Growth

September 2023 XO Recap

Check out the monthly recap report for September 2023.

Growth

Check out the monthly recap report for September 2023.

Portfolio

I don't know where March went. Partially bc I went on a vacation (WUT!?!). Danny held the fort down and I figured out how to do async tech diligence. Also discovered I'm useless without my 3 monitor (+iPad for meetings) set up. Yes I know how that sounds. No I'm

Portfolio

This week, we acquired inlytics.io [https://inlytics.io], a LinkedIn analytics tool focused on helping companies view and optimize their content performance. Pretty neat. This is the first acquisition with serious platform risk. It took me (personally) a good month to get comfortable with this. As an indie hacker,

Portfolio

XO was started in the summer of 2020. It was in the wake of a failed venture backed company where I was CTO for several years. In addition to the (concurrent) medical shit I was dealing with, it was one of the toughest periods of my life (so far!). Having

Portfolio

We bought another YC company (for clarity, we bought the assets of Workclout Inc. The corporation was acquired by Luxury Presence in a separate transaction [https://todayheadline.co/luxury-presence-acquires-quality-management-startup-workclout/] .) The last time we bought a YC company('s assets) I spent more time thinking how cool it would be to

Portfolio

> If you're here for numbers, I apologize. Perhaps in a later post I can share them but for now, the story will have to be enough. This week marks the first time XO has ever bought, operated, and sold a company. Yeah, basically most of your money comes from the

Learn

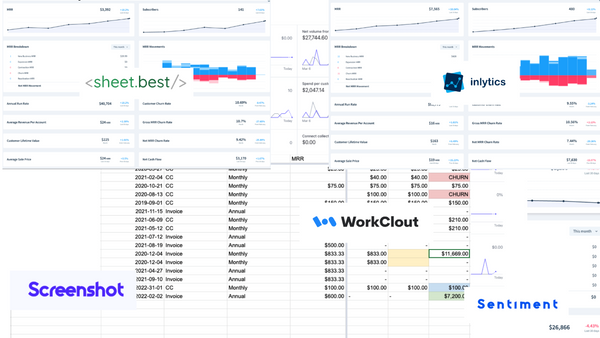

Not all SaaS companies have equal margins. Today I wanted to go through each of our products and talk through net margins. It's useful to get a sense of what margins could look like. I also threw in a small productized service to compare it against.