3 Lessons Operating 5 micro-SaaS Companies in 2022

Hey it's Danny. Happy new year!

January 1, 2022 we had 3 full-time employees at XO Capital. Myself, the operator, 1 engineer and 1 support person were operating Sheet.Best, ScreenshotAPI.net and WorkClout. In March 2022 we acquired Inlytics.io. Shortly after, we brought on 2 more full-time engineers and one additional BD/growth person. Finally, in November 2022, we acquired Colddm.me.

By the end of 2022, we had a 6-person full-time team operating and growing five micro-SaaS companies. In 2022, we also sold one of our portfolio companies, Sentiment Investor.

Here are a couple of lessons I learned about growth operating 5 micro-SaaS, predominantly PLG companies:

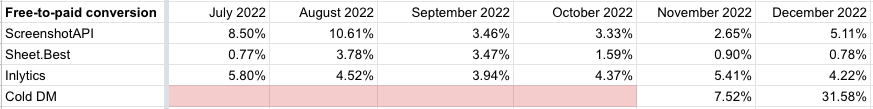

Lesson 1: Free-to-paid conversion rates are hard to figure out.

Coming from a B2B sales background closing minimum ~10k ARR deals, I’ve always found therapy in playing the numbers game with qualified leads > demos > opportunities > closed won customers.

Our PLG (product-led growth) companies were not predictable. Therefore, it was difficult to pinpoint how to predictably improve the free-to-paid conversion rates for each of the companies.

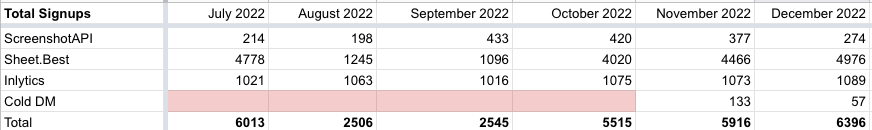

Top-of-the-funnel was extremely wide and varied in quality (and quantity). I was not in a position to turn off the firehose despite how “unqualified” some of the accounts were.

My goal in 2023 is to run some very specific plays based on product usage to figure to identify any patterns for higher than average free-to-paid.

Lesson 2: Use the users on free plans and their product usage to discover new customer segments

Pricing is typically one of the first things we look at changing (ie. increasing) after an acquisition. We had increased prices for Sheet.Best back in 2021 when we first acquired the business.

Since then, Sheet.Best was getting consistent feedback from our customers that our Free Plan, which includes 100 requests/month, was not helpful. We experienced users going with our competitors who had more robust free plans. We also experienced users creating multiple free accounts hence the extremely bloated sign-up number for Sheet.Best.

As a result, we added the Tiny plan at $9.99/month.

Today, the Tiny plan accounts for 35% of our MRR and a total of 162 active customers as of Jan 2023 (57% of the total customers).

LTV is $90, considerably lower than our overall LTV of $136; however, we now access a new customer base that has improved our distribution of revenue with a larger customer base.

Lesson 3: There are diamonds in the rough

We have this running joke at XO that “growth just happens”. It’s partially true mainly because we don’t have a clear grasp on how and why growth does or does not happen (see Lesson 1 above).

However, unlike non-PLG companies, the benefit of the majority of our portfolio is each business has an existing pool of fish to reel in. One of the cool, positive consequences we’ve seen from really trying to engage with our free users is the one-off custom subscriptions from our “diamonds in the rough”.

I started poking around the paid and free accounts that were hitting their limits pretty consistently, and eventually we discovered two companies that increased MRR by 50%, increased ARPU by 80%, and doubled the LTV.

Now, I get 2 Slack alerts from Metabase - a list of all non-Gmail user sign-ups and a list of users who are close to hitting the monthly limit of their respective account (see example below for the free version of ScreenshotAPI) to monitor potential other “diamonds in the rough”.

Conclusion

Our growth was sporadic and unpredictable for the most part, but overall we experienced a 32% MRR growth from June 2022 to December 2022.

2023 will be about trying to build out some playbooks for each of the portfolio companies. We will be relying on product usage metrics to find the patterns of our most qualified free users.

More to come.

Cheers,

Danny