Making freemium work

It's hard to get anyone to pay for something once they've had it for free. Inlytics, ScreenshotAPI.net, Sheet.Best, and now, Cold DM all have one thing in common: Freemium model

We believe companies with a PLG model are great acquisition targets for XO. We work to uncover the main triggers or signals (those AH HA! moments) that maximize conversion from free to paid and invest in product and customer experience to drive value.

What's interesting, and not so obvious (at least to me), is a high conversion doesn't necessarily highlight a strong PLG playbook. Similarly, a low conversion doesn't equate to a failing strategy neither. HBR says a moderate 2%-5% conversion rate with a healthy volume of top of the funnel activity can strike a scalable balance to maximize the freemium model. Here is the link to the article if you're interested.

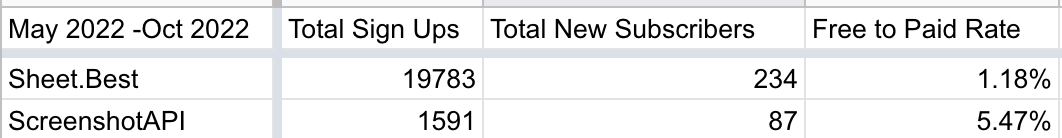

I did a quick exercise to kick-off the exploration of growing Sheet.best (SB) and ScreenshotAPI.net (SS) by making the freemium model scale successfully.

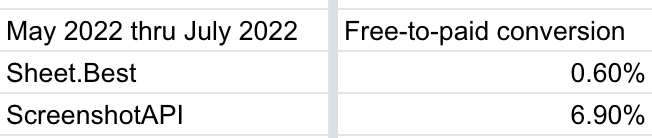

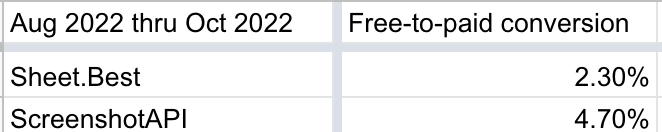

Below are free-to-paid conversion rates for SB and SS from May-July 2022:

Sheet.Best has a lower conversion ratio than ScreenshoAPI.net

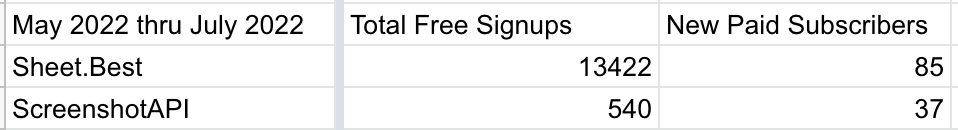

Digging a bit deeper, we see a significant difference in the volume of free sign-ups.

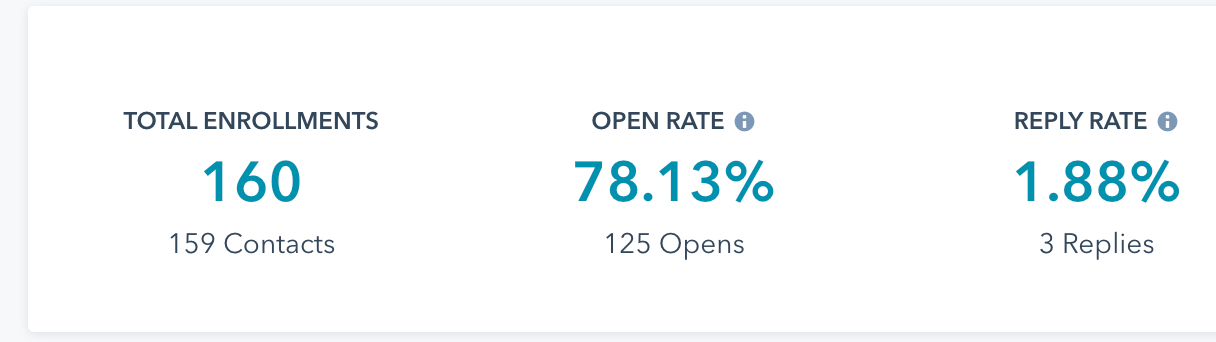

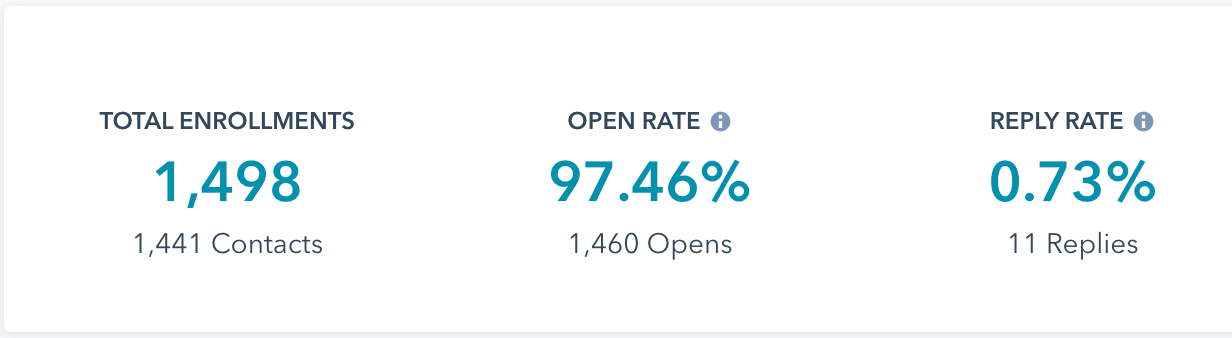

Without necessarily jumping to any conclusions, I ran 4-5 touch email sequences using Hubspot and product usage data we collect in a metabase dashboard:

1) reached out to users who stopped logging in to re-activate them

2) engaged with users who had between 10-79 screenshots or api calls – another blog post coming explaining how we define a quality free user.

Here were some of the results from those 4-5 touch sequences we ran via HubSpot:

People were clearly engaging with us (to a certain degree) based on the extremely high open rates. Cold email experts would be impressed.

In any case, the hypothesis was if we use product usage metrics to trigger more targeted, educational content to free users in a timely manner, we should see an uptick in the free-to-paid conversion.

Sheet.best improved. ScreenshotAPI got worse.

Are the conversion rates purely affected by the total number of sign-ups on any given month?

This simple experiment had somewhat inconclusive results, but it gave us new data points to use and go run more growth experiments. Here were my takeaways/questions from this thought exercise:

- ScreenshotAPI has a healthy conversion rate but struggles with generating top of funnel traffic.

Is our free version too limited? Is the 100 screenshots/month not enticing enough to check us out? Is our content/SEO strategy targeting the wrong ICP?

- Sheet.Best has extremely strong top of funnel traffic, but a weaker conversion rate.

What's happening in the activation phase that is causing potential drop-off? Are the quality of our free users really poor? Are we giving away too much? Are people somehow gaming the free version?

As Andrew pointed out in our October update, these two companies are humming and growing well, but there are a lot of unknowns and a lot of room for growth...one could even say that there's a lotta meat left on the bone :)

And speaking of bone...

Happy Thanksgiving from Andrew, Henry, myself, and the XO team.