Acquisition Entrepreneurship

Watch:

Listen:

There are many paths to Rome. I didn't think mine would take me on a journey through acquisition land, but that's life isn't it. You probably know what acquisition entrepreneurship is but here's a definition for ya just in case:

What is Acquisition Entrepreneurship? - Acquisition entrepreneurship is the practice of acquiring existing businesses to grow and scale, rather than starting a business from scratch. This approach offers several advantages, including a quicker path to profitability and reduced startup risks.

Why Buy

When acquiring a business, you generally purchase something that already has at least a small amount of recurring revenue. Even a modest operation with tens of customers serves as a valuable data point, indicating that the product meets some kind of market need. I'm not suggesting that these smaller acquisitions have achieved product-market fit, but they are certainly closer to it than just an idea or an MVP. In this sense, the acquisition is slightly de-risked by buying something that is "already working" to some extent.

For me personally, acquiring a product that is well-developed and has paying customers is extremely valuable. As a software developer, I can almost always build any product we want to acquire within a certain timeframe. However, what I can't replicate is the attention that the product may already have, and of course, the existing customer base.

Risk

In acquisition entrepreneurship, market risk is often partially mitigated because you're acquiring a business that already has a product and some level of customer validation. This leaves you primarily with execution risk, which involves scaling the business, improving operations, and perhaps expanding the product line.

Today, most products have market risk, meaning the idea you have for a product can most likely be built. This is an important reminder. Even 15 years ago, apps like Uber, etc would not have been possible because there was no App Store (there wasn't even a iPhone yet!). There would have been a risk that the product couldn't be built! That's not how things are today. Devs are getting cheaper. Writing code is getting more and more automated (finally). Your product is probably not your moat anymore.

So back to market risk. Acquisition entrepreneurship allows you to focus primarily on market risk. This is why I'm always saying buying a company is mostly just operating a company. The transaction to buy it is like 30 days. and the next 3 years are all about growth, operations, etc.

I'm not saying buying a company is an easier path necessarily, you just start at different points.

💰 Talks

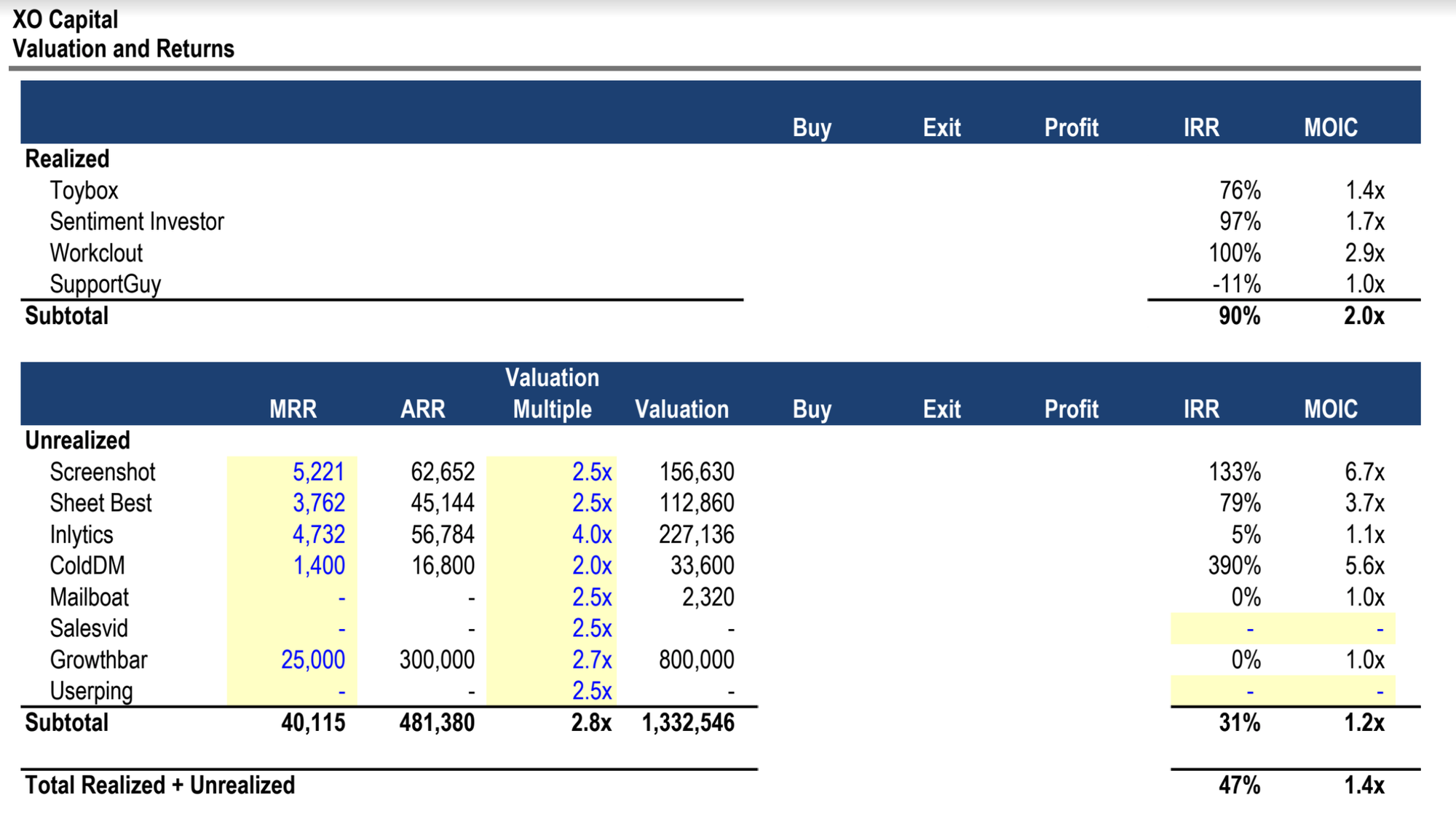

We've bought 10 businesses so far. Here's exactly how much we've made:

For our realized gains, our IRR is 90% (so far) and MOIC is a 2x. We put in $228,000 and got back $448,000 for a profit of ~$219,000. This is pretty cool. Before we bought Growthbar we were effectively playing with house money. Said in another way, our realized gains payed for all the acquisitions in the portfolio (minus Growthbar).

One thing to keep in mind is that these business also produce cash that we currently reinvest into growth if there is any profit left over. An interesting crossing point is when the $ the business has produced in revenue >= $ we paid for the business. On an aggregate level, XO runs slightly in the red right now since buying Growthbar and putting some debt on it. But on the margin, Screenshot, Sheet Best, Cold DM, and Work Clout all cash flowed more than we payed for them while owning them. Pretty neat!

XO now does about $40k MRR. Would it in theory be nicer to have 1 company that does $40k MRR with 1 product, 1 team, 1 focus, and (forgive me) one direction? Probably. But I've been trying for 10+ years to build a $40k MRR business and guess what, it's pretty hard.

Definitions

The two most common metrics that PE uses to measure performance is MOIC vs IRR. MOIC is a straight forward calculation without considering time. IRR is a little more complicated and includes the time horizon of the investment period.

MOIC

MOIC stands for Multiple on Invested Capital. It's a metric used to measure the value or performance of an investment relative to its initial cost. MOIC is often referred to as the Equity Multiple.

The formula for calculating MOIC is: MOIC = Total Cash Inflows / Initial Investment.

For example, if a fund invested $1 and received $3 from the investment, the fund has a MOIC of 3x. This means that for every dollar invested initially, they received $3.50 in total cash inflows.MOIC is commonly used within private markets. It's among the most relevant metrics to be assessed while conducting fund due diligence.MOIC is different from IRR, which measures your financial return in respect to time.

IRR

Internal Rate of Return is a financial metric used to measure the profitability of an investment over a specific period of time. It is expressed as a percentage.

For example, if you have an annual IRR of 12%, that means you have 12% more of something than you did 12 months earlier. The higher the IRR, the better the return of an investment. For example, a 20% IRR shows that an investment should yield a 20% return, annually. Generally, a high percentage return (greater than 10%) indicates a successful investment. However, a low IRR (less than 5%) might mean investors should reconsider their investment options.IRR does not account for the risk and uncertainty that may affect the project's cash flows.

Market Risk

Definition: Market risk refers to the uncertainty related to the demand for a product or service in the market. It questions whether there is a sufficient customer base willing to pay for what you're offering.

Characteristics:

- Uncertainty about customer needs and wants

- Competition and market saturation

- Economic factors like recessions or market downturns

- Regulatory changes affecting the market

Mitigation Strategies:

- Conducting thorough market research

- Validating the product through MVPs or pilot programs

- Adapting the product based on customer feedback

Example: If you're launching a new type of electric car, the market risk would involve questions like: "Is there enough demand for electric cars?" or "How will it compete against established brands?"

Execution Risk

Definition: Execution risk pertains to the uncertainties related to the operational aspects of running a business. It questions whether the team can effectively deliver the product or service, manage the company, and scale the operations.

Characteristics:

- Inefficiencies in production or service delivery

- Team dynamics and skill sets

- Financial management and funding

- Supply chain disruptions

Mitigation Strategies:

- Hiring a skilled and experienced team

- Implementing robust operational processes

- Regular monitoring and performance reviews

- Securing sufficient funding for operations

Example: Using the electric car example, execution risk would involve questions like: "Can we manufacture the cars at scale?" or "Do we have the logistical capabilities to distribute the cars?"