Turning $300k into $1.3M (2022 Annual Review)

2022 proved XO's business model. We were able to source deals, close them, grow them, and in some cases sell them. We grew to 6 full time people (not including myself and Henry). We joined the 6 figure club and proudly bootstrapped our way to low six figures in revenue while still maintaining 80%+ gross margins. So far we have turned $300k into $1.3M (unrealized) if you assume we can value each company in our portfolio at a 4x ARR.

Our challenge going into 2023 is scaling this model up. Frankly we just haven't seen very many businesses we'd love to own in our price range. The good ones are rare, despite what Twitter and Micro Acquire lead you to believe.

2023 Financial Goals:

- $1M ARR

I feel like the $1M ARR mark needs a name. We of course have names like unicorn and decacorn for the billy club, but nothing good below it. I've seen minicorn, or maybe even a microcorn. Maybe a $1M ARR company should just be called a "corn". No, that's awful too. For now, I'll just call it "awesome".

We have a deal we're currently working through that will bring us most of the way there. I don't want to jinx it, but we found a lovely business from a lovely founder and hope we can get it done. It would be a game changer for XO.

Team

We've only had the core partners for under a year. We started the year with Danny going full time on XO and buying out a previous partner. This absolutely accelerated our progress. I can't overstate how impactful Danny has been this year. That might be the biggest takeaway... find great partners.

We now have 3 full time developers, 1 customer support person, 1 growth person, and one partner full time for a total of 6 full time employees. Shared services continues to work though I feel like long term it would be better to staff each company with it's own resources and bill it against the company instead of XO.

In 2023 we will experiment with hiring operators to run one or two portfolio companies at the same time to see if that can help us scale beyond the core partners. I believe this is possible. It is, of course, all about finding the right people. We have someone in mind who has helped me launch a business before and I look forward to adjusting to giving autonomy to an operator. In our current small context, operator really means growth / sales and some light product management. For these small, single purpose applications, we don't want to invest a ton of engineering time into them. They do one thing well, and we want to keep it that way, going as deep as we need to on just that one use case, but no more. That has proved to be as close to "passive income" as I'll admit to.

Financials

- $200k Invested.

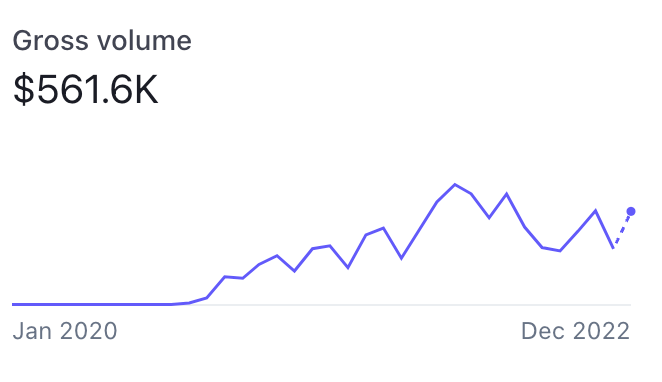

- ~$27k MRR. $325k ARR.

- Portfolio valuation at 4x = $1.3M

Danny, Henry and I have put in a total of $300,000 to buy 7 companies. Some of which we've sold. Our current MRR is around $27,000, meaning after just 2 years, our portfolio kicks off more than 100% of the cash we invested (top line of course) every year. This is a cool vanity metric. Though, the reality is we're reinvesting dollars back into each business and not taking any distributions. If we were to sell each individual business for a reasonable 4x, we could value our portfolio at $1.3M. If this were a youtube video, it would be titled:

"Turning $300k into $1.3M in 18 months".

I'd click on that thumbnail.

Debt

We didn't make much use of debt. We mostly paid cash and did some small seller financing. We still have ~$20k of seller financing on one deal that will be payed off in March of 2023, so effectively no only do the three of us own 100% of XO, but XO also owns nearly 100% of all our portfolio companies outright. That's pretty neat. On paper, to put up $300k to buy assets that generate ~$335k a year is a no brainer. The question remains, can we add a zero to that number and have it still hold true. That is what we plan to test in 2023.

Narrowing in on a thesis

There is no overarching view of the world that drives our thesis. I feel some pressure to have one, but I believe we're too small to say no to businesses that don't fit a thesis. We have to be opportunistic. Despite what Twitter says, this is still a small pond at this micro level.

We try and buy great products we think we can nurture and grow. Now when people ask what we buy I have a better answer:

- prefer Product Led Growth (PLG) companies (i.e. freemium, i.e. infrequent sales calls / demos)

- Prefer revenue > 0.

- Demonstration of product market fit. For these tiny companies, product market fit isn't always clear but let's say it's simply 50-100 paying customers with no single customer more than 20% of total revenue. For an enterprise SaaS that number might be lower, but for PLG companies, 50-100 feels good.

It's still not clear whether we're a permanent capital (non) fund or if we're also opportunistic on the sell side. If we need cash to buy a business, and this business feels like a better return on capital for our skill set, then we have no problem selling something. If on the other hand we can start to put away some cash each month, and that cash is a down payment on another business, that's the flywheel I can't wait to get rolling, but is actually very difficult to pull off.

Transitions

Transitions take 1-3 months. We bought a tiny deal recently that fully transitioned (i.e. we're comfortable building new features out and pushing them to production) in two weeks. But generally we expect 1-3 months where we can't acquire anything else. We can only single track things because they're so time intensive, and it's usually bottlenecked by me. We could (and have) done 2 at a time, but 1 is more comfortable.

Lessons

Each company is unique in some respects. This is unsurprising. We have not been able to have 1 playbook we can rinse and repeat on each new acquisition. Each one we've bought has slightly different needs, which slightly different channels that work for growth. The through line for all of them is content and organic growth. We found an agency who writes one post per week for each company and we push this out to their respective blogs and newsletters. This took a lot more work than I anticipated in getting it set up. It's still a pain. We've been at this for 4 months now and measuring results is difficult.

I worry without individual people full time getting into the weeds of each business, we will not grow as quickly. This is a counterargument to the shared services model we currently use. I pray for the day we no longer use shared services. Sharing services, context switching, and complexity are a tax on employees. For our current portfolio, each individual company is still too small to justify devoting 100% full time people, so we will suffer through shared services for a bit longer. The best way to mitigate this for engineering is to have one person mostly full time on one product, but fluent in at least 2. Using the same programming language, cloud provider, deployment methods and tech stack across the portfolio helps tremendously.

Shared customer support is also difficult. It just takes time for a non-technical person to understand the nuances of a developer product. We'd like to invest more in self service FAQs and knowledge bases for a better customer experience.

Conclusion

Overall, I couldn't be more excited about 2023 for XO. If the current deal we have under wraps ends up going through, it will be a "bet the farm" moment. Assuming again the deal goes through, financially next year will be tough. We'll be operating the largest business we've ever purchased on razor-thin margins due to a loan. If we can push through the next 12-18 months and are able to grow the business I believe XO comes out of 2023 looking like a totally different animal. One that can scale and perhaps one that can raise capital if needed.

I'm still unsure how we'll fund future acquisitions. We've failed to raise a fund before at a reasonable valuation (reasonable to me :). If we set up a fund and have our existing portfolio, investors will question how much time we spend on the fund vs existing portfolio companies. If we do not raise a fund, but sell equity in XO Capital (i.e. sell "GP" shares), then we will need to argue on valuation, and why we should be getting the same valuation as a normal tech company. This has proven too difficult to overcome in the past. Raising dilutive capital for acquisitions just doesn't work out. However, if we're doing $1M ARR I believe some of those arguments will be easier for us to make. We will have proved the model, and will be asking for $1M at around a $6M post money valuation. $6M is lower than I'd like (mostly because of the dilution) but may be worth it if we can find a strategic investor that can give us access to reasonably priced debt heading into a potential recession next year.

Individual Performance

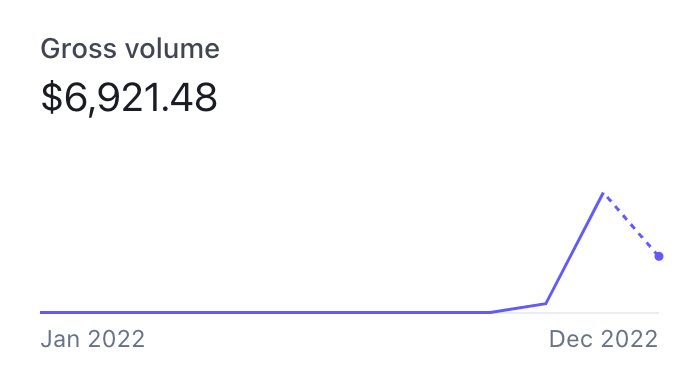

Sheet.best

- 6x since acquisition

- cash flowed more than we paid for it.

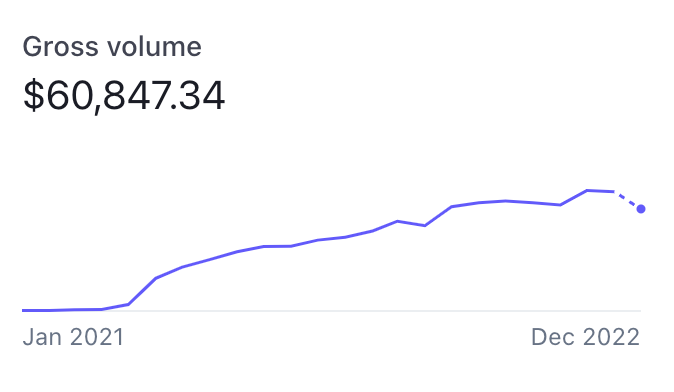

Screenshotapi.net

- 8x since acquisition

- cash flowed more than we paid for it.

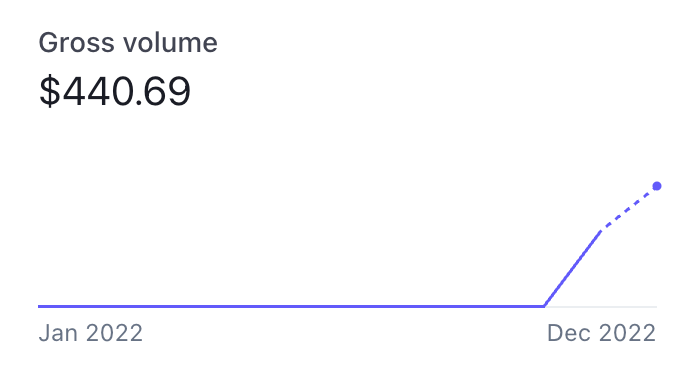

Cold DM

- 2x since we bought it a month ago

- has not cash flowed more than we paid for it.

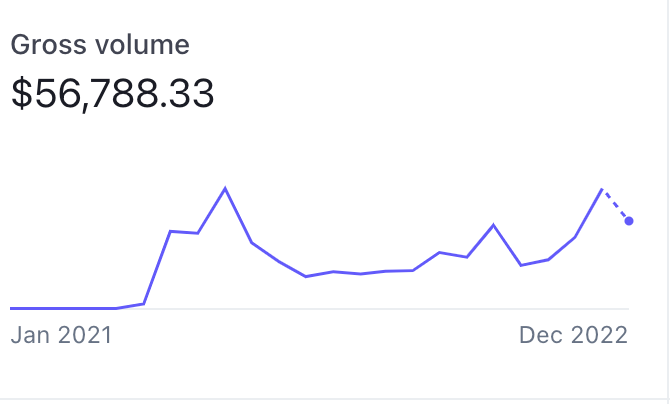

Inlytics

- has not cash flowed more than we paid for it

- has been kind of a pain in the ass.

- was our largest, most expensive acquisition and so far the least profitable.

- For 2023 we're releasing a redesign with some major improvements we hope will turn this one around.

Work Clout

- currently for sale

Sentiment Investor

- sold

- reinvested profit

Toybox

- sold

- reinvested profit into another acquisition

These are technically not XO portfolio companies (these were built, not bought by people other than the 3 partners at XO) but I call everything XO these days.

Cold Email Studio

- Service business (not really a part of XO, i.e. not counted in our financials, separate cap table, etc.)

- Mikey has done an awesome job figuring out how to scale this business. As with any service business, many of our problems are people and scale problems. Demand for the service continues to be strong despite the balmy economic outlook.

- I still believe CES can be a $1M ARR business by itself as we continue to say no to customers that just don't fit well into our delivery model.

supersend.io

- new!

- also outside XO

- this is a large product for a solo developer and has been a huge distraction and has also been a huge pain in the ass. Getting feature parity with a well funded competitor is not something I'll overlook for the rest of my life.