Micro PE Mindset

We've been running a micro PE fund for 18 months now. It's a fundamentally different business

This week at XO, we had a little bit of a customer support wake up call. Inadvertently, we were prioritizing new code and new features over existing customers. For the typical start-up, this is the right way to operate for the most part. Your objective is growth-at-all-costs. If a customer is slowing you down, screw em! You might even be so bold as to fire some of them. It's nobody's fault when that happens. Your early product was a guess, a hypothesis about the future. Hopefully your initial build was a manifestation about that hypothesis. You were off the mark by some percent. Company building is inefficient. This is often why you throw your initial MVP away and rebuild from scratch once you “know what you need to build”. Early customers may not be a good fit today. They might have been instrumental in getting you to where you are, but it's possible you outgrew them. Or, it's possible that their use-case just doesn't line up with your core value proposition any longer. The faster you can create a machine to acquire customers and keep them happy, the bigger the rounds, the happier the investors, and ever closer is that paper unicorn.

We're playing a different game altogether. If you want some really clear language around our thesis, go read Matt Morris' Dura Software Investmen Thesis Post.

Everyone knows about the margin structure of software businesses and recurring revenue characteristics. Owning equity in a software holding company diversifies away much of the idiosyncratic individual portfolio company risk and provides a long-term durable stream of cash flows. In many ways, you can compare this to a diversified REIT given the contracted, diversified cash flow streams across a collection of assets. These businesses can act both acyclical and counter-cyclical. These businesses are not of the get rich fast variety. They require a combination of patient investor capital and serious operators with consistent discipline. - Matt Morris - Dura Software Investment Thesis.

Or take a look at this short clip by Andrew Wilkinson.

Had such a great time chatting with @SahilBloom and @gregisenberg from Where It Happens.

— Andrew Wilkinson (@awilkinson) May 20, 2022

Here's one of my favorite clips, talking about slowly building wealth via compounding vs. venture bets.https://t.co/CgYJL2iwj1 pic.twitter.com/YfdIzW4FrE

We're trying to compound our way to success. We (try to) buy great businesses at fair valuations and compound growth slowly and consistently over time. That's it. That's the game. Each product we own is a promise to our customers. When we buy a product we're committing to fulfilling that promise. Nothing more, nothing less. Consistent growth.

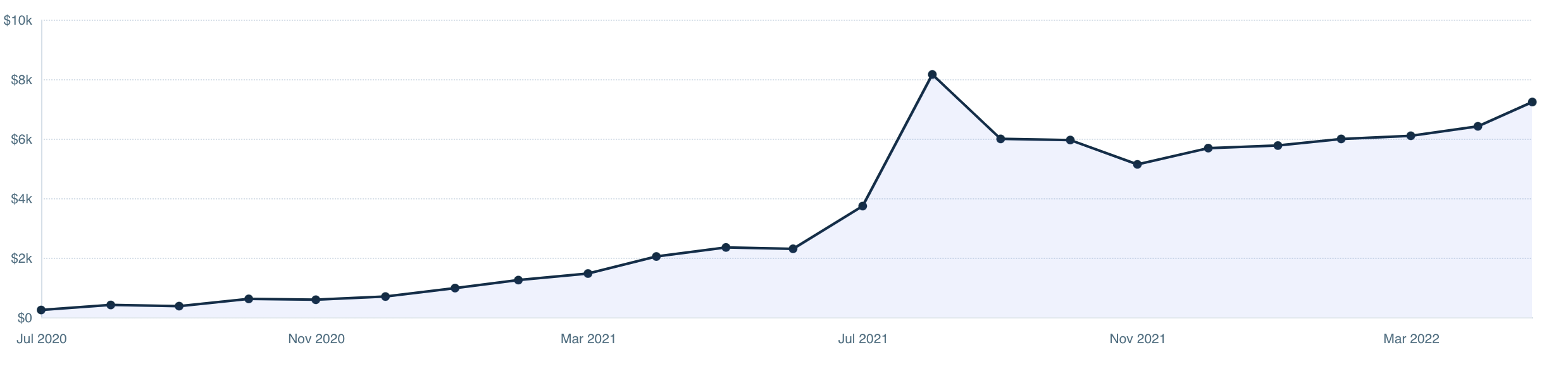

This is our growth since inception. We (anomalously) had one month where someone used the heck out of a product, but for the most part it's been 5% ish MoM growth. Actually it's been 17% but these are peanut sized deals so i wouldn't put too much faith into it. The point is we don't get large growth MoM. We get consistent growth from attributable sources and try to make sure we can repeat it next month, and the month after.

It's a patient game. I don't think everyone is wired for it. There's a strong culture around entrepreneurship. Perhaps you think of gun slinging western cowboys who can code or some other nonsense. The problem is sometimes that's true, and it certainly doesn't help that the media machine has taken hold of some of these founders and turned them into legends (or villains). There's all different kinds of entrepreneurs, but acquisition entrepreneurs I think have to be built differently. It's patience over brashness. And it's certainly not jumping off a cliff and assembling the plane on the way down. We buy planes that fly, make sure they're well maintained, and keep flying them until they're ready to retire.

Anyways, after our little issue this week, I think we decided to put customer support (i.e. retention) above growth and engineering. It feels weird. Even I missed this subtle difference between a VC backed startup and a micro PE fund, but I think it's right for us. Obviously it's both, when we're not supporting customers, we're trying to grow and build new features, etc. But, if we start prioritizing new products and new features over existing ones, I believe our model will fail.

Markets are still frothy out there, stay sharp!

✌️,

Andrew