Preparing For Liftoff 🚀

Journey to Raising Discretionary Capital offers an insightful peek into the process of raising $650k for the first Flip Fund. Andrew Pierno shares his learnings and the steps they took, including writing a weekly blog post for three years, doing ten deals nearly bankrupting himself

Watch

Listen

A Thought On The Economy

I found this article talking about a potential crash for startups in 2023.

Obviously there's some confirmation bias here, but I think it's broadly true that 23 / 24 will be tough for VC backed startups. If you raised a large round in 20,21,22 at an inflated interest-free-world amount, that valuation is going to be lower in 2023. I think many startups will fail, and of course the "cream always rises to the top" nature of venture will cause the now tightened purse string holders to double down on the winners.

That's good news for us. I think we're in a pretty great spot (given we can continue to raise $) to scoop up some previously venture backed companies and buy them for a song and operate them profitably. Exciting times!

Flip Fund®

We've soft circled $650k ish so far. I'm blown away by the support and feel really grateful to have a few of you along for the ride. If you're interested in investing (and are accredited) please check out the deck.

Of course we'll see who shows up to the party but it's been lovely chatting with some of you. We're doing a 506(c) offering for Flip Fund® 1 so we can publicly solicit investment. This is all still being set up but we're about a week maybe two of being able to start taking in cash.

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

We've put together the absolute simplest possible LLC operating agreement and investment subscription agreement. You are welcome to check that out here:

A year ago, I would wander the streets wondering how on God's great earth people raise discretionary capital. It turns out this is the formula:

- Write a blog post every week for 3 years gathering a list of people who find what you're doing interesting.

- Do 10 deals nearly bankrupting yourself to prove the model out with your own cash first

- Then you can raise a tiny amount of discretionary capital.

There was probably an easier way but I couldn't find it. At one point, I'm sure we'll move upstream and be a better fit for small family offices, but they're going to want to see some solid execution on these first few Flip Funds. Lucky for you guys, we're going to have to knock these first few out of the park, especially the first one. There is no Flip Fund 2 if Flip Fund 1 doesn't work!

Portfolio Progress:

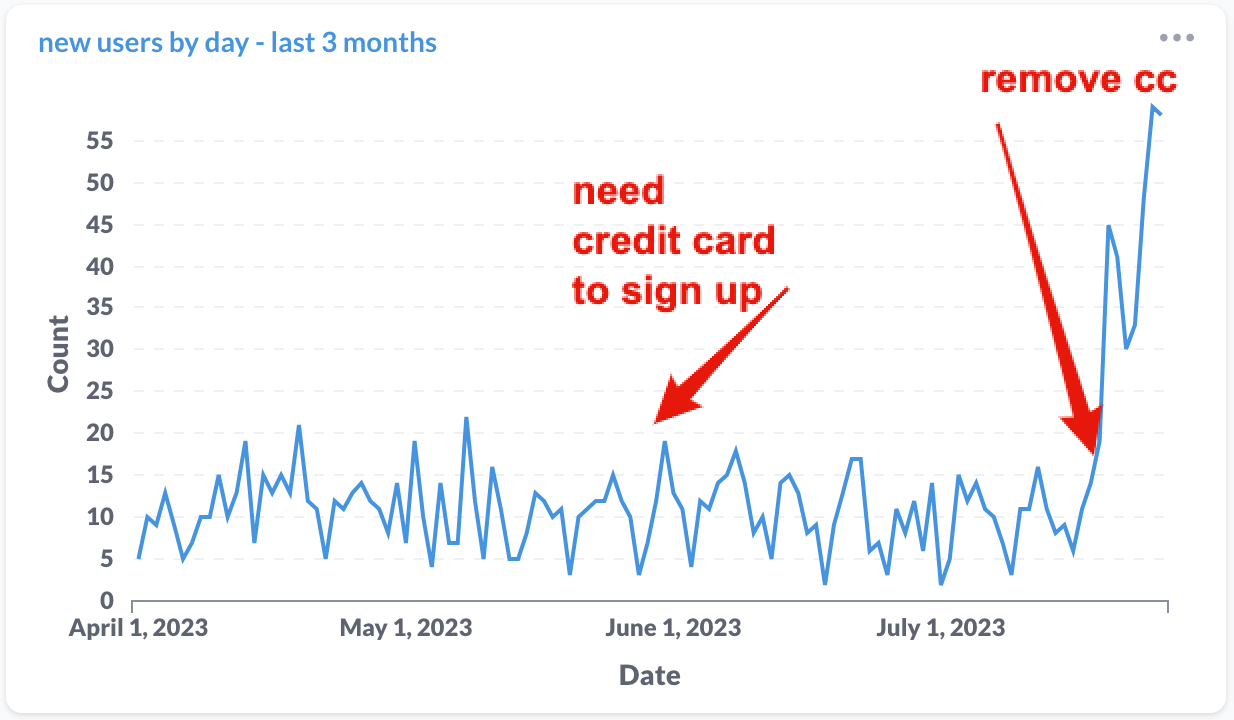

The largest change we made this week was to Growthbar. We removed the forced credit card payment and opened up India as a country to sign up. Quite predictably, signups increased.

What we don't know yet is the quality of those signups. In the past allegedly users were abusing the free trial and signing up for multiple free accounts to get half a blog post. It's always impressive how far some people will go out of their way to save $.

We'll need another 4 weeks to start measuring the new 2-week free trial users conversion rates to see if they convert at a higher number than forcing a credit card. If we're wrong, we will revert back to forced credit cards. I have to believe this will be a positive change. There are very few products I'm immediately willing to put my credit card down for before getting any value.

The next big bet on Growthbar is re-launching a writing service / marketplace. This was an experiment the previous owners ran and stopped despite there being some demand for it. In some ways, I get why you'd turn down $. If you're dead set on being a saas business there's no room to potentially mess with your business model by introducing either a service or a marketplace. For us though, money is all green and if there is demand for a "done for you" version of the product, then we have no problem meeting it. Taking a service business and bolting on a saas is a known path, but another potentially lucrative one is doing the inverse. Buy a saas and compliment cashflow with a service offering. In this case we're just the marketplace and we will take a fee for proving a great writer and a great post. We've already set this up with the company we use to write our articles and can't wait to launch this. We will do a simple cap each week of how many articles we can say yes to. This experiment is essentially just a simple form a customer can fill out on the site. I love little bets like this that do not require much engineering effort and could have meaningful postive impact.

We also took an L this week on Support Guy: PH launch with a rad feature that resulted in no new paying customers. Zero! We bought Support Guy knowing we were going to have to find product-market fit ourselves (not something we usually sign up for). But it's in a good spot now with this slack feature and we can focus on growth instead of building the product out to meet market needs.

Random

I've been really into this book "10x is easier than 2x" which is ironic because we're literally trying to go 2x and NOT 10x. They have a cool concept in there. It's the chapter on "The Gap Vs. The Gain". It's been a cool reframing to position progress in reference to my past as opposed to some unachievable ideal. Mentally it's a good way to stay strong.

I like the concept so much I built a bot that uses open ai to ping me every day to record my 3 wins from the previous day. I'm on day 4 and am surprised at how nice it is to get a text to remind myself to record all the small wins along the way.