Micro PE Vs Venture Capital

This post lays out our vision in the hopes that one day you'll invest with us.

Whenever I'm about to have this conversation I always say up front that I'm not against venture capital. Like all financial instruments, venture has a time and a place. What I do like to say though is that I believe the venture model is often applied to all startups by default, which I think is a false premise. It seems the world has forgotten you can have a wonderful $10M a year business. Might even be SaaS with 90% gross margins! A $10M a year business is not venture scale, in fact it's still considered a small business.

My view of the world is skewed by my experience. I worked at a venture studio as Head of Development (the studio raised $3M to do 3 companies + a venture fund), and then as CTO of one of our portfolio companies that raised $8M. The company where I was CTO had an adverse outcome but it wasn't because it was venture backed. So all this is to say that I've taken venture in the past, and if the occasion calls for it in the future, I'd take it again. For now though, XO is 100% bootstrapped by the 3 partners, and we're going to keep it that way for as long as we can stand it.

Broadly, the reason we've bootstrapped is because 18 months ago, XO was one bet amongst many. Since then, we've acquired 5 companies, sold 1, and grown the others. The experiment isn't over but is trending in the right direction and we're now formalizing the process. I also like the idea of going first. Meaning before we do anything with someone else's money, we'll first do it with our own. That includes playing with debt as well as experimenting with operations (the other 80% of XO).

For full disclosure, I also do a (very) small amount of angel investing. I love startups and will continue to build a portfolio of 100x-type opportunities. I also have an agency business and incessantly build and launch little products. One day I hope I'll be able to focus 100% of my time on XO but that's the tradeoff for bootstrapping. The truth is that the majority of my portfolio is earmarked for XO.

Let's start with a few definitions like what our charter is. At XO, we buy and operate software companies. Our goal is to grow them and either hold on to them forever or sell them as needed to redeploy the capital elsewhere. We're buying SaaS opportunities that may not be venture scale. Do we hope something will pop and throw off a 10x return. Of course! And we'll do our best to make that happen, but (and this is important) success does not depend on venture-like returns to yield great results.

High Level - What does XO do?

- We buy profitable SaaS businesses. Ideally for 2x revenue. Sometimes 3x. We do this with some combination of cash and leverage in the form of debt, fundraising, or a seller note.

- We operate the SaaS business. We do focus on growth, but we also focus on profitability. Growth can be expensive. We view 5% to 10% MoM growth as awesome, and are happy to compound that over several years.

Problem / Solution

Problem - Illiquid markets for selling small SaaS businesses. Too big for most individuals, too small for traditional PE.

Solution - An exit for the entrepreneur and a stewardship for the company they built.

Why Should XO Exist?

I'll speak mostly to the capital arguments. Though giving bootstrapped founders a decent exit is also awesome. These businesses are not typically venture scale but that doesn't mean they're not valuable. They're amazing, profit-driven businesses that scale just as well as the hottest VC backed companies. It's just code, after all.

I believe there is a massive gap in the private equity market. It lies below the existing PE infrastructure where existing PE firms are not nimble enough to move quickly on small deals. We can. We've closed each of our 5 deals in sub 30 days for sub $5k in total costs per transaction. This is not something a larger fund can do and I feel is something we can continue doing as we scale.

XO exists in part to steward great technology. Niche SaaS companies can be terrific businesses and I truly enjoy giving founders nice exits on side projects they hacked together over many weekends. I also believe bootstrapped SaaS companies, and companies under $100k MRR are tremendously undervalued. Historically there hasn't been a great market for them, which I'd like to change.

The ecosystem agrees. Just look at the success of Micro Acquire so far. Extrapolate that out 5-10 years and there will be a flourishing ecosystem right under the nose of the existing private equity market. Before the likes of Micro Acquire, it was difficult to sell a 'side project'. Yes, people have been trading 'websites' for years now, but the idea of 'exiting' used to only apply to large strategic acquisitions and was a term reserved only for venture backed businesses (even those with adverse outcomes!). We hope to change that.

These business may not be venture scale, but they're often 90% gross margin businesses. We believe we can buy them below the existing private equity market, and sell into it. We'd be a great feeder for corporate acquisitions as well as more traditional private equity transactions.

Now in any given portfolio of 10-20 companies will we see some that just grow no matter what and others that do not? Yes! And that's okay too, but again, we do not need outliers for our model to provide great returns to our investors.

Why Do These Entrepreneurs Want To Sell?

It varies. Here are the most common ones we've seen. Keep in mind, even a project making $10k to $20k a month is really not enough for 2 US based people to live off of given their market wage rate. For example, a software developer would be forgoing a lot of cash to take this opportunity on. Also growth is expensive. Only people that have tried to grow quickly know just how damn expensive it can be. So again, keep in mind, these aren't instagram-like businesses where a 10 person team can sell for $1B dollars. These are more modest endeavors.

- Time - Variations on this are 'I just had a kid', 'We're getting married', 'Got a new job', etc.

- Interest - The founders were excited about the opportunity 18 months ago, but they're just over it. The business might be great, and growing 5% MoM but they do not want to do any more work on it. Variations include wanting to work on something 'bigger' and either go join a startup or try to raise venture.

- Money - Sometimes people want the cash. $100k cash is a lot for some, and not much for others. If the solo-founder is 22 and gets to have $100k cash now, that might be a great move financially for that individual.

How Many Of These Businesses Are There?

To the best of our understanding, we think there are thousands of these. Maybe not 10,000 but somewhere between 1,000 and 5,000 at any given time that might be a good fit for our model. With marketplaces like Micro Acquire, we're seeing more and more people target this type of outcome vs a large venture-scale outcome. I believe this is not only directionally correct for a first time founder (to target a base hit), but i think it's starting to become more common to set out to build a business that sells for under $1M relatively quickly (1-4 years) vs a venture outcome that might take 10+ years.

Returns

In venture, 90% of investments fail, which means you need unicorns in your portfolio to drive outsized returns in order for the fund to make money. In a pool of 10 companies lets say 8 straight up go to zero. 1 does okay and you have 1 winner. That 1 winner in venture land means it's likely bigger than all the other 9 combined and will therefore payback the fund and drive most, if not all, of the returns.

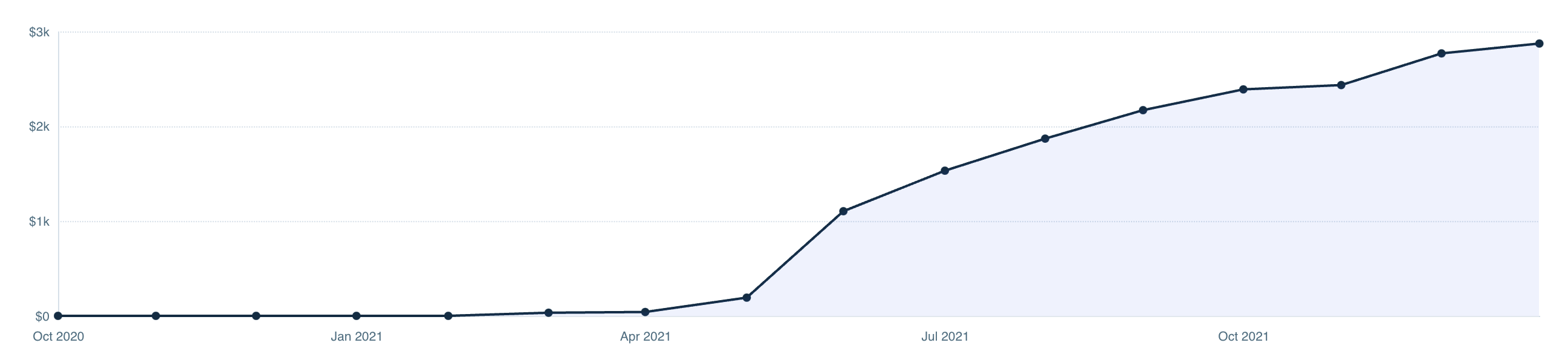

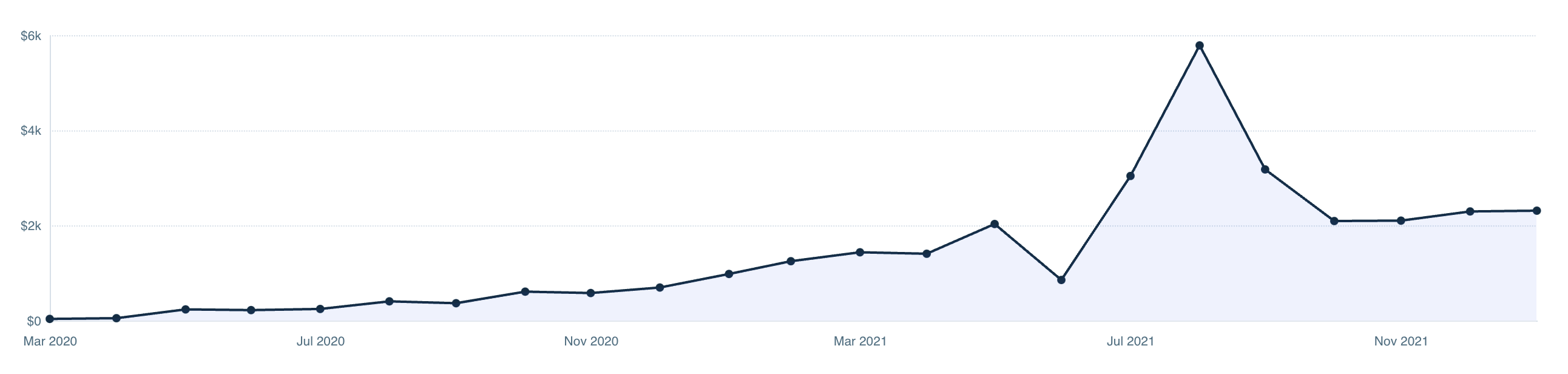

We believe buying companies with real revenue that are running profitably are significantly de-risked compared to their venture counterparts. This is somewhat of a value investment. Let's also get specific. I'm hesitant to post these because they're going to be misleading. We intentionally bought tiny companies to start. XO was an experiment at this time. One of several bets. And to mitigate risk, we bought small, which I'd recommend anyone do when first getting started. So by buying small, our growth numbers look crazy. Now, is it relatively easy to double MRR from $1k to $2k? Yes. Is it equally as easy to double MRR from $1M to $2M. No! Are you crazy! Those two things are not at all the same! So, I believe that as we buy slightly larger businesses, our numbers will get slightly worse. The point is the same though. We're happy with a 3x. That's a 300%. What was the last 300% return you had? Mine was ETH in 2016 and my equity portfolio in 2021. I was thrilled each time. I've never had a 10X return. Ever. Maybe one day, but we're playing a more conservative game than venture. Think of this as somewhere in between buying secondaries of Series B+ companies and buying real estate. There's still risk, for sure, but it's not Russian roulette.

Here are 3 companies we've purchased with real (current) numbers:

- Toybox - We bought, cleaned up, and sold this business for a 33% gain and a great IRR

- Sheet.best - We have 4x-ed this since purchase.

- Screenshotapi.net - We have 5x-ed this since purchase.

What is still an unknown is who we sell these to when we're done. The purpose of this article is to get enough people on board our model to allow us to start buying mid 6 figure to low 7 figure businesses. When these businesses sell, they typically have a broker who will run a proper process. This is largely a good thing since we want to buy below the current PE infrastructure and sell into it, giving us some multiple expansion.

That being said for sub $50k ARR businesses, we're still not sure who exactly will be buying these. It could be competitors, or other companies like XO. We plan on doing more experiments this year with our own portfolio to get better data.

In short, we don't need unicorns to return 2x and 3x because on average, the companies we acquire should go to zero less than our venture counterparts. These businesses are somewhat de-risked when we buy them.

Dealflow

We find deals in all sorts of places. My personal network on social media, Indie Hackers, Micro Acquire, and all the other marketplaces provide an evergreen supply of interesting companies to acquire. Founders occasionally reply to these emails with their companies they'd like to sell :)

We're also looking to partner with venture firms to provide soft landings for their portfolio companies that fail to meet venture scale (8 out of 10 of them will be in this category within 5 years of launching). Picking up distressed venture assets at steep discounts (like we've done with Toybox and Workclout) is an amazing way for us to grow.

Operations

The trickiest part of our model is the actual operations of these SaaS businesses. In venture, you write a check and check in every so often, lending a hand when needed. We're the opposite. The day we sign, we're thrown into the deep end, and it can be a little rough for the first few weeks.Each company has unique customers who all want live chat support, new features, and 99.999% uptime on all our products. So how do we do it? A shared services team.

Right now we have one support person / EA who takes care of support for 4 companies. There is an escalation path (that ends with me) for support chats. This works well, I have days where I do not handle a single support ticket and feel we could easily triple with just one support person.

Shared engineering is tough. I still write code across our portfolio along with one other full time developer. At the time of this writing, one month into the WorkClout acquisition, we're 100% focused on WorkClout. That will likely be true for the next 2 months. WorkClout was a larger purchase, with a large product surface area. I knew we'd get slowed down by it's size but I'm confident we can get it to a good place, fixing all the bugs, and then put it on an incremental feature roadmap and chip away at it. This process of front loading engineering seems to hold true for all our acquisitions to date. When we buy something it's typically not exactly how we'd like it set up, and so have to spend a non-trivial amount of initial engineering hours to get it to a place where we can safely ignore it for a week or two while focusing on another product. I believe we'd need one more developer to go from 4 products to 8. The key here is sub-linear growth. Assuming each company is to small to support full time staff, then this sub-linear growth will be key to our alpha.

Scale

We have two options before us. Continue to buy sub-scale businesses (say under $20k MRR) or move upstream to larger purchase sizes (and competition). By far I see the largest opportunity in the market to be in the sub-scale businesses. We are often the only buyers at the table and have been able to (with patience) construct some favorable terms for both the entrepreneur as well as our investors.

I don't know which path we take from here. Going back to my 'going first' principle, I'd like for us to experiment with buying a larger businesses while we continue to build a portfolio of small bets. If we think buying bigger makes more sense, that's where we'll focus, but until we do it as a team, it's hard to say which one is correct.

What's Next:

Last year I had said several times that I wanted to do one acquisition a month in 2022. That's a bad goal for a few reasons. If we were set on buying small SaaS companies sub $10k MRR then 1 a month sounds doable. But, if we're also going to play with raising from outside investors, doing a crowdfunding campaign, applying for an SBA loan, etc that timeline is just not going to line up.

This year I believe we can:

- Raise capital from outside investors on a deal-by-deal basis (fundless sponsor)

- Buy a (barely) 7 figure SaaS with an SBA loan

- Crowdfund one of our acquisitions

- Buy 3-5 more smaller companies.

Summary:

- Micro PE (for us) means a focus on value investing in profitable, niche SaaS companies.

- XO buys small, profitable SaaS businesses. We operate and grow them.

- We're not VC (we buy 100% of the company) and operate like a micro PE firm.

- We don't need 10x returns for our model to work well.

- We believe the chances of one of our acquisitions going to zero is less than starting from scratch