WorkClout: First 30 days after acquisition

WorkClout was XO's first non-self service, non product-led growth purchase. As a result, the first 30 days since purchase have looked quite different in comparison to Sheet.best or Screenshot API (a more in-depth post on this topic coming soon).

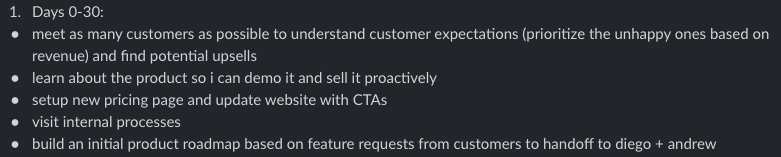

On Day 0, I jotted down some high level goals for myself for the first 30 days. I completed all but 1.

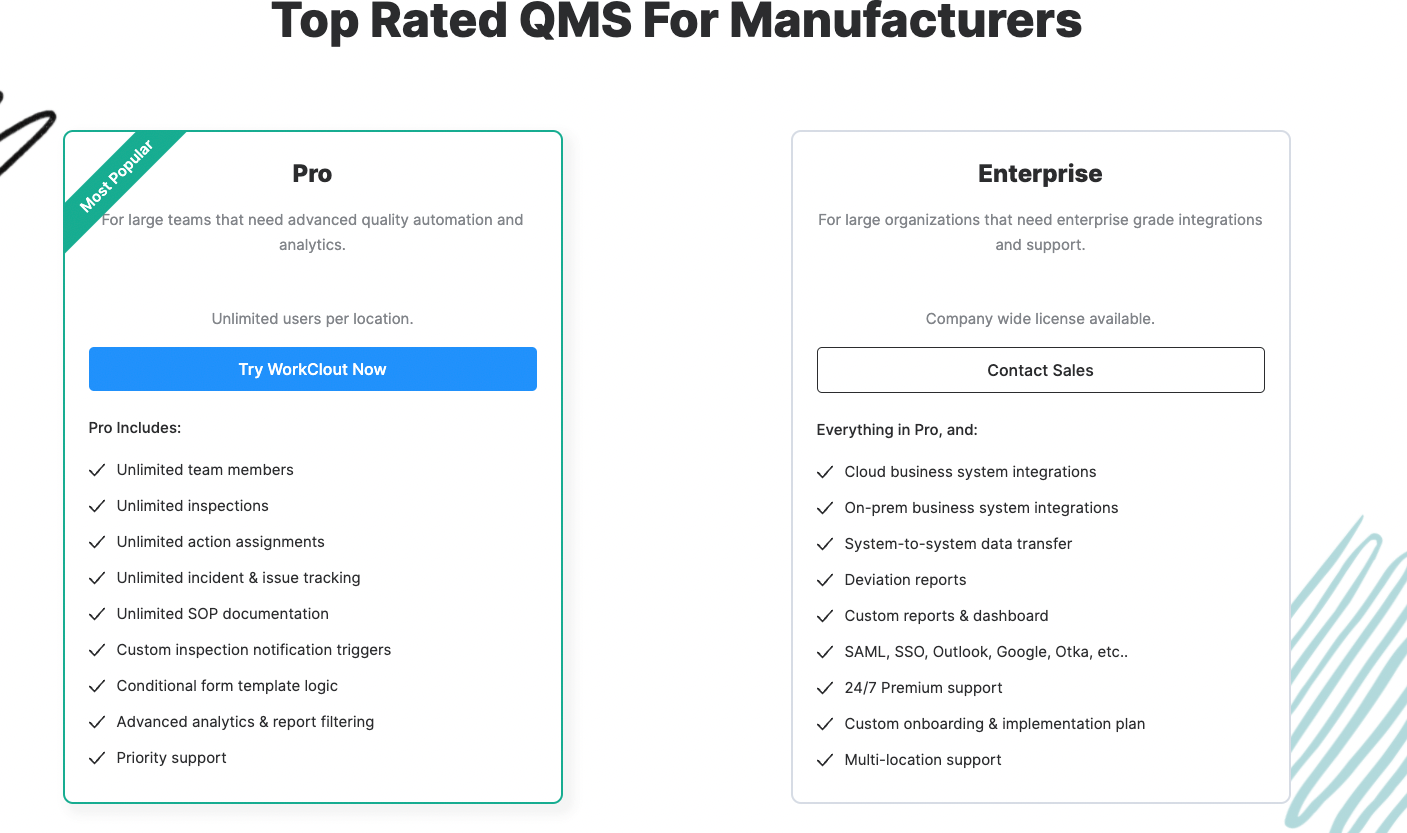

Setting up a new pricing strategy without having a strong grasp on the value metrics, customer behavior and market expectations was a little bit naive; however, having spent the majority of the 30 days listening to customers, identifying gaps in the product, and prioritizing alignment of value + investment, I put together some initial observations of WorkClout's monetization strategy:

Observation #1:

Check out this awesome breakdown of SaaS Pricing Strategy by Patrick Campbell, CEO of ProfitWell.

A “value metric” is essentially what you charge for.

Our current pricing, even without knowing what the actual $$$ is, misrepresents some of the key value metrics for a software tool like WorkClout by giving away an unlimited volume of every key feature of the platform.

Observation #2:

Because there isn't a clearly defined value metric due to the broadness of the feature sets, the existing approach to monetization will either a) automatically disqualify smaller businesses who do not value "unlimited" or b) ineffectively close the larger customers.

Pricing based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

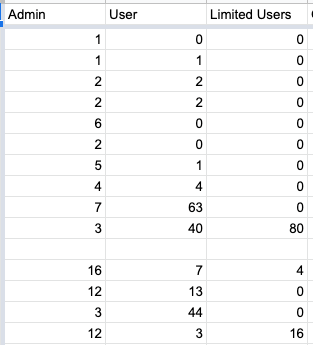

Taking a snapshot of a random sample of users in WorkClout accounts, you can see the size-able variance in user counts. Without delving into usage metrics, there is a linear correlation between number of users and amount of value derived from the inspections generated through the WorkClout platform.

Are we leaving revenue on the table with some of the larger customers who require many users while simultaneously losing out on new revenue with some of the smaller customers with fewer user requirements? Maybe.

Observation #3

Finally, based on observation #1 and observation #2, it is safe to believe that WorkClout fits multiple customer segments; therefore, to maximize revenue, creating a monetization strategy that befits the multiple customer segments seems important.

When you undergo the work of figuring out which customer segments value which feature, you can tier them based on who values what. An alternative and maybe easier way of saying this is how your price is set by how valuable is the problem you are solving for the customer.

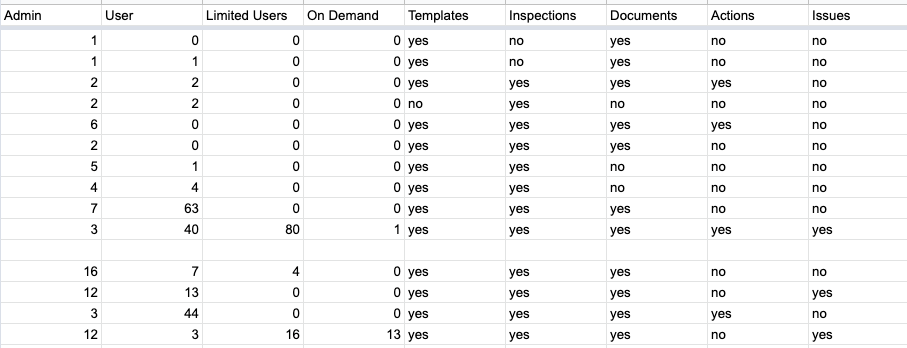

If we were to extend that snapshot of the random sampling of WorkClout accounts to include "yes or no" characterizations of Feature usage, I wonder if we can track product behavior patterns to tier things based on what matters.

So What?

The observations point to two specific experiments to improve the monetization strategy at WorkClout. A consequence of this experiment is we invalidate the existing customer profile and uncover one that aligns a bit more with a product-led growth strategy.

- Build a tier offering a low barrier to entry that offers a user-based component to support the smaller SMBs and mid-size companies that do not value the "unlimited everything" model

- Ensure that the price point and the value metrics align so that companies who are big enough in size to warrant an "Enterprise" price also couldn't just get away with a competitor's free product. This #2 experiment is to test if we can minimize churn risk with a higher investment requirement for a certain tier of WorkClout.

Building customer segments based on size of the company and level of commitment to digitizing the quality/compliance processes will optimize the correlation between usage of WorkClout and the price.

Conclusion

This specific exercise is a good lesson for XO and our portfolio companies. As an operator, acquisition and retention is often my primary lever for growth; however, as we acquire more businesses and we get stronger about pricing strategies, I wonder if pricing can be a secret ingredient in our ability to scale growth consistently.

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

If you are interested in pricing or monetization strategies, I pulled all of my quotes from the following readings:

PS - Here are a couple WorkClout updates from the first 30 days:

- Pushed 25+ product updates and 4 mobile app updates quick customer wins.

- Grew 12% in MRR from Dec 2021-Jan 2022

- Cleaned up A/R by fulfilling all outstanding invoices