Micro Acquisition Deal Structures

Structuring deals isn't my strong suit. I don't have enough reps yet. Luckily, there's a gentleman on our team who does!

Henry's background is in private equity. He can run through financials like nobody's business and come out on the other end with some ideas on how to structure a deal to help us mitigate risk and find something the founders will say yes to.

The tricky part of deals this small is that no founder wants to be valued on revenue alone. There's also good will and just a general feeling like they put a shit ton of time into the thing and want something for it. They'd almost rather value it on an hourly rate that they worked on it in some cases. That doesn't work for us, we want to build a portfolio of cash flowing businesses. If it doesn't kick off some cash right when we buy it or a few months after, it's not a good fit.

Some of these we've made up, others are obvious, and one in particular I'd like to get a copyright on :) We will usually mix and match a few of these.

100% cash up front

This is about as straight forward as it gets. You write a check and get handed the biz. The founders are happy, and you now hold 100% of the equity and the risk of the business going forward. As a buyer, this is your least favorite. Cash is precious, and having all your cash tied up in deals doesn't leave you with many options.

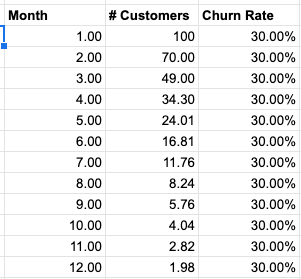

The Churn Out

Sometimes you find yourself looking at a relatively new business with relatively high churn. Let's say an uncomfortable 30%. If zero net new customers come on, you'll have zero cash flow in roughly a year. This is a nose dive. Hopefully you can sweep this one under the rug because you fucked up.

But maybe there's some growth too. Not much, and perhaps some months not enough to cover the churn. Enter the "Churn Out". Structure the deal so there's less cash up front but if the total MRR stays at or above X for the next Y months, you'll pay an extra amount. This incentivizes the sellers to help you transition and may even encourage them to help grow the business. This isn't always going to fly. We did a deal with a "Churn Out" because we were moving all buyers from Paypal to Stripe. We were worried that a bunch of people were not going to move so we structured the deal such that if MRR stayed at or above the MRR at the time of purchase and after the transition to Stripe, we'd pay an additional amount. For the record, MRR did continue to grow and we didn't lose many customers and had to pay. And we paid gladly!

The Earn Out

Share the wealth. Earn outs take all kinds of funky forms in the real world, but the simplest version is when you pay an additional amount if certain customers close or if MRR crosses hurdles. Say for example the current owner has a pipeline of customers she expects will close over the next 12 months. She did the work to build the pipeline and wants some upside if they do convert. You could structure a carve out in the agreement to give her additional cash, perhaps on a monthly basis from just those named customers in the pipeline.

Another version could be even simpler where if the MRR crosses X within Y months after closing, there's an additional payout.

Seller Financing

Seller financing allows you to pay a purchase price in installments instead of all at once. We did this with our first acquisition. We agreed to a price, and we payed it out over 3 months. This is nice because depending on the business' cash flow, you can use some of the business earnings to pay off the acquisition. It usually isn't dependent on business performance and is just an easy way to spread payments out over time.

SBA Loan

We haven't done this yet. We will. I'll report back on the reality of getting an SBA loan to buy a software company. In theory you can put between 10% and 25% down in cash and borrow the rest at a lovely interest rate with a 10 year payback period.

Generally you want to keep things simple. Often the sellers of small businesses don't know anything about finance and there's nothing worse than explaining to someone how they're not going to get all the money up front. But, these tools can help overcome the burden of tying up all your cash immediately when purchasing a new business. Try them all! Ping me on twitter if I missed one!