Fund Structures

I received a question on Twitter I thought might be useful for everyone to see the answer to.

Disclosures: I'm not a lawyer. I don't play one on TV. Consult a lawyer to make decisions like these and don't listen to me.

Did you buy assets or a company? Did you guys form a partnership/company/etc? Very curious about this part of microaquisitions.

— Tonya Ugnich (@ugnich) April 1, 2021

Here's our current structure:

Delaware Multi-member LLC - we have 4 equal partners.

We're planning on raising a fund some time this year and we've been kicking around ideas on how to structure it.

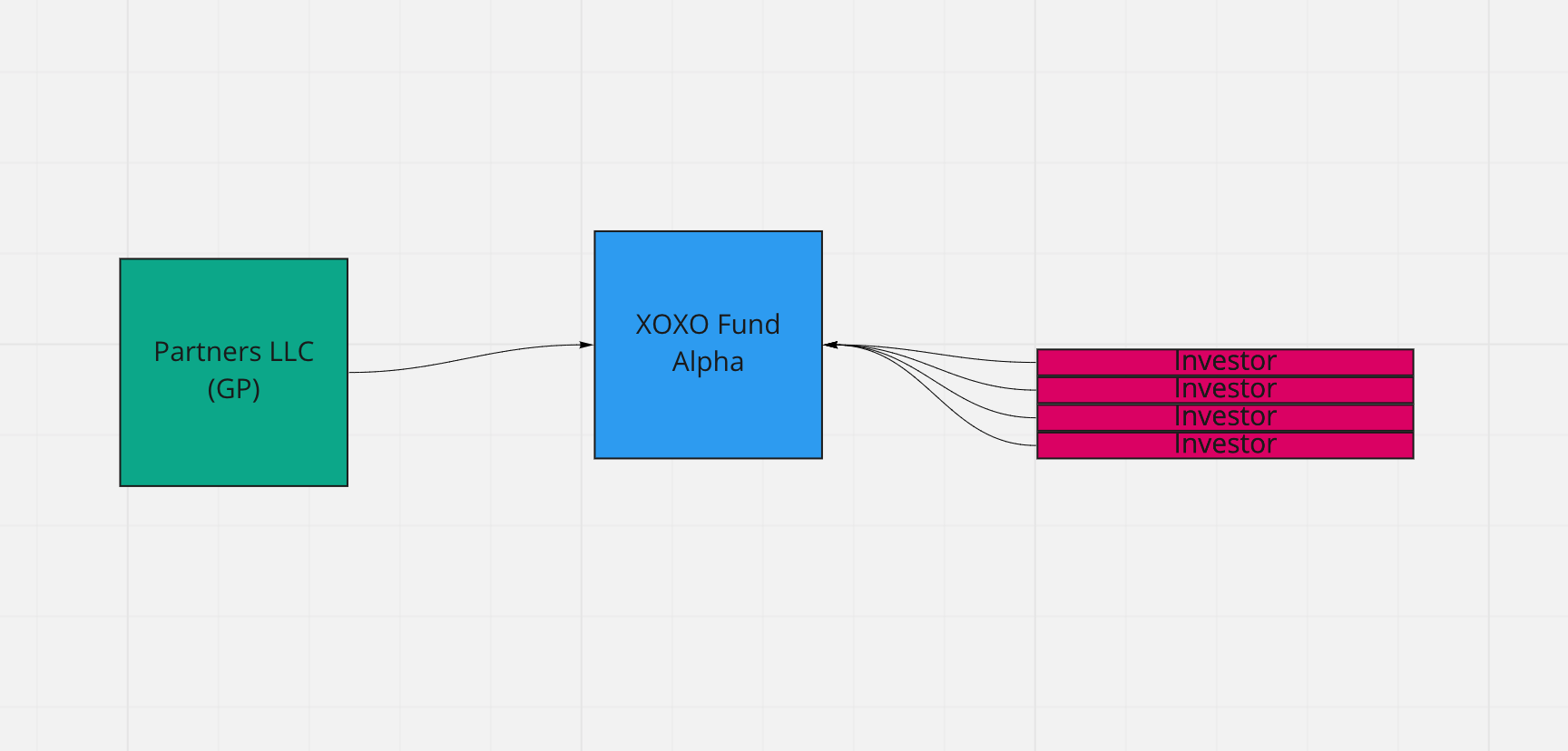

Proposed fund structure:

GP LLC - this is the 4 of us. This could also be an LLP. I'm not clear on why that would be better though.

XOXO Capital Fund Alpha LLC - this is a multi-member llc with a slightly different / custom management structure compared to an out of the box llc like you'd get from Stripe Atlas. It will be managed by the GP LLC as opposed to just a normal member managed LLC

Investors - individual investors or companies that invest in the fund.

I did see that Andrew Gazdecky from Micro Acquire started doing stuff like this for their minispac or microspac but they do it as a C-corp. Here's my interpretation of using a c-corp for this stuff:

- double taxation sucks - you pay taxes as a corp and then you pay income taxes on distributions

- only needed if investors can only invest in c-corps (some investors require this)

- you're going to have more than 99 people on your cap table (might be lower depending on various things I don't understand

- Getting money out of a c-corp is also kind of a pain in the ass.

In short, try to use an LLC. It's easier to go from an LLC to a C-Corp, but going from a C-corp to an LLC takes an act of congress (very hard).