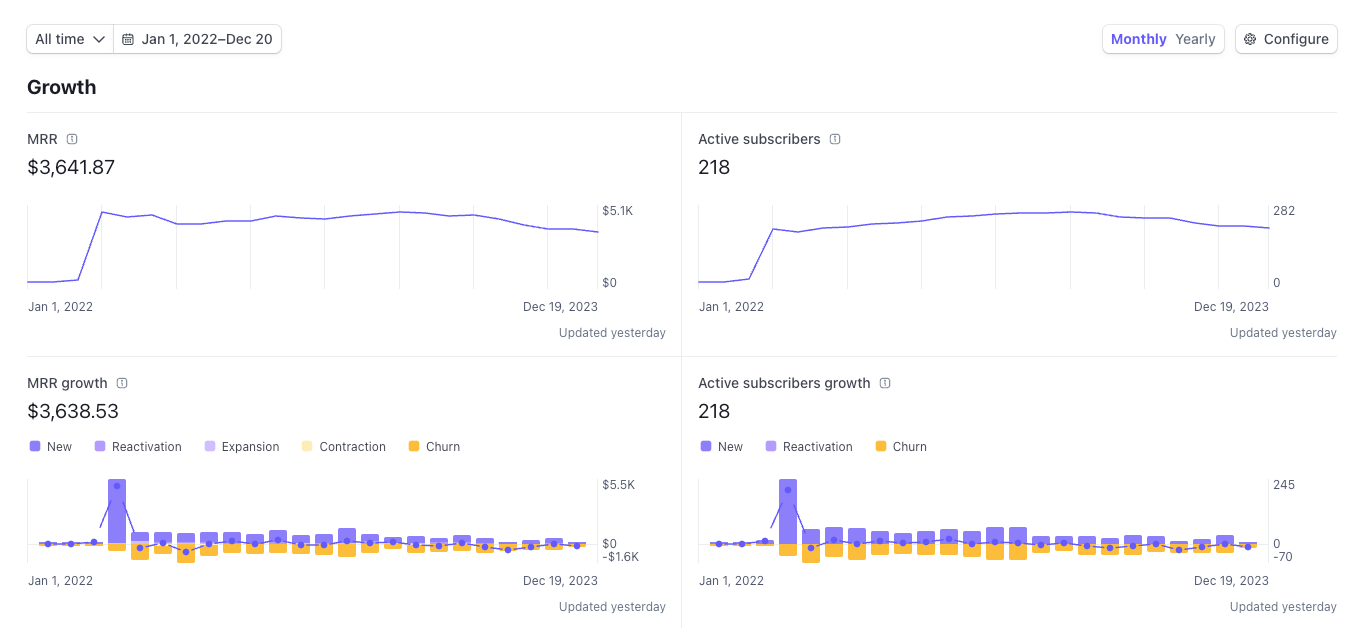

Growthbar

Screenshot API

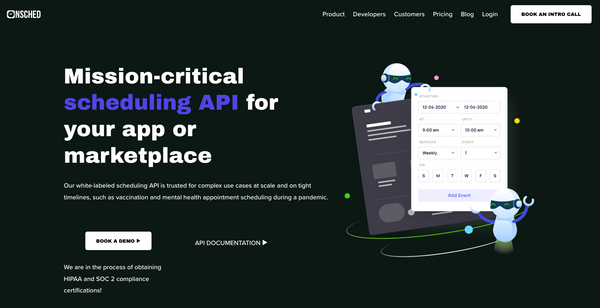

Journey

Others (not technically XO)

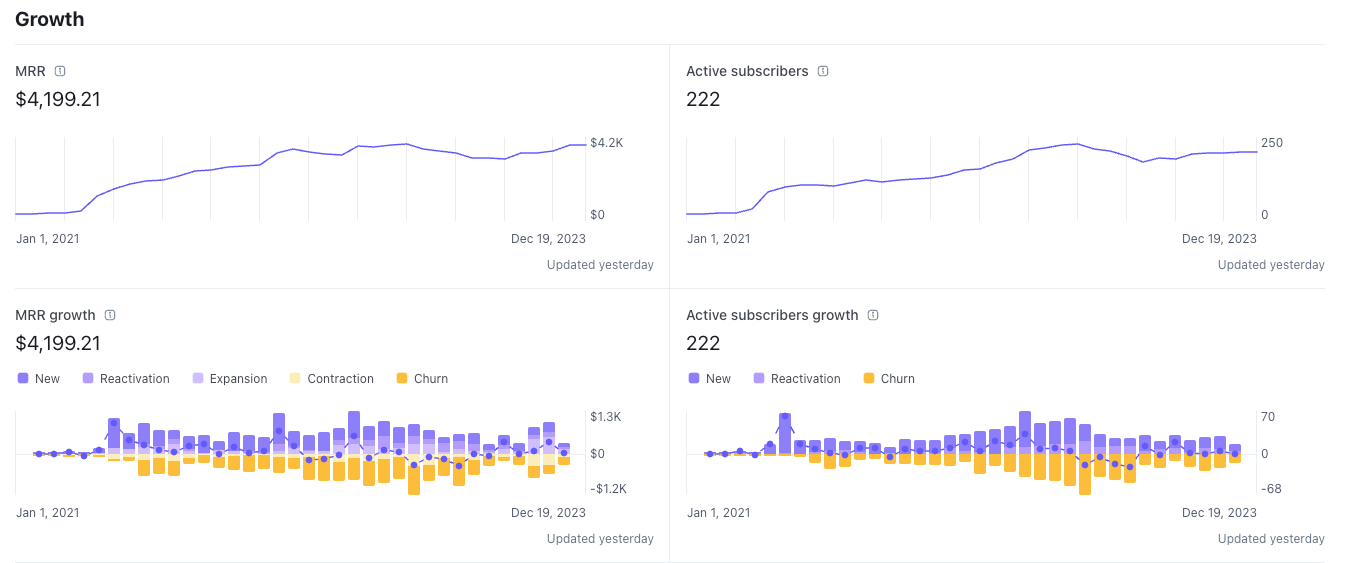

Super Send

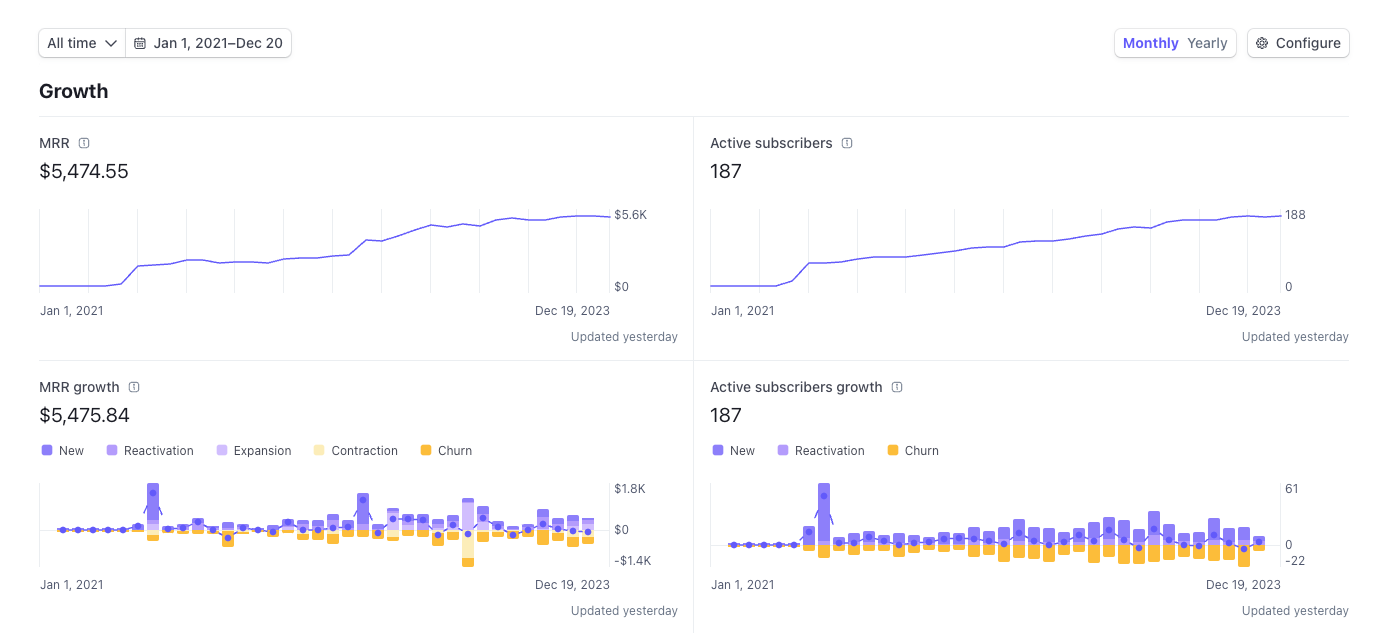

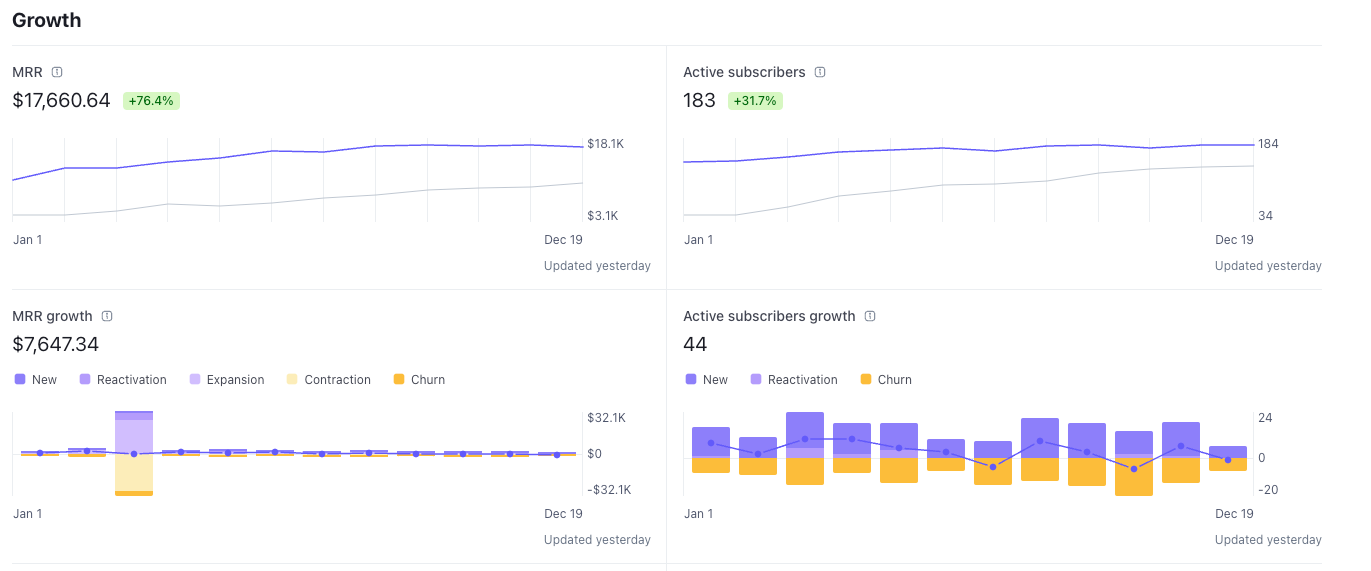

Super Send continues to grow, just not at the pace that I'd like. Churn is still tough for this kind of product.

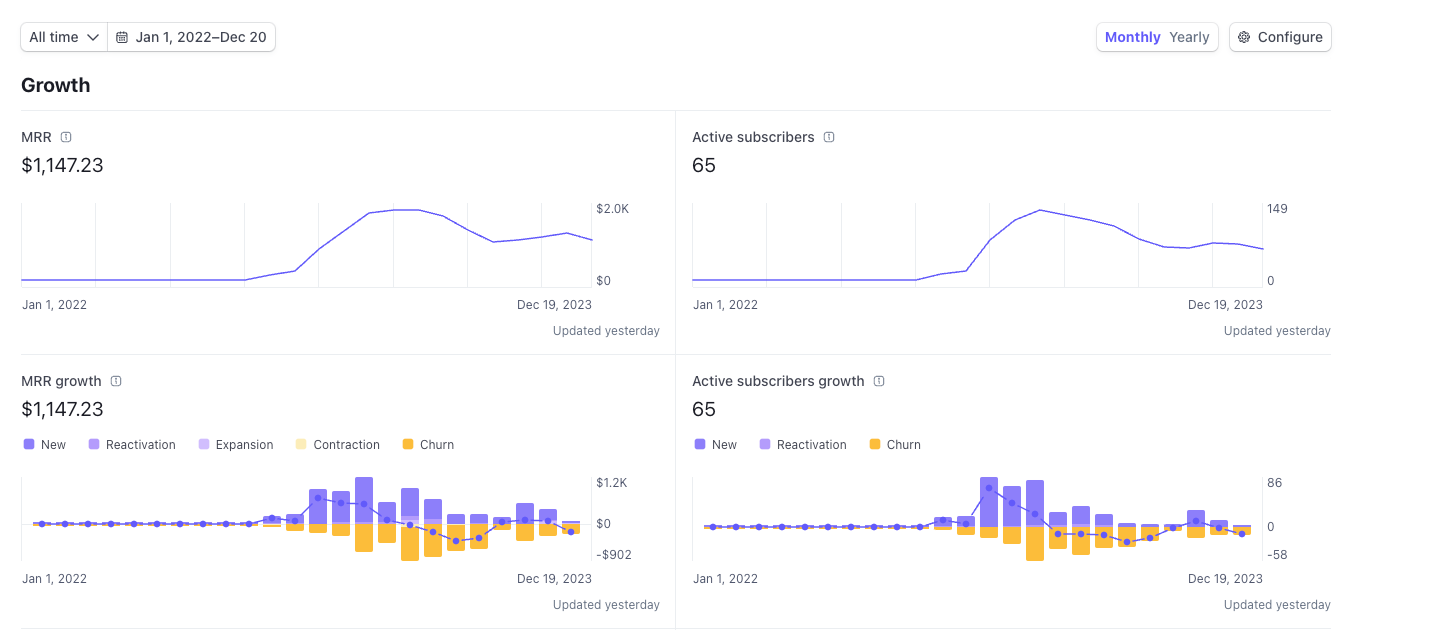

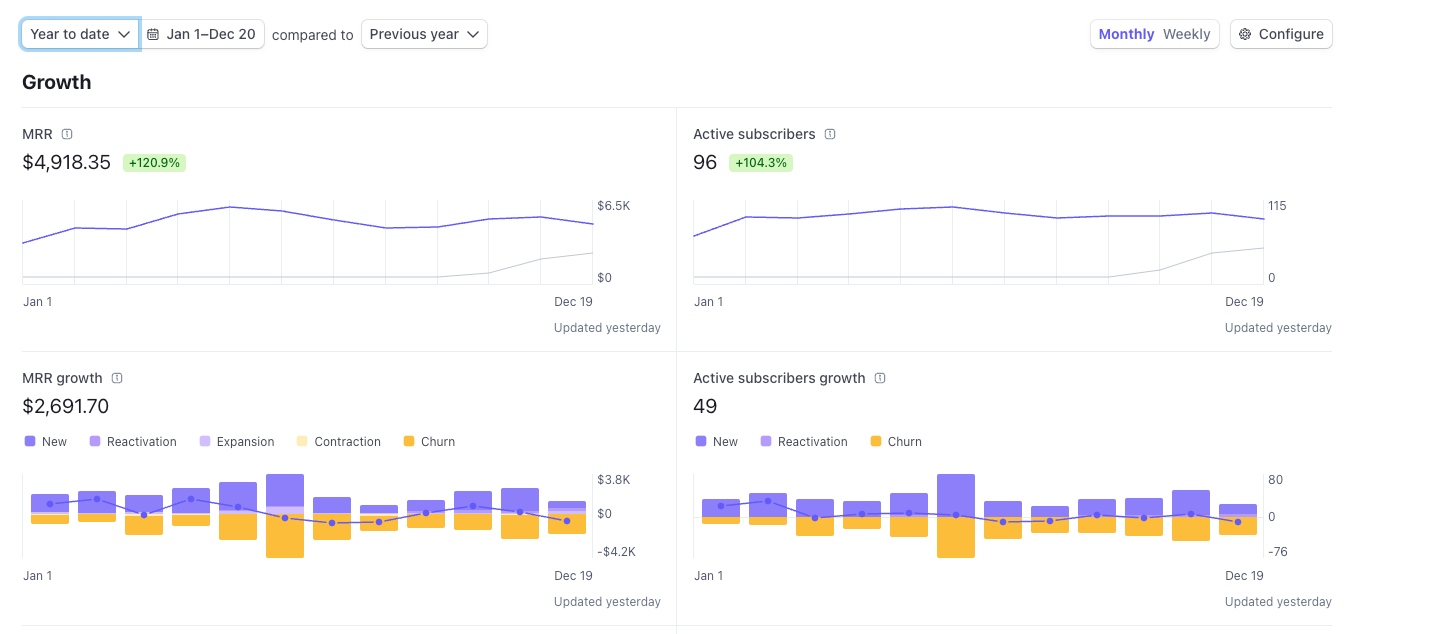

Cold Email Studio

Not all the rev for CES comes in through stripe anymore so MRR is higher and all time net volume is higher but still this business is about half of what it was doing at peak.