Anatomy Of A Micro Acquisition (Screenshotapi.net)

Learn how I acquired screenshotapi.net step by step

This is a play-by-play of how XOXO Capital acquired https://screenshotapi.net

Sourcing

I found the app on indie hackers. It had the stripe verified revenue still hooked up to it, which was at $550 some odd dollars a month. As our first acquisition, this was a great MRR for us to get our feet wet. It was a simple enough product that I could understand it completely, and I then reached out to the founder on twitter to try and see if he'd be open to selling.

I reach out to people on twitter a lot. Stuff comes up on my feed or people post their metrics about their bootstrapped SaaS and I just ask if they'd be open to selling.

Negotiation

When I first asked if the founder would be open to selling, he was only luke-warm on the idea. It hadn't occurred to him that he could sell the business and certainly had not thought about what that might look like.

A few days later though he came back to the table, saying he'd be open to selling it, and I started negotiating on price. His main reason for selling was to focus on a VC backed startup.

This, it turns out, is a common pattern I've seen so far. Founders are looking to ditch 'the little thing' for a potentially much larger company. I think this is a cultural thing. In startup culture, there's a kind of founder worship. The one's that make it to the moon are quickly idolized. I'm not saying it's a bad thing, merely that it's disappointing we as a startup community don't celebrate people who have built something profitable but not venture scale.

After several rounds of back and forth, I agreed on a price. The negotiation wasn't particularly interesting. I initially hopped on a video call with him to just introduce myself and after that everything was over email.

Deal Terms

The MRR at the time of purchase was $550 ish.

We paid $23,000 over 3 months.

This was our first deal, and we were a little desperate just to buy something and likely over paid. We took his highest month, carried that forward 12 months, and applied a multiple of 3.5.

$550 MRR times 12 = $6,600

$6,600 times 3.5x multiple = $23,100

Final Price: $23,100

This isn't a good deal for us. We had to bake in a lot of optimistic assumptions about growth. In hindsight, we paid too much. But with these low MRR deals, it's really hard to just price things based purely off cash flow because the founders often feel like it's not worth selling since they've put so many hours into the product.

Legal Docs

All 4 partners at XOXO Capital took the https://www.microacquisitions.com/ course from Ryan Kulp of Fork Equity. The course came with some legal docs that we used for the transaction.

We've only done all cash asset purchases.

One note about those legal docs is that I've found a few mistakes in them and there are definitely legal holes. I think those docs are good for up to a $250k deal. Anything beyond that and we're going to get a lawyer to go over them and customize the docs the way we think they should be.

Specifically, there's not a lot of recourse in the existing legal docs for a seller if we buy something and discover, for example, that the servers crash every 8 hours (this happened!).

Transfer

Escrow

We used escrow.com to put the money and the domains in. There are few services on planet earth I hate more than escrow.com. We use Mercury to bank and Escrow.com just could not understand how to find our wire transfers. Nothing quite like the feeling you get when you just wired $20k to some website you just signed up for and they tell you 'they can't find your wire'. Fuck escrow.com. I've considered building an alternative solution just so nobody has to feel the pain of using them for micro acquisitions.

Asset Transfers

The code transfer was easy. The code was on Github so they just changed the ownership to our Github org. Took about 15 minutes.

The biggest pain in the ass by far was google. Specifically google adwords. It took 3 months to finally unravel the billing information with many emails to support.

Some stuff, you'll find, was never built with a transfer in mind so if possible just have them give you access to the entire account.

Pro tip: If possible, just have the owner give you the entire account, not just transfer stuff to you. Particularly with AWS / GCP / Heroku. It's a scary thing to have to make heavy DNS changes 2 days after you've bought something.

Issues

In all honestly, we didn't really do much diligence. Sure, we made sure the stripe data was correct, but we really didn't look too closely at the code. It's so hard to evaluate an entire system from a few sentences in an email or viewing code over a screen-share. This is still something I don't think I've figured out how to do well.

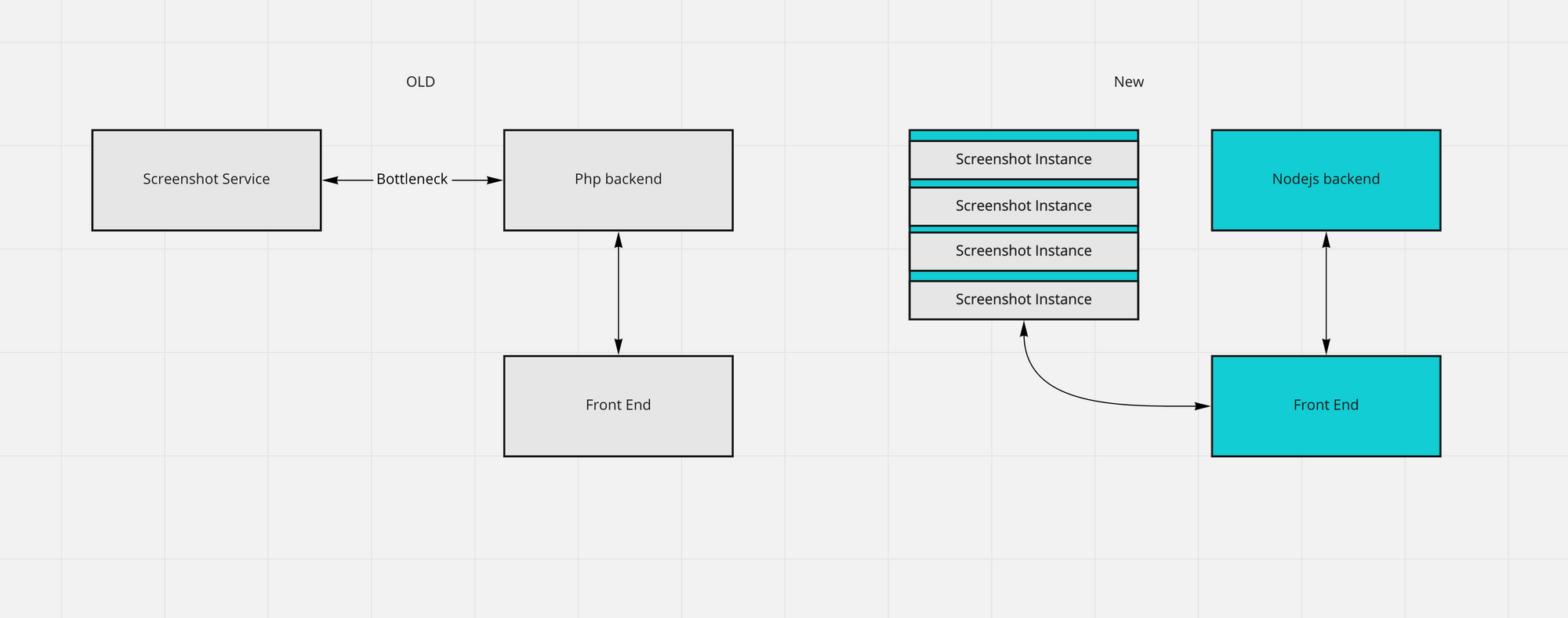

The architecture of the product wasn't going to scale. This was immediately apparent as we started tracing the logic of the screenshot mechanism.

Rewrite

We decided to ditch PHP. This is a personal preference. I consider PHP the language I learned in school and dear god did I not enjoy that. This wasn't necessary, but it would be nice to hand the new owner (if we sell) a product that's all in the same language. It simplifies things for them.

We also put the whole system on kubernetes and it will now scale to the moon!

This took about 2 months all in, and we're planning on going live with it April 1, 2021.

We also scoured Upwork and found an amazing JR developer for $10 an hour. He joined our slack group and plugged away at the project.

Though 3/4 of us are devs in our acquisitions group, the exercise isn't really about whether we can do the work ourselves. It's about operations. Acquisitions have a much higher ops burden than investing. We cut down on ad spend to accommodate the new money spent on the re-write and kept it profitable.

Growth

I'd like to take credit for doubling the MRR in 2 months, but honestly, it's been growing quite quickly and profitably using google ads. At some point this will stop being a profitable channel, but if it keeps going for another few months, we may be able to get to $5k in MRR just from google ads.

That would be a nearly 10x increase in MRR. Saying you bought something, 10x-ed it, and sold it looks really good to investors (investors in our fund). Although, we'd be perfectly happy sitting on it at $5k MRR and just taking the cash. It would be a nice little distribution each month. Roughly $1k in costs and $1k to each partner. Beer money! Or a vacation fund! Or just groceries haha.

Good Deal or Bad Deal?

So far, it's been a good deal. We've grown it 2.5x and are well on our way to making this first acquisition a small win for the fund.

In hindsight we should have done more diligence on the code quality and architecture, but again, this is still something I don't have a good strategy for.

We've since done 2 more acquisitions and are still getting our feet under us as to what our diligence process looks like.

Another note is that this product is largely a commodity. Any sufficiently narrow product is more or less fungible with competitors. It's really a land grab. If you reach a potential 'screenshot' customer first, then they'll likely stay, since we now have all the features our competitors do.