Cash Accumulation

When we started two years ago I naively thought I'd read enough Twitter threads to understand that basically all we needed to do to win was:

- buy good businesses (hard)

- accumulate excess cash (hardest)

- redeploy that cash (harder)

However, we now have two years of operating history and here's the reality:

- Our largest inflow of cash was from selling a business

- Our second largest inflow of cash was from an enterprise sale of an enterprise SaaS which we have since concluded is not the right type of micro business for us to own.

- The rest of the months were roughly break even or operating at a slight loss.

Even in a service business like the email marketing agency, which cleared $350k last year but did not make much profit for reasons we hope are fixed this year.

The point is, when you're buying tiny businesses, there really isn't much (if any) excess cashflow. The "cashflow" accumulates when you sell a business and then redeploy that capital to buy something slightly larger or buy two smaller ones that are growing quickly. In theory, we'd love to own stuff forever that kicks off consistent cash and grows at a consistent rate. The reality is though that sometimes we have to sell stuff off we'd rather keep to be able to generate enough cash to do another acquisition.

The flywheel that i think is more practical despite it not being ideal is:

- flip businesses to accumulate cash.

- redeploy that cash

The tricky part though is that you need to find something quickly to buy if you're watching your IRR #s. Thankfully we've just used our own cash to date so that's not a problem, but one day we may raise a fund and people will ask our IRR so it's still a concern.

In short there's no free lunch once again. If we buy enterprise SaaS businesses, they're really time intensive and labor intensive but have the ability to close 5 and 6 figure customers. Those customers subsequently demand a lot. On the flip side, single purpose applications have relatively lower labor requirements but do not have the ability to have 5 and 6 figure customers.

The last vector is when you buy a larger business but you load it up with debt. This also makes it tough to accumulate cashflow to then redeploy elsewhere because if you're levered at 70% then there isn't going to be much leftover cash. If there is, then good for you, you cut a really great deal or the deal was sufficiently large.

Example:

- You buy a business for $1M that does $250k a year.

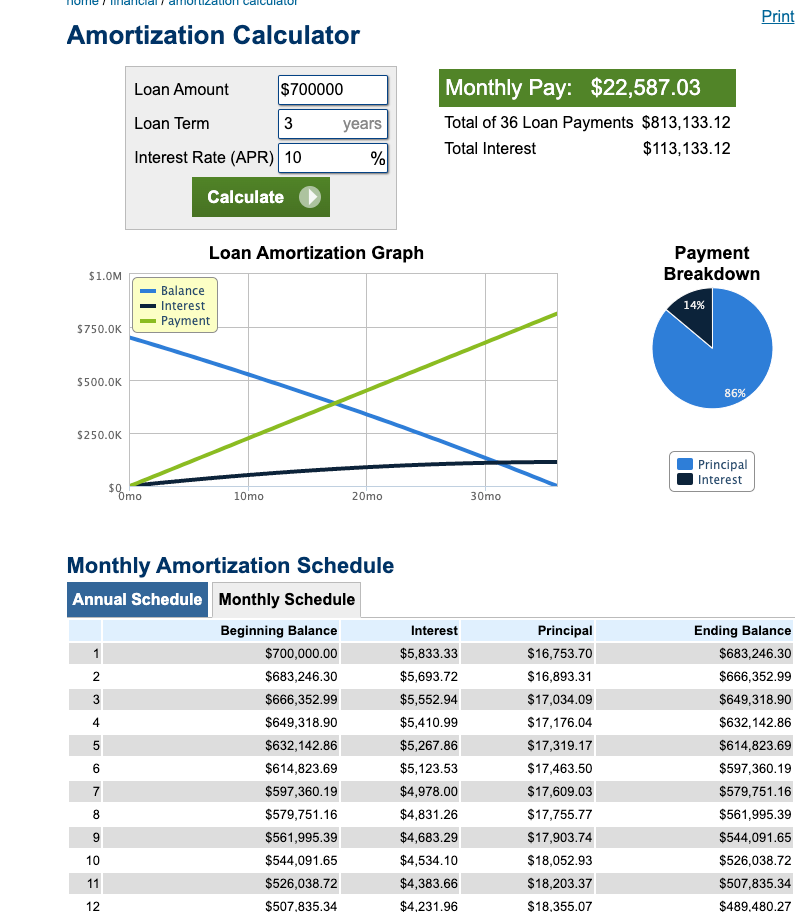

- You're borrowing 70% of it at a 10% interest rate that amortizes over 3 years. (good luck finding a seller willing to do this by the way).

- At $250k ARR, that's $20,800 MRR. The debt payment on that would be $22,587 ... so already zero room for operating.

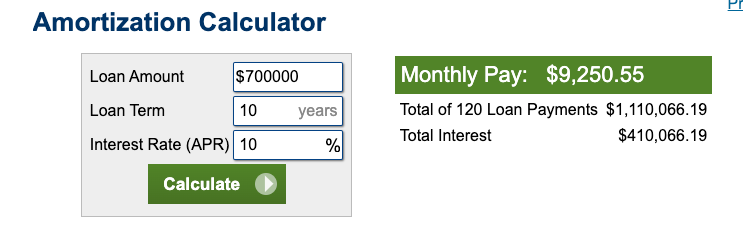

This of course is why SBA loans are lovely in theory, because they amortize over 10 years. This deal amortized over 10 years is way better:

Now you'd actually have some cash to pay yourself (if you were doing everything) or hire one person and maybe be able to pay your mortgage.

So levering up is difficult too. The best way out of this is to of course already be rich. And with that brilliant insight, I hope you have a great weekend.

Are we having fun yet?!?

Andrew