Why Acquiring SaaS Companies Is A Lot Like Real Estate Investing

The more people I pitch about our acquisition fund, the more I like comparing what we do to real estate investing.

The more people I pitch about our acquisition fund, the more I like comparing what we do to real estate investing.

Yes, yes, of course they're different! But it's no fun arguing why two things that are actually quite different are indeed quite different.

So let's say the similarities I lay out below are broadly useful as a mental framework for how to think about SaaS acquisitions. If you're a hardcore Silicon Valley diehard who has 'been there from the beginning', this article will not help you in any way. If you come from a real estate background (or have more experience with real estate than with software), this one's for you!

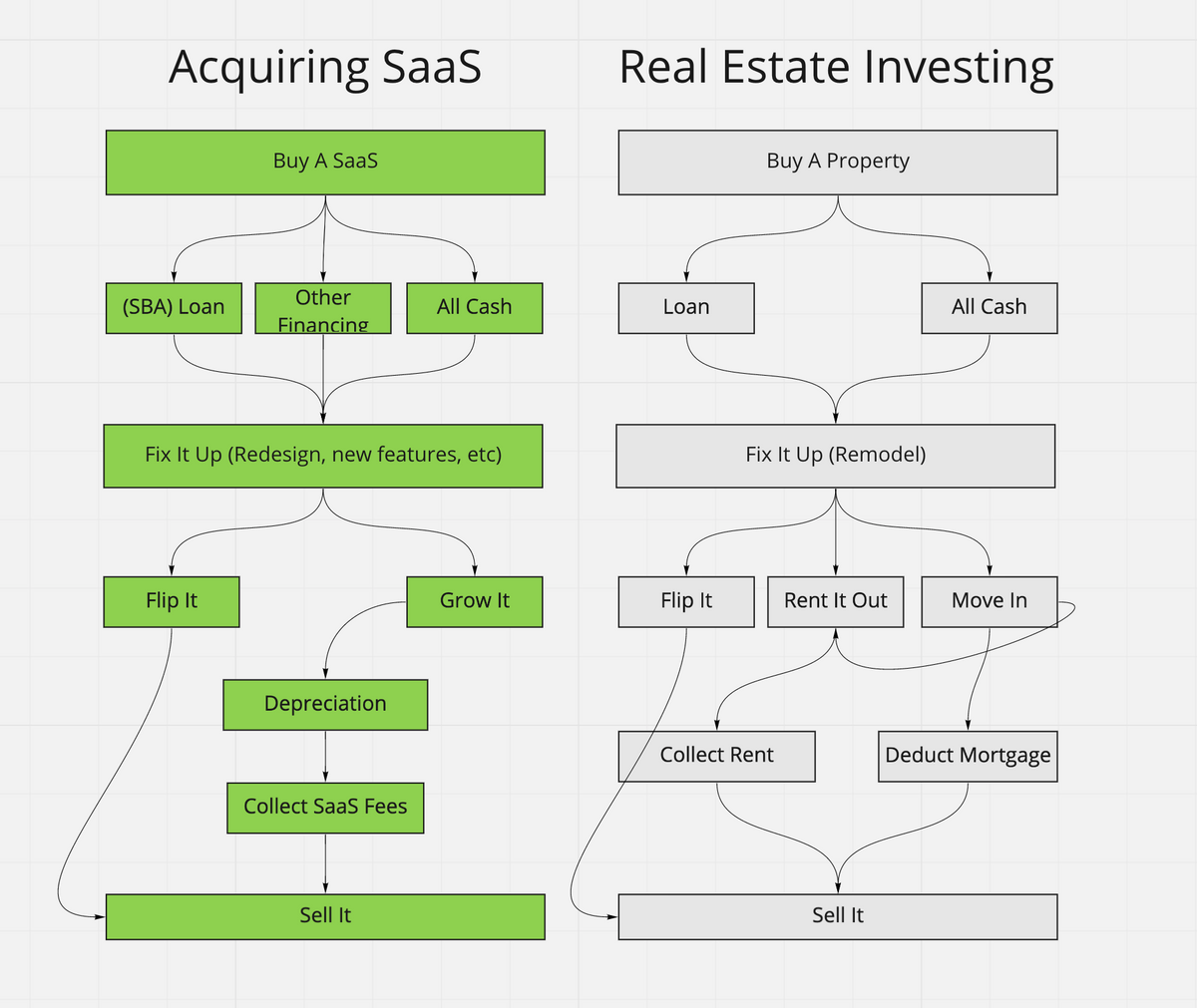

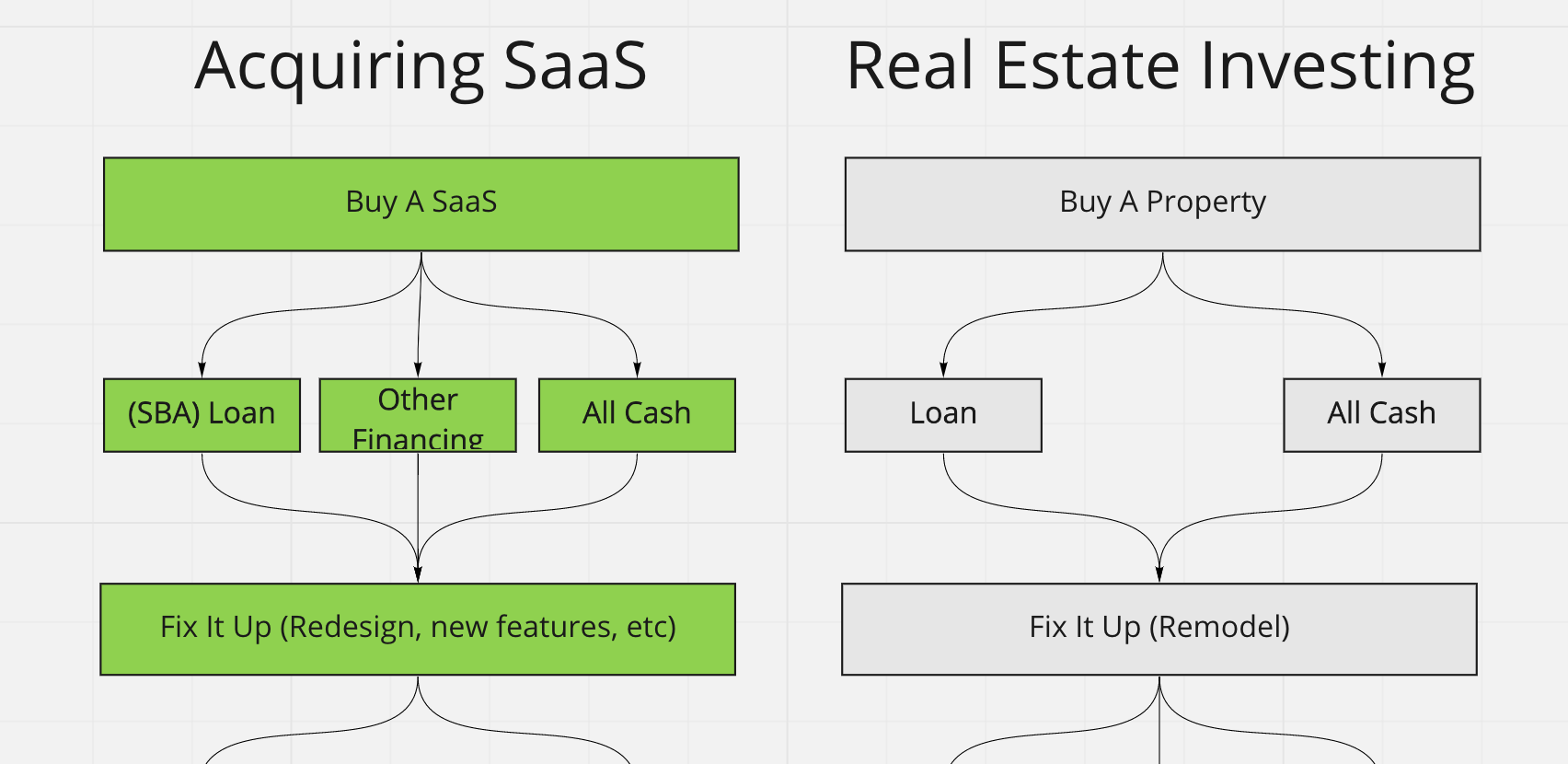

Let's start at the top. You buy the thing. This is a distinct step! You've got to wire money to these random people, and typically there are middlemen involved who still take fees for shit you don't understand. Acquiring a company usually has the same step (for the record, I have a deep dislike of Escrow.com. They're possible the worst b2b company I've ever seen. I may even build an escrow company just because of how painful their process has been for me). We've done one transaction where we just wired directly to the seller, and TBH this felt better than using escrow, but was a unique situation where we felt comfortable doing that.

Maybe this step should have been above the buying step, but whatever, you get it. You need money to buy the thing. I'm not going to go through all the ways to finance a deal, but there are many. Just like in real estate, there's an art to structuring a deal. Same with SaaS acquisitions. You can get creative!

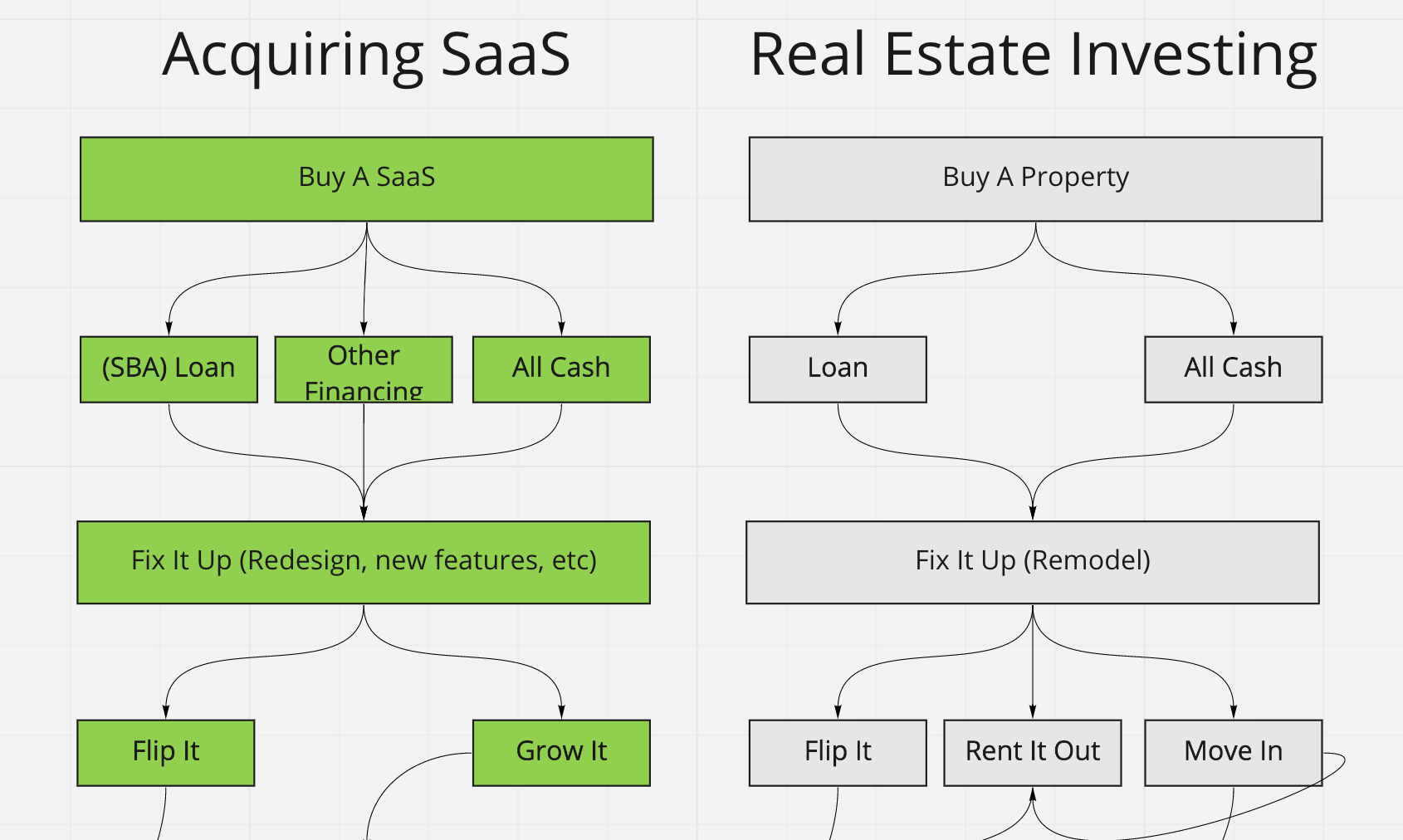

Now once you own the thing, you get to go through this fun process of discovering all the shit you missed in diligence. And yes, there will always be stuff you miss in diligence.

2/3 companies we bought were heaps of garbage. I don't want to say they were steaming piles of shit (that would reflect poorly on us :) but they were close. Each involved significantly more engineering effort than we assumed. We've gotten a little better at diligence but it's a delicate balance between wanting to close a deal quickly and painlessly and asking founders to show us all the skeletons in the closet.

This is the same thing when you buy real estate. There's going to be something you discover and it's generally not something positive.

We bought one company where basically all our customers hated us and were going to churn "imminently". We'll see how that shakes out in a year or two.

Now that you own it, what do you want to do with it? You probably made this decision before you bought it. You saw something in this that few others did right? Some kind of angle? Some kind of insight that led you to believe this was a good deal? Let's hope so!

But seriously, whether you're flipping it, operating it, or just growing it in a portfolio, there's now cash being either thrown off the thing you just bought, or in the case of real estate investing (residential) you can live in it. But on the commercial side, you basically want to rent it out to get cashflow. Same with buying a SaaS.

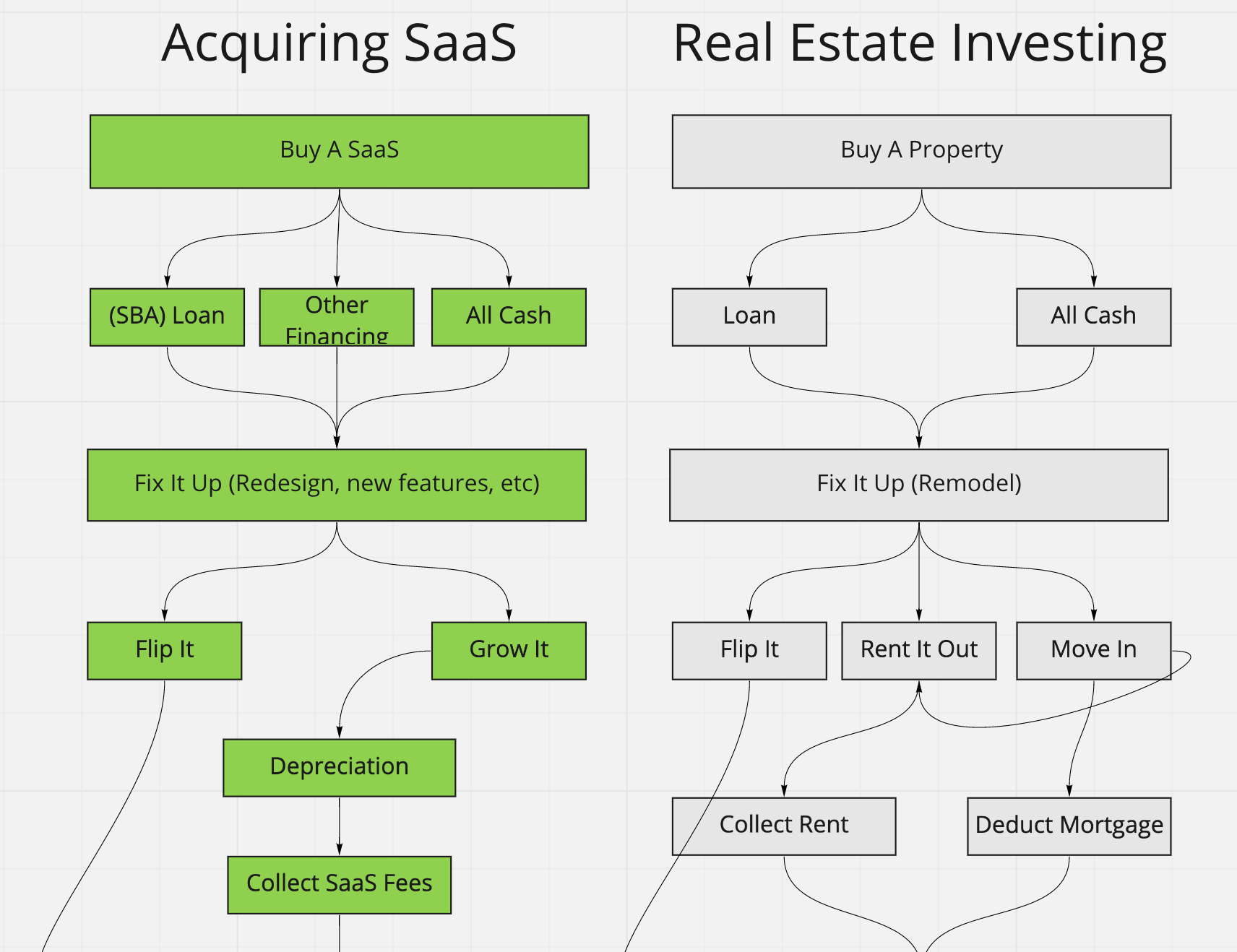

The big difference I'll point out once you reach this step is that real estate margins suck compared to SaaS margins. This is the part in the pitch when people in real estate really understand how powerful this model is.

Now for all your hard work, you get to collect rent or SaaS fees. SaaS should be about 80% margins. If you bought a service business. Aim for 50% or higher. Either way, these numbers are higher than average real estate margins.

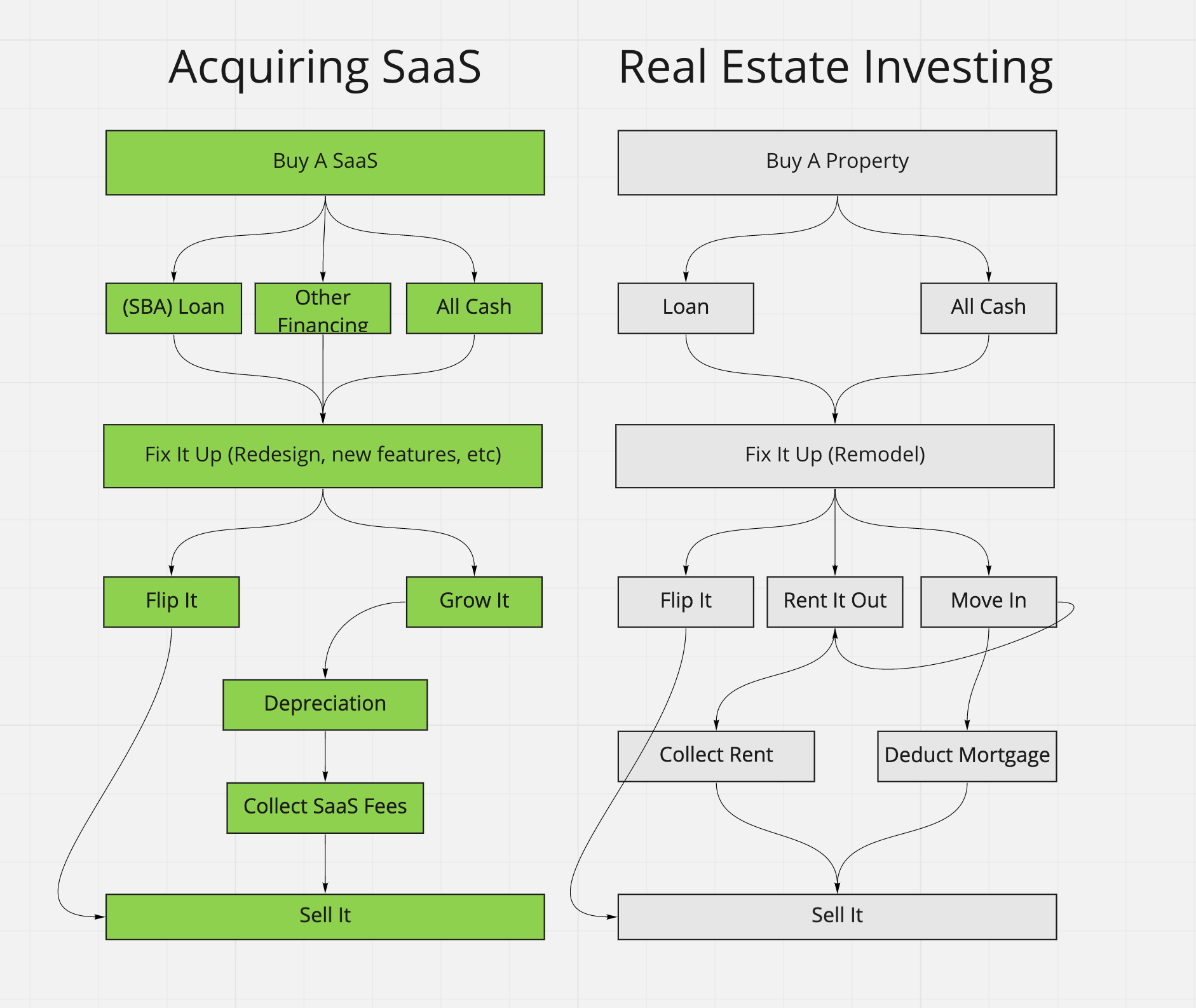

Do you get it yet? It's the same playbook as real estate investing applied to higher margin businesses.

Now you see the full picture. Of course some people buy with no intention of selling. That's true for us too, until someone comes along with an offer we can't refuse.

The other difference I'd like to point out is how different growth (or appreciation) can be for acquiring SaaS vs buying real estate. Software scales. Even service businesses can scale if you put in good people processes. Yes, real estate is likely a much lower risk investment, but the upside potential on a good SaaS should be very high indeed.

Additionally, when you buy a SaaS company with existing cashflow, you're already mitigating a lot of the risk of "going to zero". This is quite different than a venture backed startup that has to swing for the fences or go broke (due to Venture Capital's reliance on power laws for outsized returns). When buying a portfolio of SaaS businesses that already have revenue, a modest 5% growth rate per month over 3 years will work just fine. If it's more, great! But, it doesn't have to grow at 20% Month-over-month.

A note on depreciation. I'm not a lawyer or accountant, etc so consult your people. But, as far as I'm aware, when you build software and ultimately sell that software (an asset purchase for example and not as a stock sale where the acquirer buys the shares of the entity you created) that is not considered capital gains. However, if you buy software already built and sell it later, that is capital and can thus be depreciated. This is amazing! You can depreciate the asset you purchased just like in real estate. Again, please consult the team you probably don't have.

TLDR;

If you're investing in real estate, consider buying a SaaS. You'll like the margins and the growth better. And if you're interested but don't have the time to execute this on your own, my DMs are always available!