Diligence

Diligence is hard. Here are some tactics / useful tips we've used to stumble our way through 3 micro saas acquisitions. Check out our 50+ diligence questions.

Diligence is hard. Here are some tactics / useful tips we've used to stumble our way through it 3 times. Scroll to the end for 50+ diligence questions.

Our group has bought one company from micro acquire and 2 others not on micro acquire (One was from Twitter and the other was from Indie Hackers). I also just did an interview with Andrew from Micro Acquire where I touch on this. I'll link to it here when it's out.

Obvs this isn't legal / tax advice... hire a lawyer, hire a cpa, blah blah blah, etc.

My company does B2B SaaS so everything in here is focused on that. This also is for smaller deals. Let's say between $100k to $500k. Anything more and I'd get my CPA involved to sanity check my interpretation of their financials, and my lawyer involved to go over any contracts they've signed with customers to understand liabilities. We do have a partner on the team who is in private equity (real estate) and he's super helpful on the financial stuff.

We do have a list of questions we took / tailored from the microacquisitions.com course which all 4 of the parters took before we bought our first one. I'd recommend the course if you're serious about doing this. It has some decent legal docs and walks you through the whole process.

High Level

- Get on a zoom call. Do you get good vibes or shady vibes? There are all kinds of people out there.

- Get on a zoom call with 3 of their biggest customers (by revenue). Just frame it as if you were a potential customer. People are usually fine with this. If they're not, that's a little weird. Maybe not a deal breaker, but a red flag. Do the customers hate the product? Will they stay if you take over? How good of a relationship does the owner have with their biggest customers?

Financials

People mostly ask for 2 years of Profit / Loss (P/L). P/L can be hard to read and hard to interpret if you're weak (like I am) on financial stuff. Don't worry about fancy terms like SDE or EBITDA.

"I don't like when investment bankers talk about EBITDA, which I call bullshit earnings." - Charlie Munger

Just get the important things:

- how much are they spending on things (all in, what's it take to run the business)?

- how much are they taking in?

- What's the profit margin?

- Do they have any lifetime deals you have to support (these are liabilities for you)?

- Is revenue lumpy? Could be due to annual subscriptions.

- Do they have high customer concentration? i.e. do their top 3 customers represent more than 50% of the business? You'll need a comfort level with that.

- What does it cost to acquire a customer?

- How long do customers stay (LTV)?

- Churn rate - Churn sucks.

An easy way to get some of this is to do a screen-share where they show you their stripe dashboard so you can verify all the revenue. Also ask for a bank statement to make sure what's coming in from stripe is actually making it into the bank. This may also be done via a screen-share.

Tech

This is so hard. If it's just you, and it's a SaaS business, just stick to languages you know really well. You're going to be buying a job. Looking at random files in a screen-share is super hard to say definitively whether or not the thing you're buying is a work of art or a piece of shit stitched together with duct tape. We've been burned here before

- What's the uptime? If it's not 99.9 they better have a good answer

- What's the deployment process?

- What's the architecture? Have them draw you a diagram.

- What's the first thing that s going to break if you 100x the usage? All systems have choke points, just know what this is beforehand.

Other Considerations

- Will they support you for 3 months after the sale?

- Will they be available at an hourly rate to help with issues? mostly this is a no, but sometimes it's a yes.

- Do they have any contractors they've used on the project that they could intro you to?

All that being said, diligence is a balance. If you ask more questions than another party that puts a bid in, you might loose because you were 'asking too many questions'. We had one where we didn't do that much diligence because they were a Y-Combinator backed company. That was a big mistake.

Also, cautionary note. You're going to be wrong, and you're buying a job. I'd partner up with some friends (or random people on indie hackers / trends.vc / etc like I did :) and I'd start small... And dear god just buy one at a time. We did 3 at a time and it was foolish.

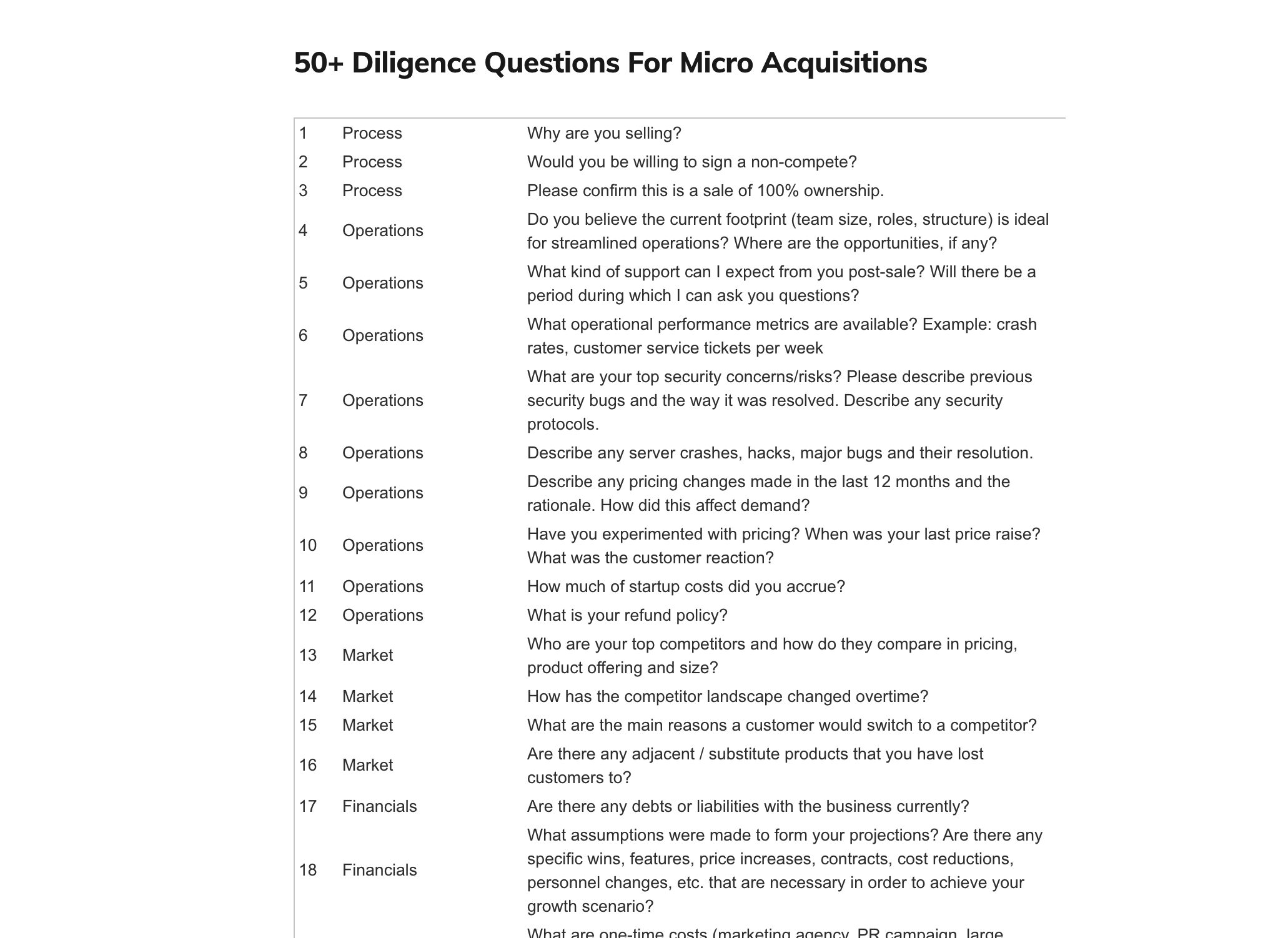

50+ Diligence Questions For Micro Acquisitions

Good luck out there. Let me know how it goes!

Also, I'm starting a podcast. It's called 'Fund Stuff'. We're going to talk about 'Fund Stuff'. If you know someone that would be good to bring on, shout at me on twitter @andrewpierno