Growthbar Acquisition Teardown

Listen:

Watch:

XO Buys SaaS companies. We've bought 10. I thought it would be helpful for people to take a look at a snapshot in time for our most recent acquisition. This was all the data available at the time we bought it. Not 100% of it but most of the high level things like P&L, etc.

Growthbar was our 10th and largest acquisition, and the deal came together quickly. The transition was smooth, and it just felt right along the way. Mark (prev owner) was a pleasure to work with. But let's break down the listing, and the data and get into exactly why we bought it. This should serve as a barometer for future deals and the way we make our acquisition decisions. Of course, we haven't owned it for long yet but that shouldn't (yet) affect the deal analysis at the time we made the decision.

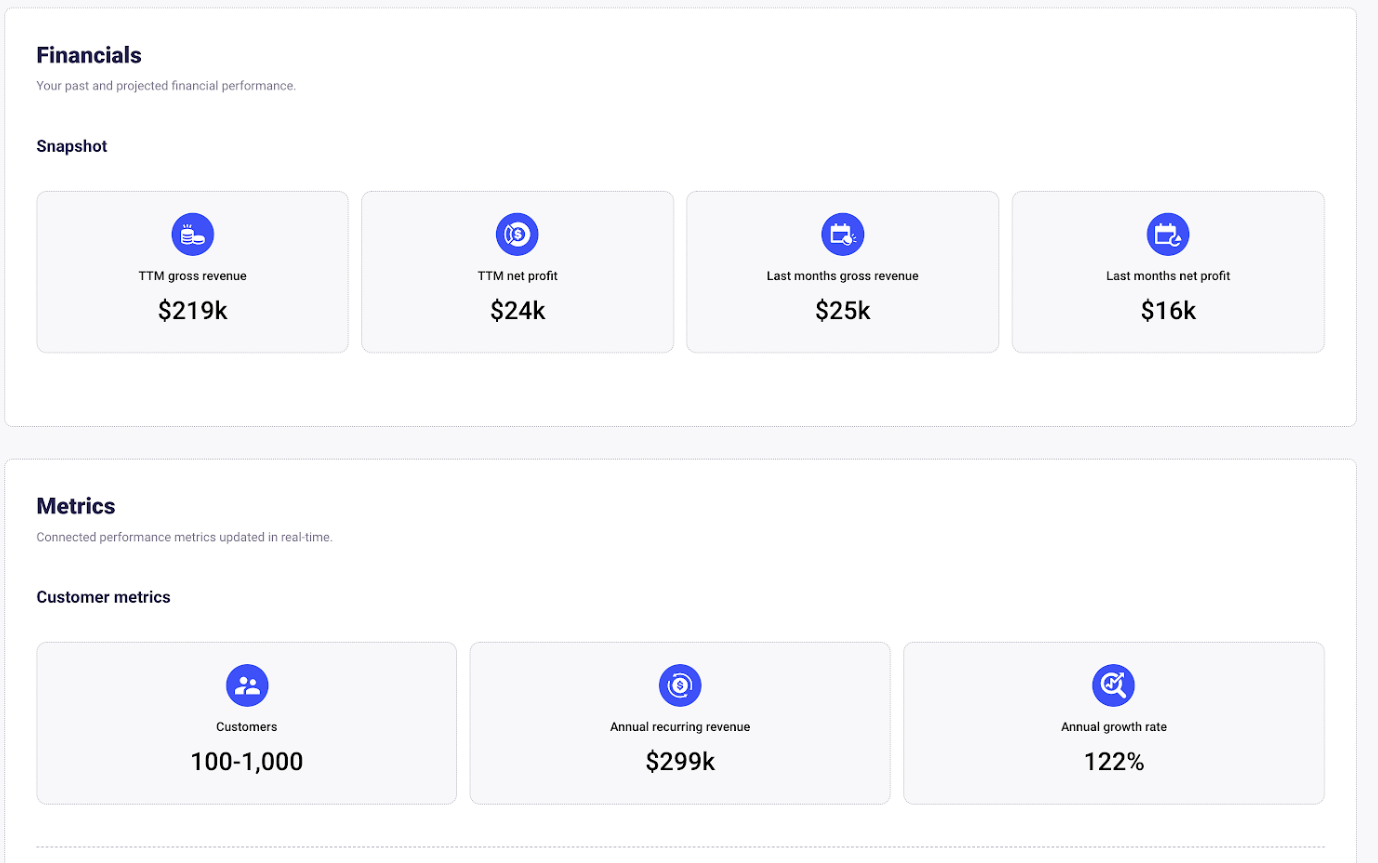

At a high level, here's what we liked about the business:

- It was a good size for us. ~$25k MRR + The asking price was reasonable < 3x ARR

- The product had a really fast time to value for customers

- Mostly direct, organic traffic

- Low customer concentration

- 122% growth rate over previous year.

- The original contractor who built the platform was willing to continue helping us on an hourly basis.

What are we really buying?

What are we really buying with a small acquisition like this? (small is relative, this was our largest to date).

We're buying:

- some tech. probably no moat. maybe old code.

- some customers. hundreds in this case.

- at least one channel. Healthy direct traffic.

Growthbar got early access to openai and benefitted tremendously early on because of it. Now there are plenty of competitors. Competition doesn't bother me, there are a handful of +$10M ARR companies in this space all doing roughly the same thing. UX can be a differentiator. Some people will just prefer one tool to another even if they have feature parity.

Price

Price matters. Buying something for a great price is one of the biggest levers you can pull to reduce risk. If you buy something for 1x ARR and don't royally screw it up, you'll make money in year 2. These seem to almost always work out unless there is some exogenous shock that kills the company. At 2.5x. - 3x you have to be a little more patient (without growth) but it's still true you can "wait out" a bad deal and turn it into a good deal. These concepts are mostly for downside protection which is exactly how you should evaluate a deal. Yes of course offense is important but ain't no offense like a good defense.

Channel

Growthbar has mostly direct traffic from Google. On the one hand this is the holy grail. On the other hand (people don't think of it this way but) this is some platform risk. With all the impending changes to google search with generative AI we will have to see how this shakes out. Our conviction around this was mostly:

- Google will be around for a while

- Generative AI has some place in content creation

- People will need tools to still play the SERP game and the generative content game.

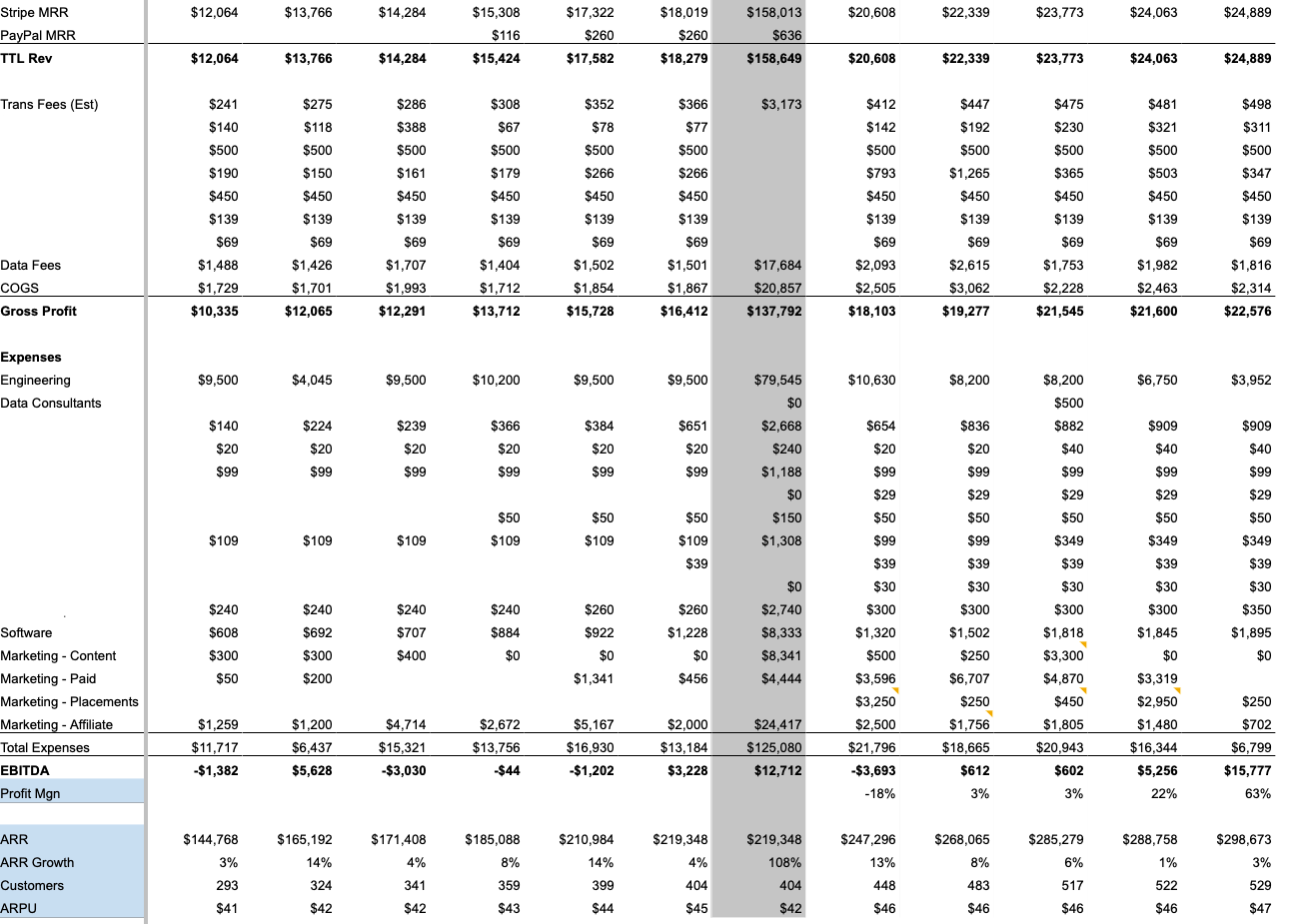

P&L

This was the P&L at the time we purchased the business (up to may 2023). There is some healthy gross profit and the biggest expense (unsurprisingly) is engineering.

If you remove the marketing spend and cut down a bit on engineering, there is enough room there to use some debt on this. We chose to do some seller financing over 18 months, so we really won't see any $ from this for 18 months. This is always a tough period because we are a little hamstrung by the debt payment. It does prevent us from significantly spending $ on growth but does allow us to buy a slightly bigger business.

Without any growth and a consistent MRR we would be paid back in about 2.5 years. That's not bad. Of course this is gross. There would likely be zero profit for 18 months without significant growth. Then after 18 months there would likely be reasonable profit to start accelerating growth or prepping it for a sale if that's what we want to do. Keep in mind our target is a consistent 3% MoM growth with low engineering costs.

Risks:

- Google search is changing / under threat

- AI content generation is getting a lot of eyeballs. Possibly saturated. Lots of competition

- Legacy tech stack.

Would you buy this?

Is this enough for you to write a check? It was for us. It's scary moving up stack doing larger deals and more than a little disheartening to make a change to an app and see this nosedive. I'm not sure how to explain this. We're these customers real?

but we're working through product improvements, applying our playbook and will need to just keep doing what we do for another few months to start to see the shape of Growthbar's future.

Dealing With Bad Data

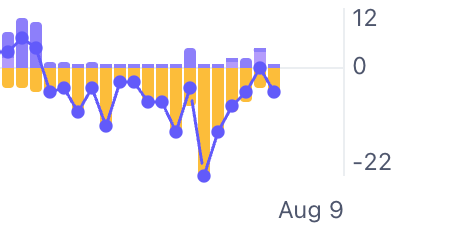

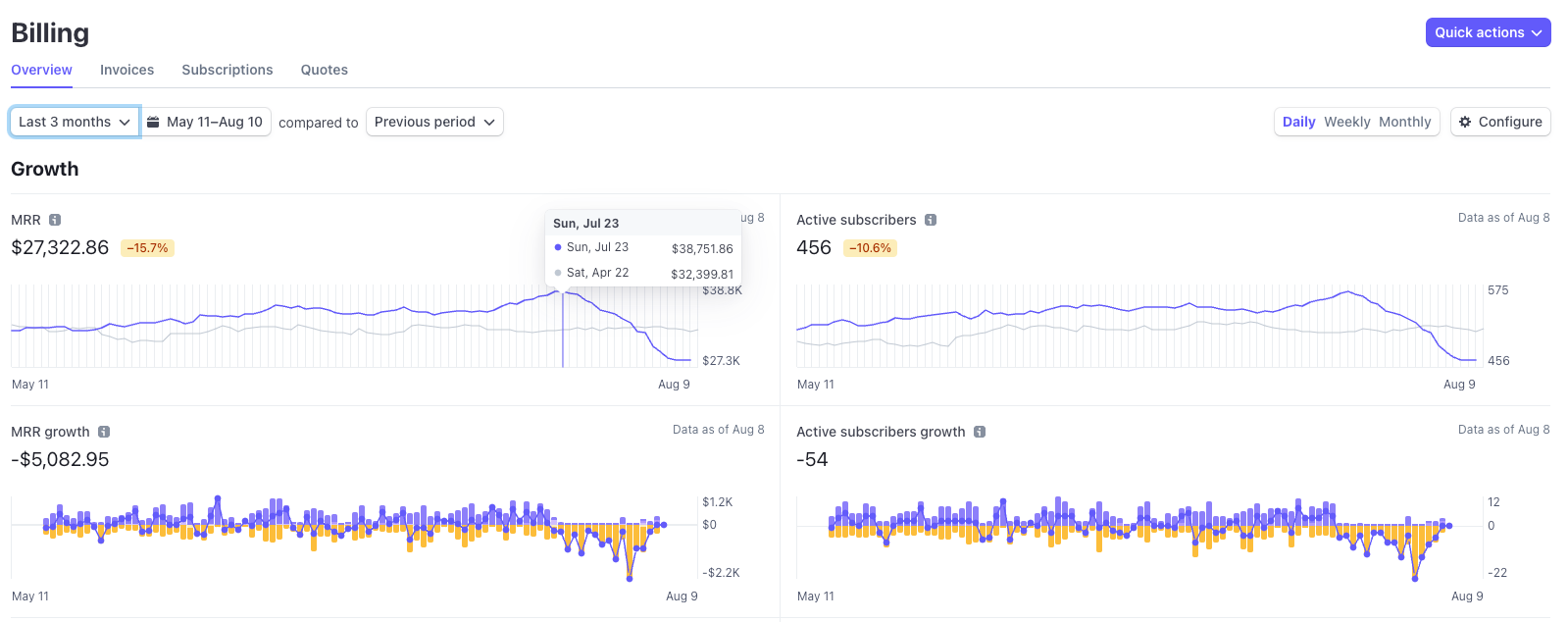

This is the Stripe dashboard:

The stripe data for this company is all kinds of wrong. If you look at July 23, you'd see an MRR of $38k. This is dead wrong. Cash collections were closer to $25k.

The reason is the way stripe calculates stuff. If you have a free trial user, that's an active subscriber and gets counted in your MRR. If they cancel, they still stay in your MRR calculation until all the dunning is done (can be weeks). This means the MRR number is wildly inflated in Stripe. Real MRR is closer to $25k.

This forcing of credit card info to sign up coupled with a default to an annual subscription caused a lot of disputes. So many that every dollar we make now goes into Stripe jail for 2 months. Makes it even harder to know exactly how much you're making in a given month because the cash for this month is actually from subscriptions 2 months ago.

For context, this is is Profit Well:

It's less wrong. But still, be careful looking at these tools, you're much better off looking at the bank account to give an accurate sense of cash collections.

What should I write about next?