Acquisition #6 - Inlytics.io

This week, we acquired inlytics.io, a LinkedIn analytics tool focused on helping companies view and optimize their content performance. Pretty neat.

This is the first acquisition with serious platform risk. It took me (personally) a good month to get comfortable with this. As an indie hacker, these types of businesses tend to be easier to start than something with no third party risk. You get to draft off the growth of another company and acquiring users is more straightforward since you know exactly where to go hunting. As a buyer of that risk, it's a totally different story. Not only are we assuming that risk profile of the platform, but we're shelling out a lot of cash too. Our exposure goes down over time but the initial few months where we're operating 'in the red' is worrisome. Bootstrapping something with significant platform risk has a lower overall risk level than acquiring a business with significant platform risk.

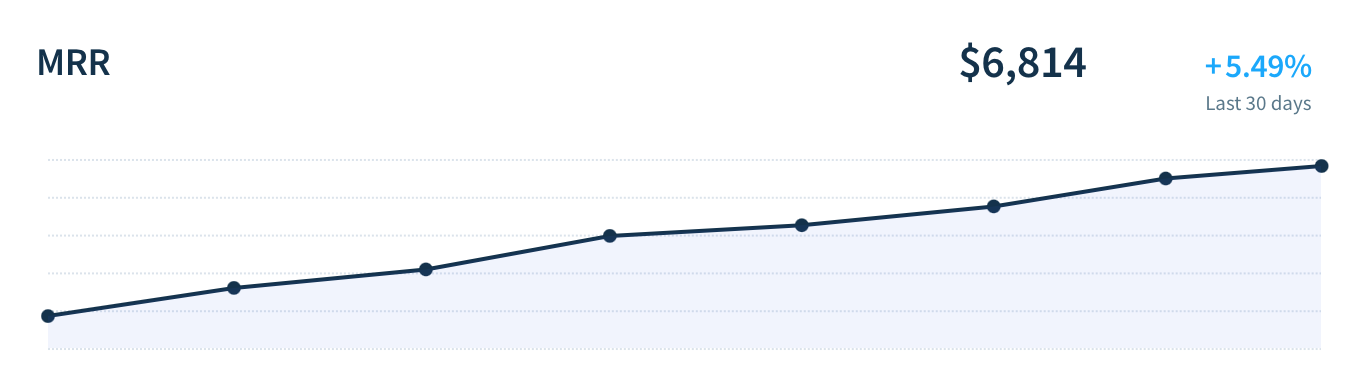

Inlytics is healthy, stable, and growing with over 400 customers and solid expansion revenue. As of today, it's doing just shy of $7k MRR. It's an awesome addition to our portfolio and the previous owners did a great job with the product and handover.

I still think people underestimate compounding growth over time. This is what 10% (average) MoM growth looks like.

You're roughly doubling every 8 months. Thats amazing! Do you know how many doublings you need to double your money. One! With our vc-go-unicorn-or-bust dogma people forget how lovely consistent compounding over time is. Unless LinkedIn somehow shuts this product down (it would be tough to do that though, but please don't tell me I jinxed it.), this will turn out to be a good buy (seriously though I'm not very superstitious but writing this down and sending it out feels ominous).

Diligence

I was traveling for the tail end of this transaction and didn't have the time to figure out scheduling. Not that I've been enjoying the diligence process anyways. I decided to do it async. And it was amazing. Asking people to cover a list of questions in a video gave us a much richer understanding of the tech and the codebase. All those little extra details someone adds when unprompted can turn out to be critical six months

Deal Source

We found this deal on MicroAcquire! This is our second purchase from Micro Acquire. The other 4 have been off market / direct. We're just starting to be at the point where we get some reasonable inbound stuff from founders. Mostly over twitter. Off market, inbound deals are lovely.

Deal Timeline

From first contact to wire it took 10 weeks. This is the longest process we've run so far. There were a number of reasons for the duration, but most importantly neither side was in a huge rush. We weren't intentionally trying to run a quick process.

Deal Terms

We're not going to disclose exact amounts but we did use some seller financing on this one. There was about 3/4 cash up front and 1/4 seller financing over 12 months.

Number of Emails

146

Communication To Customers

We're going to be reaching out to the larger customer

Exciting news for the Inlytics' Community

My name is Danny Chu, and I am one of the founders at XO Capital.

In March 2022, Andrew, Henry and I, acquired Inlytics from Eugen and Tim, the two amazing founders who built a powerful product serving a clear need in the LinkedIn ecosystem.

What’s XO Capital?

We buy and grow small profitable software companies. We use our experience in operating software businesses to appropriately capitalize amazing products that already have existing product-market fit evidenced by a vibrant paying customer community. Check out our existing portfolio here.

XO Capital is super excited to continue building Inlytics, growing the vibrant community of LinkedIn users, and serving passionate customers from all over the world.

What’s next?

We’ve hit the ground running talking to customers, and we are starting to build out the product roadmap based on the existing feedback and development priorities.

In the midst of the acquisition, I personally want to apologize for any delayed responses for support or sales requests over the past 7-10 days. Feel free to grab a 15 minute time on my calendar if you're interested.

Cheers,

XO and Inlytics TeamDevelopment

We brought on another developer. We don't need 1:1 devs to products but with 5 products and only one full time dev (outside of me), it was time to bring in some more help. Within 24 hours we had a sprint planned and some bug fixes to do! We're on track to meet our typical 1-3 month cleanup process before switching our focus to growth.

Taking Over The Product

If I haven't mentioned how amazing it is to have solid teammates you trust then let me say it now. It's amazing to have a strong team. I've been on shitty teams. I've (accidentally) created shitty teams that I then had to go fix. XO is solid. Henry is super strong on financials, also just a fun dude and super thoughtful when bouncing ideas off of. Danny is such a better sales person and operator than I am it's silly, and I'm ... we'll you know ... I started it so i guess there's that. I write code. Fast (and dirty). Also I love pitching. Weird combo!

All that is to say, Danny did most of the work here and absolutely crushed it.

Growth

We're still short on growth talent at XO. We've done a decent job so far just winging it. My measly attempts have born a little fruit but I'm talking about a rigorous process of how we take companies from 1 to 10. We're working on it. We have ideas. We have a little cash to play around with, but the next 12 months I want my focus to be on two things:

- Raising cash

- A mysteriously effective growth process that is the envy of all. lol.

Acquisition #7?!?

If you made it this far. 1. Bless you. 2. Yes we're already close on closing deal #7.

It was supposed to close today but:

- We're starting to get better about getting everything we need before wiring money. People just tend to change their behavior after they've been paid. Just a fact of human nature i guess. In this case it's some critical bug fixes. Yes, we're now going to ask (require!) certain bugs to be fixed before the handoff. If it kills a deal so be it.

- Mostly #1. Also sometimes people get busy.

Fundraising

This is not a solicitation for investment. just documenting / sharing my thoughts / our journey.

We're combining all our products / companies into a single C-corp and will at some point raise money into that single c-corp. We (annoyingly) had like 5 LLCs at one point and it was just getting to be a pain in the ass to manage. Bundling everything into a single c-corp was not an obvious thing to do, but feels like the most straight forward way for LPs and GPs to align given we operate the businesses as well as buy them. The fuzziness comes from the fact that we're operating these companies. If we continued down the path we were on, there would have always be a tension between where our time is spent, and exactly how much time is spent on a particular company (especially if that one is growing the fastest). From an investors perspective, I 100% understand. They invested in a single deal and want to know how much of our time goes to their investment. With these tiny deals, that's a hard thing to answer, and "shared services" wasn't cutting it.

I do think we're building the dopest micro PE firm on Earth, though and can't wait to scale this thing up a bit. We've got 6 full time people now and 6 acquisitions (coincidence). I still don't know if we will do a regular raise or if we will do some kind of WeFunder for non-accredited, but probably going to just take a few accredited folks and keep it small. Truthfully we might just raise a single round and be done. The economics of this weird little biz are such that each round of capital is extra dilutive bc we have to spend to acquire cashflow (not just spend on headcount). If we could continue to bootstrap, we would. Our personal cash only got us so far (nearly $20k MRR!) but we don't want to slow down.

✌️

Andrew