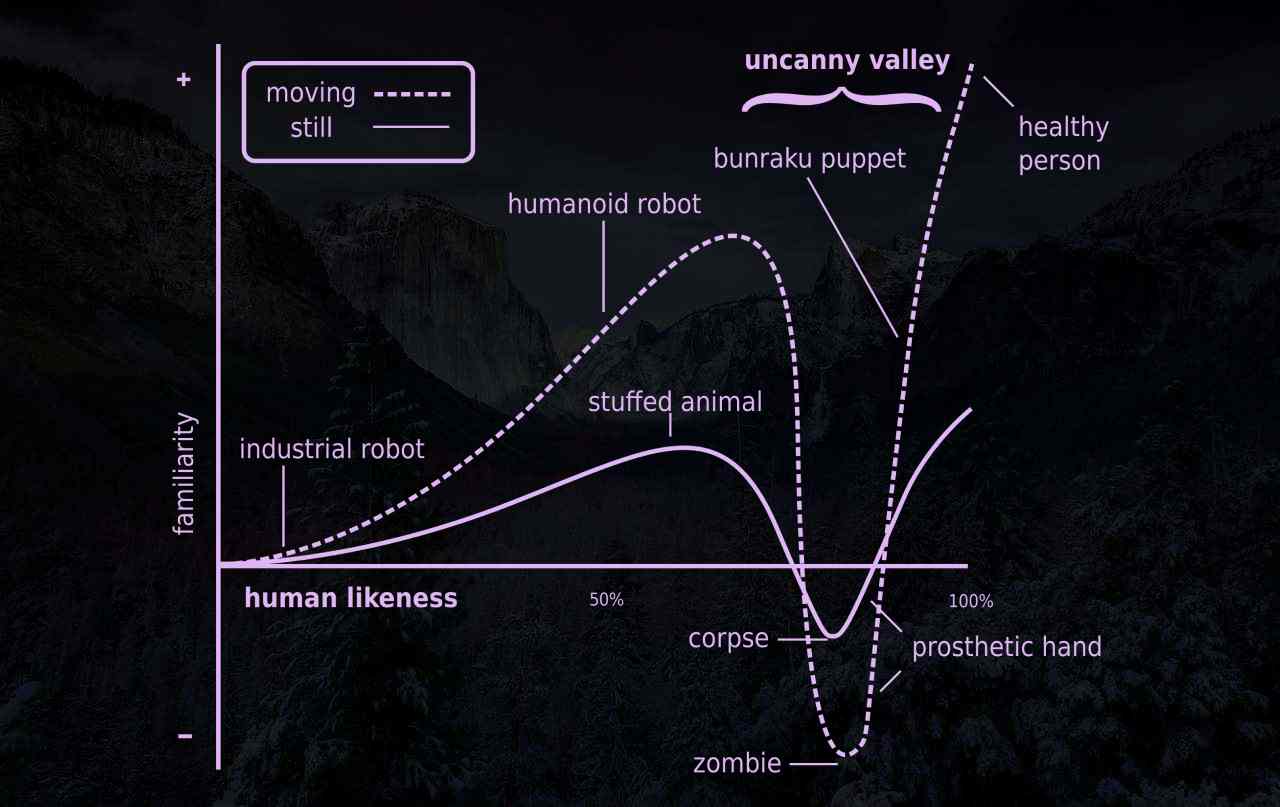

The Uncanny Valley Of Micro PE 🐌

In aesthetics, the uncanny valley (Japanese: 不気味の谷bukimi no tani) is a hypothesized relation between an object's degree of resemblance to a human being and the emotional response to the object. The concept suggests that humanoid objects that imperfectly resemble actual human beings provoke uncanny or strangely familiar feelings of uneasiness and revulsion in observers. "Valley" denotes a dip in the human observer's affinity for the replica, a relation that otherwise increases with the replica's human likeness. - wikipedia

At the beginning of XO, we purchased 3 companies all within a very short period of time. 2/3 we still hold. 1/3 we sold. Both original acquisitions ended up pretty favorably for us. We're up 5x MRR on both.

The next 3 acquisitions were slower. We took our time. We understood better what to look for and what we should be paying for them. 2/3 of those we still hold. 1/3 we sold. They're more recent but one is up 2x and the other is up 30%. They were larger deals, so growth hasn't been as explosive, but today these two make up the majority of our MRR.

I thought we would move faster. Yesterday on our weekly partner meet, we discussed if we were being too cautious. I don't think so. We've been very disciplined about our buys and because of that, have extraordinary internal metrics on fund performance. Our cash out of pocket so far is sub ~200k and we do ~$27k MRR. That's epic. Add a zero to that and we're so in the money it would be stupid.

But that's just the thing, it's been difficult to add a zero to that given our current capital constraints. Just yesterday we saw an amazing deal that was not SBA eligible. Something we could not currently afford. I do lament those misses but we're just not there yet. As a bootstrapped co, I have to accept that for now. As for more micro deals, there just isn't that many available to buy despite the hype on Twitter. There are not currently 10 companies for sale in our buy box that I'd be thrilled to own. The good ones are rare. My miscalculation was just how rare they are.

We may be in the uncanny valley of micro private equity. Just too small to start buying 7 figure deals, and slightly too big to buy more sub $5k MRR businesses. Without a war chest of capital we're reliant on the SBA for larger deals. Not all deals of that size are SBA eligible. We've proved our business model. Have 18 months of profitable operating history. Have sold 2 businesses. This is an investable company. We have great numbers. Our scale story is to buy bigger businesses, and we have validated they exist.

so what to do...

- Continue buying tiny businesses. As painful as it may be, we may need to buy + grow our way out of the uncanny valley. Push until we get to $83.5k MRR ($1M ARR). Might take a year, might take 3 but we can get there from here.

- Continue being patient. Wait for an SBA eligible SaaS company we can both afford and would be thrilled to own. This may also take a year. We've been looking for 6 months.

- Raise money. Raising something like $1-2M would give us some options to buy bigger without being reliant on the SBA. I have one such deal I'd pick up tomorrow if we had this pool of capital. The upside is we'd have investors, and the downside is we'd have investors.

- Buy different stuff. We've been exclusively looking at SaaS. If we tried e-commerce (no experience) or bought an agency (some experience) we may be able to get there faster. This is probably a trap.

Options 1 and 2 are where we think we'll hang out for as long as it takes. Time is really on our side. We're profitable, growing, have a bit of cash in the bank, and overall feeling groovy. This is a long game.

Have a great weekend,

✌️

Andrew