Deal Structures

A couple of people have asked about deal structures so here are a few we commonly use for buying micro saas companies.

All Cash

Pretty straight forward. You do all cash. Usually it's 100% into escrow.com and release maybe 50% before asset transfer and 50% after asset transfer complete since it's kind of hard to do asset transfer inside of escrow.com. Ideally all the cash would be in escrow.com and all the transfer stuff would be there too, the buyer could inspect it all and then approve the release of funds.

Seller Financing

Despite all the BS on Twitter, good luck getting someone to agree to 80% seller financing. If you can find someone to say yes to this, obviously you should do it. Normally you can do 10%-20% seller financing with no interest rate over 1-2 years. We don't do anything over 1 year as a seller. You as the buyer can push for 0% interest, and you as the seller can push for some nominal interest rate. We usually end up doing 0% interest on both sides of the table.

Debt

We have failed 3 times to get an SBA loan on a normal SaaS acquisition. If you can figure out how to make it work, let me know. Most of the time, the banks just get really confused on simple P&Ls and i just got a sense that even the people that claim they can do saas actually haven't done it or it's much more rare than you'd expect. We had a deal rejected because the seller had some add backs ... this is quite common and still the bank couldn't get over it. You'd need a squeaky clean P&L with a very patient seller to pull this off (and likely a non-competitive deal since they'd probably take less $ for all cash upfront).

Earn Outs

For small deals, doing an earn out is unrealistic. Small is < $250k. As the seller, it's very difficult to have confidence in a random buyer to grow your business when you no longer have control over growth. What if they suck at execution? As the buyer, sometimes you want to structure earn outs to minimize some downside risk. Since growthbar, we will be valuing annual payments with no history of renewal at $0. If they renew, then the previous owners can get 80% or some such number.

Churn Outs

I'm still waiting for this term to catch on. If the company has high churn (which many micro-saas do because they're typically pre PMF) you can add a "churn out" clause. We've done this 3 times. Typically you do it for 1 year and if the MRR is above X (or you could use TTM Revenue, etc) the seller get's Y. It goes something like this:

| MRR Range | Price |

|---|---|

| > $10k | $250k |

| > $9k <= $10k | $200k |

| <= $9k | $180k |

| <= $8k | $160k |

You may also want to use the churn out to mitigate platform risk. We did this with inlytics because we were nervous about the linkedin integration.

Equity Earn In:

We don't do this but you could keep the previous owner as an equity holder and potentially have them receive a share of future profits. You might do this if you are planning to sell the business in the next 1-3 years and both you and the seller think you could grow the business from here.

Mixing & Matching:

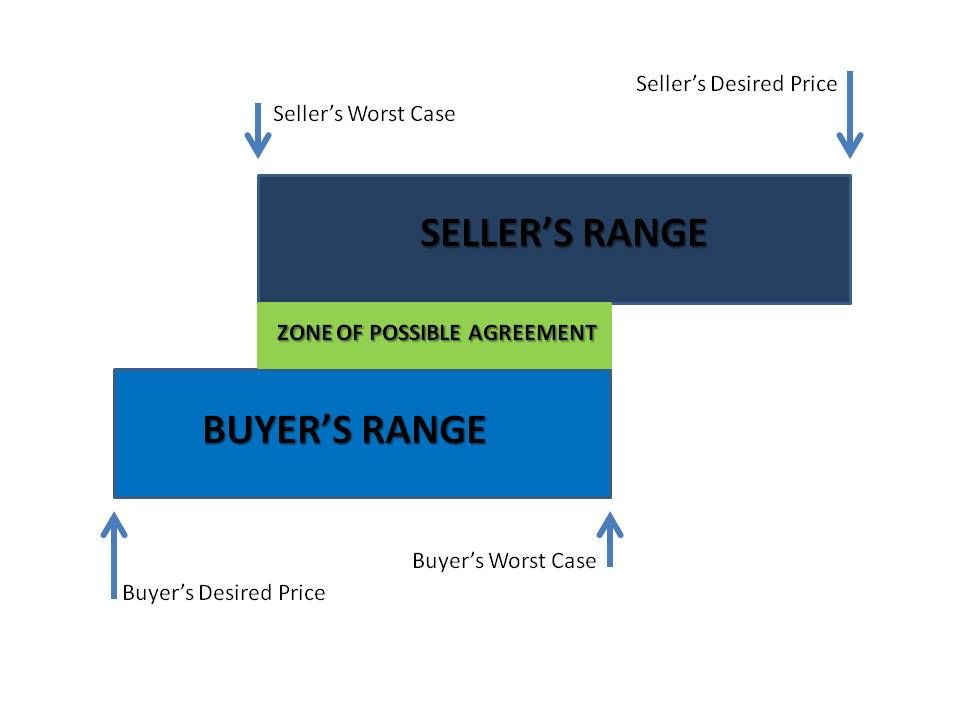

You could pick one or many of the above options to combine them. Warning though, things get complicated fast and a confused seller is an unhappy seller. And unhappy sellers can walk away. I'd advise chatting through scenarios with the seller and talk through the things you are worried about and see if you can come to an agreement together that matches your risk tolerance and their sell price (ZOPA - Zone of possible agreement).