Measuring Stuff

A Preamble On Markets

I can't title something like this without mentioning how tough the markets have been the past few weeks. I, much like you, have definitely been measuring my stock + crypto portfolio. It's much lighter than it used to be! Luckily I am mostly in cash, but still am down an annoying amount of money the past few weeks. Particularly in crypto. I'm the textbook definition of the guy who tries to catch a falling knife.

I know the FED raised rates this week and I hope that does something for inflation, but I'm on the hard landing camp and have been for a while. There's just no free lunch when you print as much money as the FED did. I also don't believe it will affect prices in tiny acquisition land. Not for us anyways. We've only been paying 2-3x ARR for the ones we've acquired. That discipline will be well served if we see a downturn in our business. So far I haven't seen an uptick in churn. That could change fast. I once heard a real estate agent describe what happens when stuff hits the fan economically as demand evaporating. It could happen, it will happen at some point, and when it does we will hopefully be prepared. I'm a war-time type leader anyways so all of this could be quite self serving!

So stocks may not have bottomed, crypto likely has not bottomed, interest rates are up (there goes my dream house on the west side of LA!). Luckily I have XO to deploy capital into ... except the truth is that great products are not for sale that often. The more publicity micro acquire gets, the better i think for us over the long term but the reality is we may spend 6 months not buying stuff. If we do this for a sufficiently long time, I could see a possible span of years where we just don't buy anything. It's already been a full 3 months since we made our last acquisition.

Back to measuring stuff

measuring stuff is important. I think most young companies aren't that good at it. And most larger companies have so much crap everywhere it's a monumental act of congress to get anything clean to glean some kind of insight.

So you lean on easier numbers like whatever is in stripe. Or maybe you pay for a tool like Chart Mogul, segment, etc.

At XO, we've particularly sucked at measuring stuff other than revenue. Which yeah i mean that is the only thing that really matters, but measuring revenue assumes a ton of stuff. It assumes basically every step before a purchase. And you probably don't have a frictionless funnel to move users from strangers to happy, paying customers. We certainly don't.

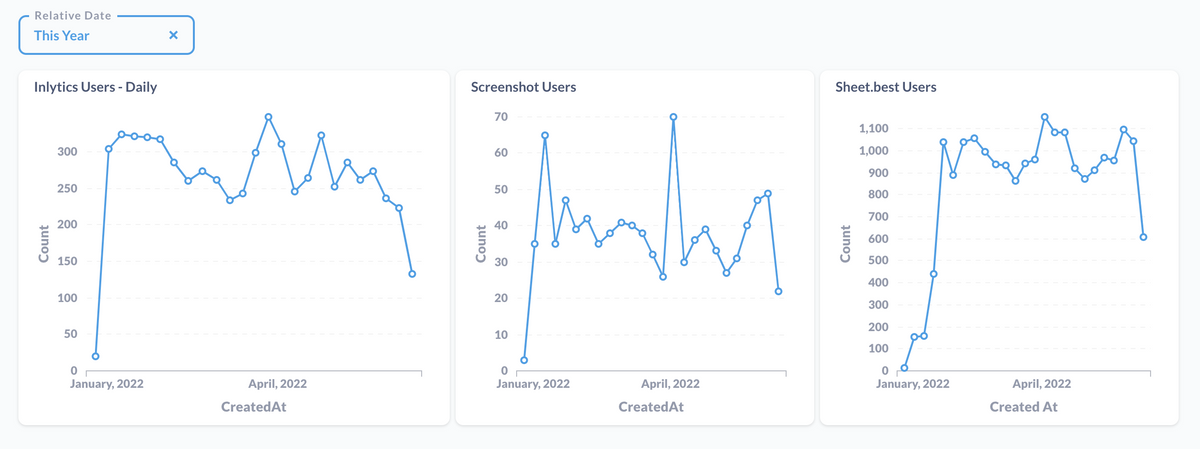

At the moment all we have set up is Metabase, which is a tool I adore for simple dashboards. It's free. We also use Chart Mogul, and google analytics. I don't check any of these as often as I should. I look mostly at our bank account and chart mogul to get a rough idea of if we're on track or not. This will get tightened up over the next few months.

One benefit of having gaps between acquisitions is a bit of down time to get out of working on each of the businesses and start setting up a playbook for XO. A kind of guide on our secret sauce for how we grow companies after we buy them. Right now it's a notion doc in bad shape.

Golden Metrics

If I could snap my fingers and have the knowledge I need to make decisions, I'd get answers to the following questions on a per portfolio company basis:

- Is the growth strategy working? (Growth)

- Are customers happy? (Retention)

I had a list of about 20 things that I trimmed down to two. There are probably more that should be on there, but if I trust the answers to those two questions, then I know what engineering needs to do, what marketing needs to do, etc. Perhaps part of this is a dashboard. I'm not sure yet. I do think it will be something. we build ourselves though, perhaps selling it as a SaaS or perhaps just dog-fooding it for a year or two until it's an indispensable tool for us.

Anyways, stay strong, don't panic sell, and try not to check Coinbase this weekend.

✌️,

Andrew