Flip Fund® Logs Pt 2

Listen:

Watch:

Having an audience is insanely powerful. We got nearly $500k of soft commits in <2 weeks.

I have:

- ~10k followers Twitter

- ~11k followers Linkedin

- ~800 on this email list.

The only one I trust though is this email list. Twitter ... god knows what will happen there, and Linkedin is where I get the most engagement, but having your own email list is beautiful. Every email I send out I get maybe 10 ish replies and have some lovely chats with interesting people.

After letting our inner circle know what we're planning with the Flip Fund we soft circled our target in < 2 weeks. I took 4 meetings. Everyone else (most of you lovely folks) has been following us for a while, knew us, knew how we worked, and just emailed back a number they were comfortable with. This didn't happen over 3 weeks though. In reality, I planned this ask 3 years ago. Of course these are all just soft commits on an initial concept. I'm sure many more meetings are in my future, but it's a hell of a start and a wildly different tone and cadence than last time we tried to raise.

Some very interesting questions have come up. Questions in bold, answers below.

How much is committed so far?

- ~$500k soft committed

Is this blind / opportunistic?

- ya

Where’s the LPA?

- There’s no LPA, this will be a direct investment into a multi-member Delaware LLC. We’re going to likely have a one-page membership agreement for the LLC. As bare bones and simple as possible.

What’s the entity structure?

- multi-member Delaware LLC operating out of Texas. Everyone is investing on the same terms.

What happens if a sale doesn’t occur after 12-24 months?

- If anyone wants out early, we can either bring a new member in or have existing members buy the shares at the same multiple we bought the business for applied to the current MRR.

If everything goes well and the acquisitions doubles in value, will you look to hire a broker to sell or sell it yourself

- Selling it ourselves has been most cost effective. We're open to working with a broker if they can get us a better deal than we could get on our own. We've tried to sell 1 deal with a broker and ended up finding the seller and closing the deal ourselves.

How are you going to bill hours?

- We’re not. We’re going to take 100% of the cashflow and use it to grow the business as we see fit. If you’re not cool with that don’t invest. We will however release a full P&L each month and you will be able to see exactly what we’re spending and where the $ is going. You will also have read access to the bank account.

Is there a case where the business throws more cash flow than you guys can put into work that it will get distributed?

- I admire your optimism. Sure, in an extreme bull scenario, we’d consider distributions at year end, although this would have tax implications for you (regular income).

What % of XO’s time is dedicated to this?

- We have at least 1 engineer dedicated to each port co. For our own portfolio, we have 3 engineers who rotate projects every 30 days. Some acquisitions come with contractors we can rely on for engineering, some don’t. We may also hire dedicated resources to the new co.

- We have a full time customer support person across the portfolio, and their time is split as needed on inbound CS tickets / tasks.

Exit Strategy

- Most likely sale is to a small PE buyer like us or a personal owner / operator. Probably too small for strategic but possible.

One of the questions I'd like to spend a little more time elaborating on is how we spend our time / resources currently and what that would look like in the Flip Fund.

We currently have 3 FT devs who rotate companies every 30 days. If there is an ad-hoc emergency obviously it's all hands on deck, but it is the current person assigned to that company who will be in charge of resolving it. Of course that person can pull in other team members to help resolve it quickly but in a normal week, we may have 0 or 1 at most. We started this a few weeks ago to prevent context switching for the devs. I don't personally mind it that much but I can absolutely understand how it messes with someone's flow. Engineering is still our bottleneck, as it usually is. It's been doable but painful. Our goal is to be able to buy businesses large enough to fund 1 GM / CEO and at least 1 developer. The GM role will focus on growth and product in that order.

For customer support, we have 1 full time person who handles inbound customer support. Her time is spent wherever there are tickets with the goal of closing out the day with 0 unresolved tickets. She's awesome.

When thinking about a marginal acquisition, it's tough to say exactly how this will impact the team. Growthbar for instance has a contractor who built the product from scratch. We currently use him for 100% of the engineering on Growthbar. This is amazing because it doesn't add to our headcount, and there's almost no risk of failing to execute on a feature idea because this is the same guy that built the thing from scratch. It also free's up our time to think more about where to steer the product.

But what about a more complicated situation where we want to do a complete rewrite from scratch? This is where things get tricky, and why we want to buy larger businesses. In our current workflow, an end to end rewrite would likely involve a lot of my time + 1 developer full time for several months depending on the size of the rewrite. Taking 33% (1/3) of our engineering hours for several months for 1 product is tough. Hence why we'd either need a contractor or a full time resource dedicated to that product.

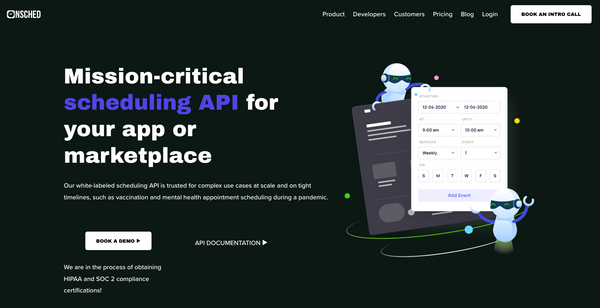

Another situation is more about the strategy of the acquisition wherein we're trying to get some multiple expansion. For example, we buy a b2b enterprise SaaS whose UI looks uglier than a bowl of cold oatmeal. Part of our strategy will likely be a rewrite, but it might also include staffing the company up so the acquirer gets some headcount with it (desirable in most cases). This makes the EBITDA of the company lower but might still be more attractive than buying companies with 0 employees (like we have done).

So short of answering this question by saying "it depends", which it does, I'll say for the Flip Fund, we will likely either buy something that has a contractor (for the case where we do not want to rebuild it), or plan on hiring 1 developer full time onto the project (plus a heinous amount of my time). On the customer support side, we have excess capacity so we can absorb that cost. On the growth side, Danny, myself, and a few contractors we currently work with will be responsible for growth.

Overall 12-24 months is a really short time horizon to double a business but I think we can do it. We've done it before with smaller acquisitions and if we buy a company with a solid product (I don't really want to sign up for a rewrite for the flip fund), and 1 channel that's already working (ideally SEO), then we've got the right ingredients.

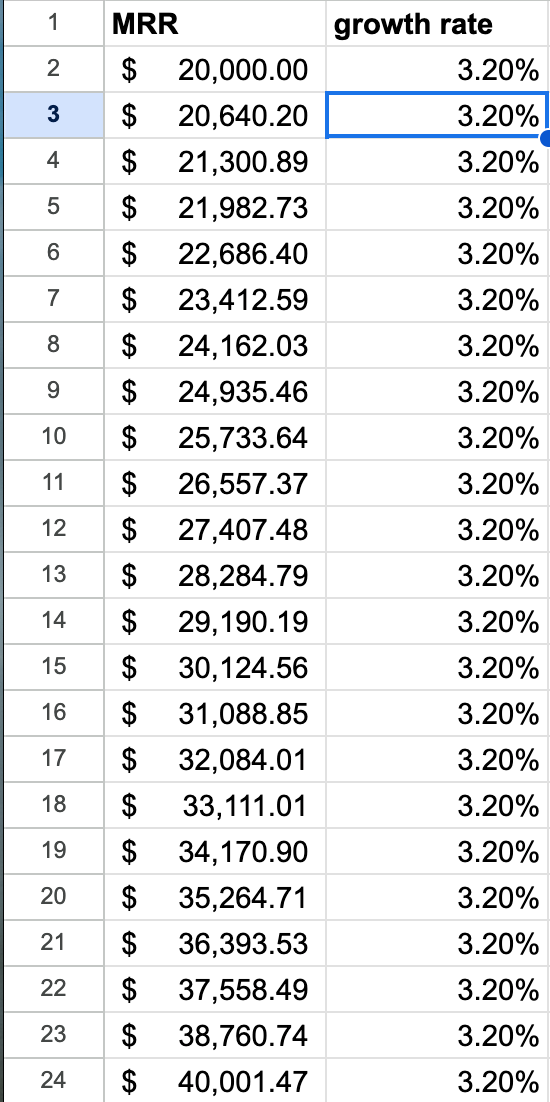

What does doubling over 24 months look like?

3.2% MoM growth. I might get this tattooed.